Sinokor’s VLCC Blitz Sends U.S. Gulf Rates to Pandemic-Era Highs

A shipowner’s once-in-a-generation wager on oil tankers has made it so powerful that it controls an overwhelming majority of supertankers that can collect American oil next month.

By Asad Zulfiqar and Sherry Su (Bloomberg) —

China is snapping up cargoes of crude that would normally head to Europe, spooking the continent’s physical oil traders who’ve just seen imports from Russia all but halt at a time when local demand is rising.

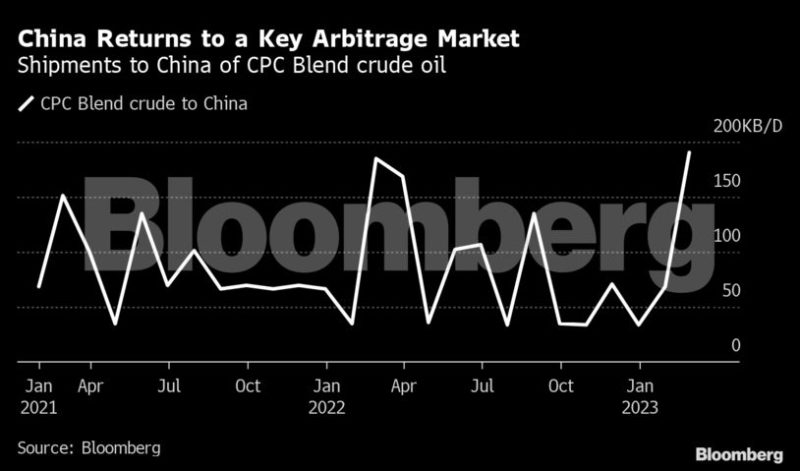

The world’s largest oil importer already bought 5 million barrels of mostly-Kazakh crude for collection from a port in the Black Sea next month, according to traders of the grade. In daily flow terms, it’s the most since at least the start of 2021.

That matters because the oil in question has been the preserve of European refiners, especially since the middle of last year when companies in the European Union cut purchases from Russia following the invasion of Ukraine. Physical traders report that Europe’s own demand is also strengthening, intensifying competition for barrels.

The impact on prices — expressed as premiums or discounts to benchmarks — has been bullish. And with China’s return from Covid still in early stages, it is a reminder of just how susceptible Europe could be to resurgent buying from the Asian country.

So-called CPC Blend crude, most of which comes from Kazakhstan, has rallied to a discount of $3 a barrel to Dated Brent, an international marker for physical oil transactions, according to traders. As recently as a month ago, it was at $8 below.

The signs of strength go beyond the Black Sea. Norway’s giant Johan Sverdrup stream is now fetching $3 to $4 a barrel below Dated, having been at a discount of more than $6 in early December.

There too, demand has shown signs of gaining. China’s Unipec bought at least 2 million barrels of Johan Sverdrup for January loading. Norway’s Equinor ASA also booked a supertanker to move 2 million barrels of the grade to Asia later this month. There may be more to come and February trading has yet to begin.

Demand is expected to rise particularly after China’s Lunar New Year at the end of this month, according to traders.

The rally in differentials doesn’t appear to have been replicated to the same extent elsewhere in the world, highlighting just how sensitive Europe may be to external competition for local barrels. Several traders of west African oil also said they anticipated increased buying from China, although it had yet to materialize as of Thursday.

Russia was previously the EU’s biggest supplier of crude, shipping about fifth of the bloc’s imports, but those flows to the region all but halted since a near-complete prohibition began on Dec. 5.

As competition for other local grades rises, the bloc’s refiners may find they have to pay more to prevent an exodus of supply. The North Sea is home to Brent, a complex web of futures, derivatives and physical trading that’s central to the global oil market.

As well as rising Chinese demand, demand has also risen within Europe itself, adding to the upward pressure on differentials, according to traders.

Many European refiners returned to the market after a long break during the festive season. Refining margins remain good, though not spectacular, according to traders.

Plunging oil freight rates have also opened up opportunities to send cargoes elsewhere. Those trades had been closed off because shipping costs added several dollars a barrel to the price of a delivered cargo of crude. Lower shipping cost also helped boost demand from European refiners.

–With assistance from Bill Lehane.

© 2023 Bloomberg L.P.

This article contains reporting from Bloomberg, published under license.

Sign up for gCaptain’s newsletter and never miss an update

Subscribe to gCaptain Daily and stay informed with the latest global maritime and offshore news

Essential news coupled with the finest maritime content sourced from across the globe.

Sign Up