Oct 22 (Reuters) – U.S. shipbuilders and port operators are getting hit in the fallout from President Donald Trump’s campaign to wipe out the offshore wind industry, suffering hundreds of millions of dollars in lost government support, vanishing vessel orders, and an uncertain future for the billions of dollars’ worth of investments.

The impact represents an unintended consequence of Trump’s policy on the offshore wind industry, which has included stop-work orders and permit reviews for massive projectsthat were spurred by former President Joe Biden’s green investment policy.

Trump calls offshore wind an unsightly and inefficient technology that harms whales and birds. But he is also a huge supporter of U.S. maritime industries that he views as crucial in the global competition for trade and military dominance of the high seas.

“He has a counterproductive argument,” said Joe Orgeron, a Republican Louisiana state representative and former offshore vessel business owner, who pointed out the offshore wind industry was responsible for many ship orders in recent years. “That all came to a sudden halt, unfortunately.”

Reuters interviewed 13 port representatives, shipbuilders and trade groups who detailed the knock-on impacts of Trump’s policy moves targeting offshore wind, the details of which are reported here for the first time.

The impacts include more than $679 million worth of canceled Department of Transportation financing for ports to support offshore wind, including a $34 million grant for a facility in Salem, Massachusetts that was expected to generate $75 million in tax revenue over 20 years and create 800 jobs.

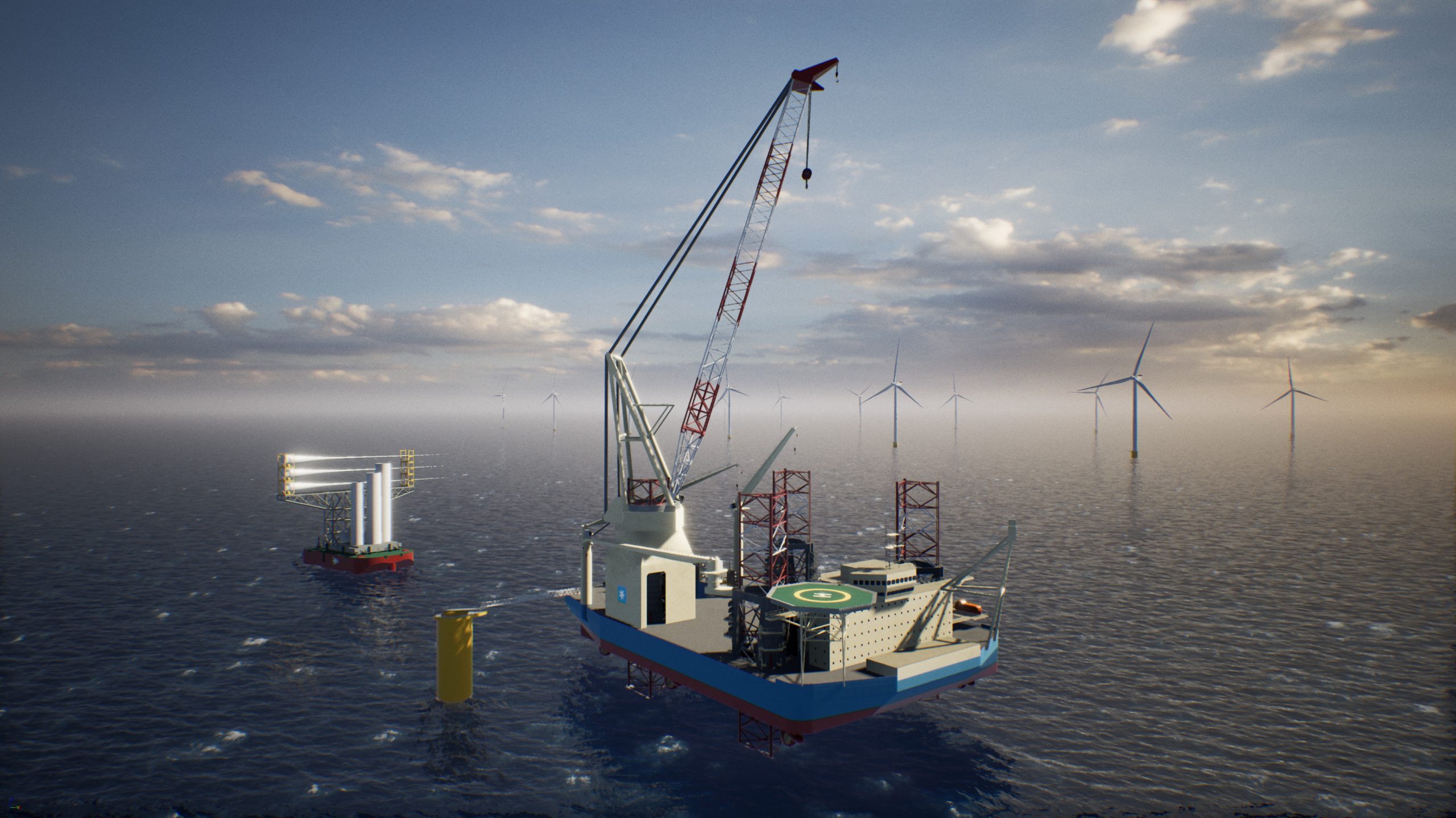

Meanwhile, orders for new offshore wind service vessels – designed to carry workers and huge turbines offshore or to lay undersea cable – have also disappeared, according to trade group Oceantic, following a busy 2024 that saw the launch of at least 10 U.S. vessels built to serve offshore wind.

