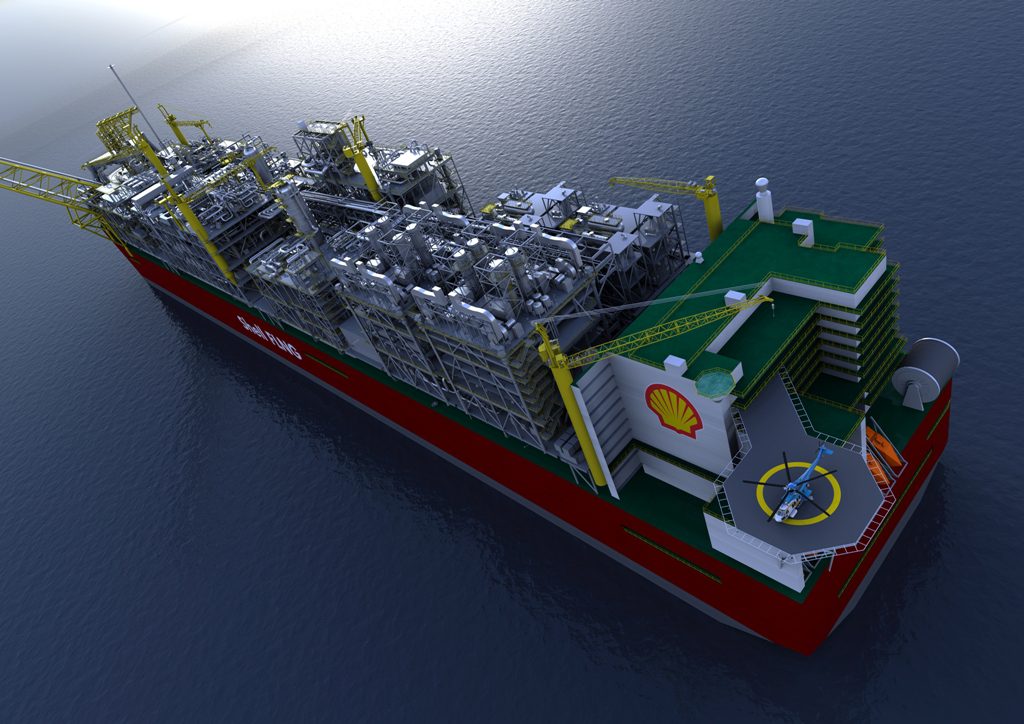

Rendering of the Prelude FLNG facility, via Shell

(Bloomberg) — Woodside Petroleum Ltd., Australia’s second-largest oil producer, signed an initial accord with Royal Dutch Shell Plc to enable the use of floating liquefied natural gas technology to develop its Browse project.

The technology may be the fastest way to commercialize the project, off the coast of northern Australia, Peter Coleman, chief executive officer of the Perth-based company, said today in a statement. Woodside said it will hold talks with its Browse joint venture partners, including BP Plc, as selection of a development concept needs to gain their approval.

Woodside earlier this month scrapped a plan to build Browse onshore, estimated to cost $45 billion, in favor of studying cheaper options as costs rise. Shell, Europe’s largest oil company, may take over as operator of the project and further boost its stake if the partners decide on floating LNG, according to CIMB Securities (Australia) Ltd.

“There aren’t many examples of new technologies where there haven’t been teething problems, and that’s fine for a company the size of Shell,” Mark Samter, a Sydney-based CIMB analyst, said today in a phone interview. “For Woodside, it would probably be better to sit back, wait and learn from the mistakes before jumping in feet first.”

Shell’s Prelude project off Australia, due to start in about 2017, is vying to become the first floating LNG venture in the world. After starting work on $180 billion in LNG plants on land in Australia, developers are considering about $85 billion in floating projects.

Cost Escalation

Floating LNG may be almost 20 percent cheaper than building a Browse project on land, Deutsche Bank AG said this month. A new onshore Browse development would have cost about $45 billion, JPMorgan Chase & Co. said in an April 12 report.

“FLNG had the potential to commercialize the Browse resources in the earliest possible time frame and to further build the company’s long-standing relationship with Shell,” according to the statement from Woodside. The accord sets out the key principles that would apply if Browse is developed with Shell’s floating LNG technology, the company said.

While Woodside said earlier this month that it would consider a floating LNG plant, a pipeline to existing facilities in Western Australia or a smaller onshore plant, Shell said its floating LNG technology is the best plan.

Three Fields

The companies initially planned to send gas from three fields off the Western Australia coast to a processing plant at James Price Point in the Kimberley wilderness region. The fields are located in the Indian Ocean, about 425 kilometers (264 miles) north of Broome in Western Australia state.

“Unfortunately the cost escalation has been such that the total costs for Browse have resulted in the current development concept not being commercial,” Coleman said in an April 12 statement.

Woodside reached a deal last year to sell a 14.7 percent stake in Browse to Mitsubishi Corp. and Mitsui & Co. for $2 billion. BHP Billiton Ltd., Australia’s largest oil producer, agreed in December to sell its stake in Browse to PetroChina Co., that nation’s biggest energy producer, for $1.63 billion.

– James Paton, Copyright 2013 Bloomberg.

Join The Club

Join The Club