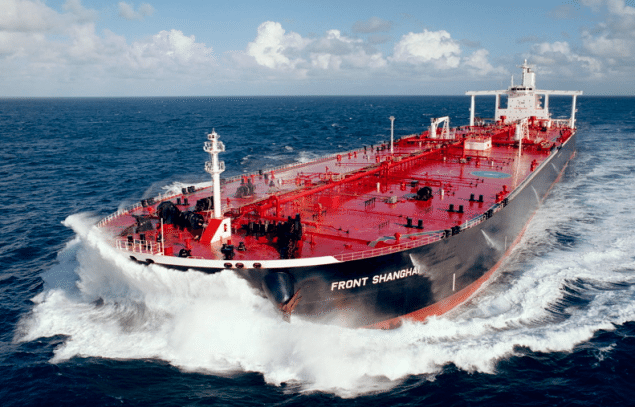

Front Shanghai, Image (c) Frontline Tankers

(Bloomberg) — Oil-tanker owners will struggle to retain crews and maintain ships after losing the most money in four decades, according to the industry’s biggest trade group.

The problems won’t ease any time soon because some vessel rates may take as long as four years to rebound, said Katharina Stanzel, the managing director of the International Association of Independent Tanker Owners, or Intertanko. Its members operate more than half of the world’s tankers by capacity.

Owners lost about $27 billion since 2009 and rates for the largest vessels may only recover by 2017, according to Intertanko. Daily rates for the biggest carriers slid 68 percent over the past year because of a glut of capacity, figures from London-based Clarkson Plc, the largest shipbroker, show.

“The biggest risk I see is that we will have nobody left to actually make the deliveries,” Stanzel said by e-mail May 17. Industry conditions were “probably equally dramatic” when rates plunged in 1973-74, she said.

Earnings for very large crude carriers, each able to hold 2 million barrels of oil, retreated to $10,674 a day, according to Clarkson’s figures. That’s less than half of the $24,200 that Frontline Ltd., the tanker operator led by shipping billionaire John Fredriksen, said in February its VLCCs need to break even.

General Maritime Corp., the New York-based tanker operator, filed for bankruptcy protection in November 2011 and was followed a year later by Overseas Shipholding Group Inc., the biggest U.S. tanker owner. General Maritime emerged from bankruptcy protection in May 2012.

World Fleet

Intertanko members operate vessels with a combined capacity of about 283.5 million deadweight tons, according to the group. That equates to about 58 percent of the global fleet of tankers bigger than 10,000 tons.

Owners are contending with oil demand that will advance 0.9 percent this year, the least since 2011, according to the International Energy Agency, an adviser to 28 developed nations. The tanker fleet’s capacity will increase 7.8 percent in that period, Clarkson data show.

“What makes this situation particularly challenging is the outlook is so negative,” Malcolm Willingale, a project manager for Intertanko, said in an interview May 10. The surplus and slowing demand growth may hold rates down until 2017, he said.

Oil companies are shipping more cargoes on single-voyage charters, which earn less for tanker owners. The proportion of ships operating in the so-called spot market expanded to about 59 percent of total trade last year from 51 percent in 2010, according to Intertanko.

Ships on five-year charters are earning about $26,000 a day, while those in the spot market are getting about 60 percent less, according to Clarkson data.

Forward freight agreements, swaps used to bet on future shipping rates, anticipate VLCCs will earn $15,000 a day on average in 2015 for carrying Middle East oil to Asia, according to figures from Marex Spectron Group.

– Rob Sheridan, Copyright 2013 Bloomberg.

Unlock Exclusive Insights Today!

Join the gCaptain Club for curated content, insider opinions, and vibrant community discussions.

Join The Club

Join The Club