Existing vessels are also being sold off, or considered for redeployment to other global regions, according to the reporting.

The Trump administration said it can revive the U.S. shipbuilding and port industry, which has suffered from years of cost-inflation and a dearth of government support, without offshore wind’s support.

“This administration will restore America’s maritime dominance by modernizing our ports and expanding our shipbuilding capacities to compete with communist China,” the U.S. Department of Transportation told Reuters.

“We’re also doing it as quickly and cost-effectively as possible— two attributes completely absent in offshore wind manufacturing.”

BIG CANCELLATION

Danish shipping giant Maersk canceled a $475 million contract earlier this month for a ship that was custom designed to install massive turbines at the Empire Wind power project off the coast of New York, laying bare the downturn in vessel demand.

Equinor’s Empire Wind had been embroiled in Trump’s opposition to offshore wind earlier this year when the administration issued a stop-work order that delayed its construction for a month.

The ship’s builder, Singapore-based Seatrium, said it was evaluating its options for the vessel, which was nearly fully built, and could take legal action.

Offshore wind’s rise in the Northeast in recent years had fueled robust demand for many such vessels, including several built in U.S. shipyards or flying U.S. flags, according to trade group Oceantic Network. It said the sector cumulatively has attracted $5.1 billion in port investments and $1.8 billion in vessel orders.

Among the vessels built is the $715 million Charybdis, the only U.S.-flagged wind turbine installation vessel, which is now working on Dominion Energy’s Coastal Virginia Offshore Wind project.

Louisiana’s Edison Chouest also built two major offshore worker housing vessels for Equinor and Orsted projects currently under construction.

But that work is drying up.

Offshore wind developer US Wind said in court documents filed this month it had been on track to secure specialized vessels for offshore wind installation, but the Trump administration’s efforts to stop its Maryland project had disrupted that progress.

Such vessels are scarce and booked years in advance, requiring early action to meet construction timelines, the company said.

Rhode Island’s Blount Boats, which began building crew transfer vessels for offshore wind in 2016, said it has stopped completely.

“We’ve moved on,” said Executive Vice President Julie Blount. “There are no contracts for those boats, and it’s simply because the Trump administration has closed that down.”

Meanwhile, some existing vessels serving offshore wind are being sold off.

Houston-based Seacor Marine announced in August it would sell two U.S.-flagged liftboats — used on the Block Island and South Fork offshore wind farms — to Nigerian oil and gas services company JAD Construction for $76 million, citing delays and cancellations.

Seacor did not respond to a request for comment.

Other ships face uncertain futures. The $200 million Acadia, America’s first rock installation vessel, will likely work overseas after completing jobs for Equinor and Orsted, said Bill Hanson of Great Lakes Dredge & Dock Corp.

The company has no plans for more offshore wind vessels.

PORTS REELING TOO

Oceantic estimated last year that more than two dozen U.S. ports were pursuing offshore wind projects. Many of those lost critical funding after the DOT canceled 12 grants worth $679 million in August, hitting projects in states including Massachusetts, New York, California, Maryland, and Virginia.

“It’s realistic to look at the current landscape and see that this industry is going to be deeply challenged by the current administration,” said Salem Mayor Dominick Pangallo, whose city’s port project is struggling after a funding cancellation.

In Northern California, the Humboldt Bay offshore wind port that lost $426.7 million – the bulk of the canceled DOT funding – is expected to be delayed by about five years to at least 2035, according to Chris Mikkelsen, executive director of the Humboldt Bay Harbor, Recreation and Conservation District.

The project is hoping to be able to tap funds from a state climate bond to make up for the lost federal money.

In Norfolk, Virginia, the developer of a marine logistics terminal that lost a $39 million DOT grant submitted a revised proposal refocusing the project away from offshore wind to align with the administration’s priorities, city economic development officials told Reuters.

Some port projects are still underway. Equinor’s South Brooklyn Marine Terminal, which will support its Empire Wind project, is 70% complete and has employed about 3,000 workers, according to a company spokesperson.

In Maryland, US Wind says it is sticking with its plan for a shoreline steel manufacturing facility that could serve the shipbuilding and energy industries despite both the cancellation of a $47.4 million port grant and the administration’s plans to revoke the permit for its offshore wind project. But US Wind has also warned in court documents that it could face bankruptcy if its project is canceled.

Jim Strong of the United Steelworkers union, which has a deal to supply workers for US Wind’s facility, said he was optimistic that Trump would see how investments in offshore wind can reverberate through industries that he cares about.

“He showed a tremendous amount of passion in his campaigns in talking about steel,” Strong said of Trump. “I want to believe that once the story is out there, that there could be a change of positions.”

(Additional reporting by Lisa Baertlein in Los Angeles; Editing by Richard Valdmanis and Marguerita Choy)

(c) Copyright Thomson Reuters 2025.

Join The Club

Join The Club