Indian Seafarers Freed After Months of Detention at Yemen’s Ras Isa Port

India says it has secured the release of more than 150 seafarers who were stranded at Yemen’s Ras Isa Port, according to the Directorate General of Shipping. All 11 vessels...

By Lars Petter Blikom, Segment Director for Natural Gas at DNV

Over the past week, here at DNV, we have done another market analysis to assess how fast LNG will penetrate the marine fuel market. I am not at liberty to share the results, but it got me thinking about a broader theme.

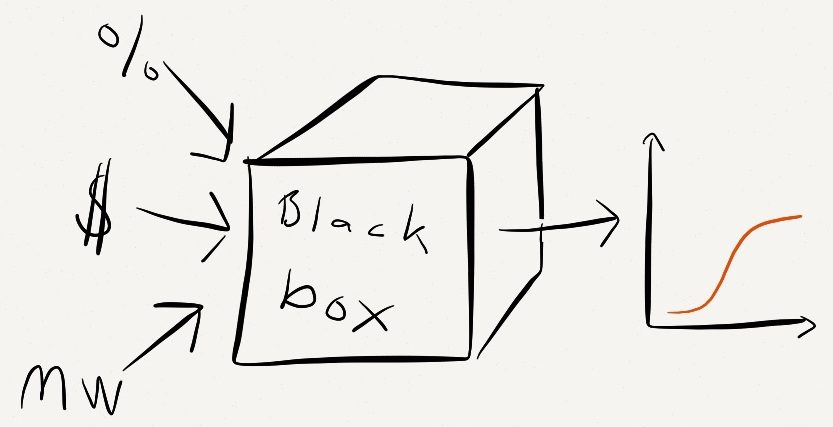

But first, here’s what we did: We have developed a model that combines various sources for number of port calls and future fleet growth. With this model we can estimate the number of ships of a certain type and size that will call in a certain port in the future. Once we have the model, this is quite straigh-forward to do, and it produces a near perfect benchmark for discussing the next step: the penetration of LNG into each ship category.

And this is when the head-scratching starts; how many ships in each category will be opting for LNG? and at what time? Take Panamax bulk carriers for example, how many percentages in 2020? In 2030? It is very difficult to make these guesses, even for long time experts in the business.

We can for example anticipate 50% share of LNG for newbuildings of a certain ship type delivered after 2020. After 20 years with expected ship renewal rates, LNG will then fuel some 40% of the global fleet of this ship type.

But, why would the number be 50%? I believe it will only be 50% if the lifecycle economics of oil fueled and a LNG fueled ship are equal. In other words, it will only be 50/50 if the choice doesn’t have an economic impact.

Once LNG is available and the novelty of the technology is a thing of the past, which will be the case by 2020, ships will again compete on cost, and shipowners will opt for whatever solution appears cheaper at the moment of ordering the ships. This means they will all go for the same choice. So it will not be 50/50, it will be all or nothing.

If natural gas and LNG is consistently priced lower than oil over the next three decades, we will see oil more or less replaced by LNG in the marine fuel sector. If LNG becomes, and stays, more expensive than oil then LNG will only be implemented in small niche markets and single trades around the world.

I know which one I believe in; in 2040 a ship burning oil will be a rare sight on the seas, but quite popular in museums.

(Particularly for uncertain situations, I believe an efficient model is an invaluable tool. I can easily play with different assumptions and immediately see what they mean for the demand in the analyzed area. I’d be happy to share, but then you’d have to show me the money.)

About

This article originally appeared on DNVs LNG-blog, “Energy of the Future“, which provides valuable information, analysis, and market observations throughout the LNG and shipping industries. The blog has an interest in the whole LNG value chain, from natural gas reservoirs through liquefaction, transportation, and re-gasification, to end-users. End-use of natural gas includes in particular the application of LNG directly as a fuel for shipping.

Sign up for gCaptain’s newsletter and never miss an update

Subscribe to gCaptain Daily and stay informed with the latest global maritime and offshore news

Stay informed with the latest maritime and offshore news, delivered daily straight to your inbox

Essential news coupled with the finest maritime content sourced from across the globe.

Sign Up