By Anna Shiryaevskaya (Bloomberg) —

A record rally in natural gas prices in Europe doesn’t mean it’s become lucrative to send every available molecule to the region.

Even though European prices have more than tripled this year, they are yet to beat rates for the liquefied fuel delivered to Asia, the biggest importing region. That’s because countries from Japan to India are panic-buying before the winter, heightening competition for the small fraction of the supply that trades freely in the spot market and isn’t tied to long-term contracts.

Gas markets in Europe, Asia and the U.S. are connected through the LNG trade, so moves in one region could redirect flows. As the world’s biggest traders and producers meet in Dubai for the Gastech conference — the first major in-person event for the industry since the onset of the coronavirus pandemic — LNG purchases will be a key topic of discussion as nations seek to keep the lights on and people warm this winter.

Here are five charts explaining why Europe hasn’t been getting enough LNG and what it will take to turn that around.

1. Where Is the LNG?

Europe went from surplus to scarcity in just two years. That’s because of soaring demand in Asia, as China quickly emerged from the global pandemic. The worst drought in a decade in Brazil also compounded to the shortfall, as the nation turned to LNG to produce electricity normally generated by hydropower dams. All of that left very few cargoes for Europe, with imports slumping since the start of June.

2. Long-term Contracts

Most LNG is locked in long-term contracts and the majority is destined for Asia. So, what traders have to play with is actually less than half of total supply. These contracts are usually linked to crude oil, which is currently cheaper than gas prices at European hubs or LNG in Asia. That means countries are likely to stick to their contracts, leaving less available for the spot market.

“Long-term contractual volumes are in the money and you will definitely bring that cargo,” said Ciaran Roe, global director for LNG at S&P Global Platts.

3. Mind the Gap

The first step to figuring out who wins the battle for cargoes is watching the gap between prices in Europe and Asia. In the financial world, that means watching the spread between futures traded in the Netherlands and the Japan-Korea Marker, the spot price in northeast Asia.

“If you have a spot cargo, you will deliver it wherever you see the best netback,” said Stacey Morris, director of research at Dallas-based index provider Alerian. “It is going to be very competitive.”

4. Beyond the Spread

But it’s not all about the spread. What really matters is the cost of the cargo when it actually lands in Europe. At the moment, the premium of 16 cents over the futures makes LNG purchases unlikely.

“Unless this changes, you won’t have much spot LNG in Europe,” Roe said.

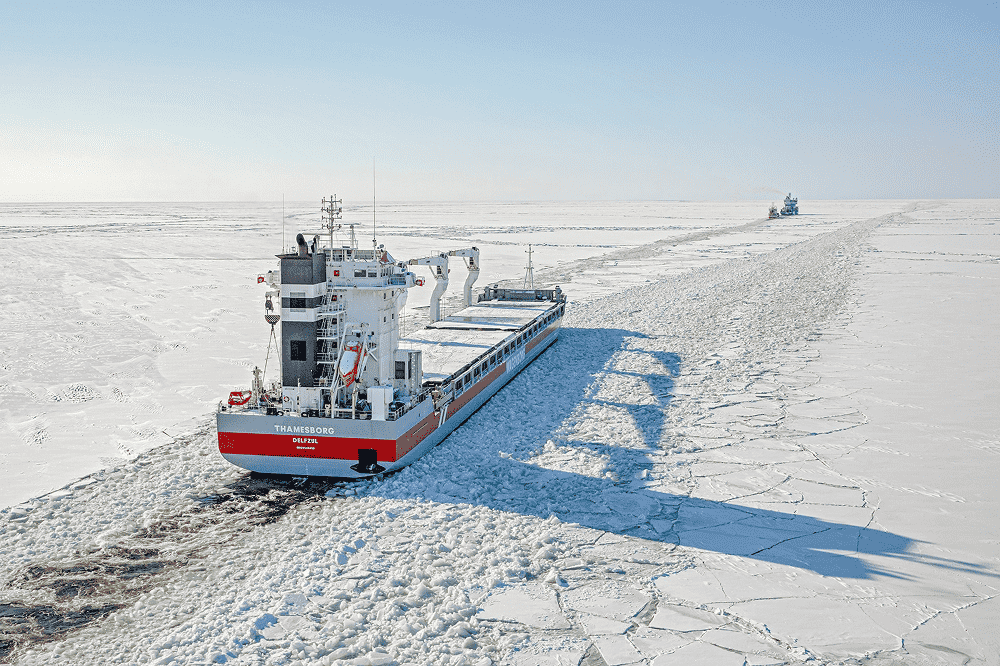

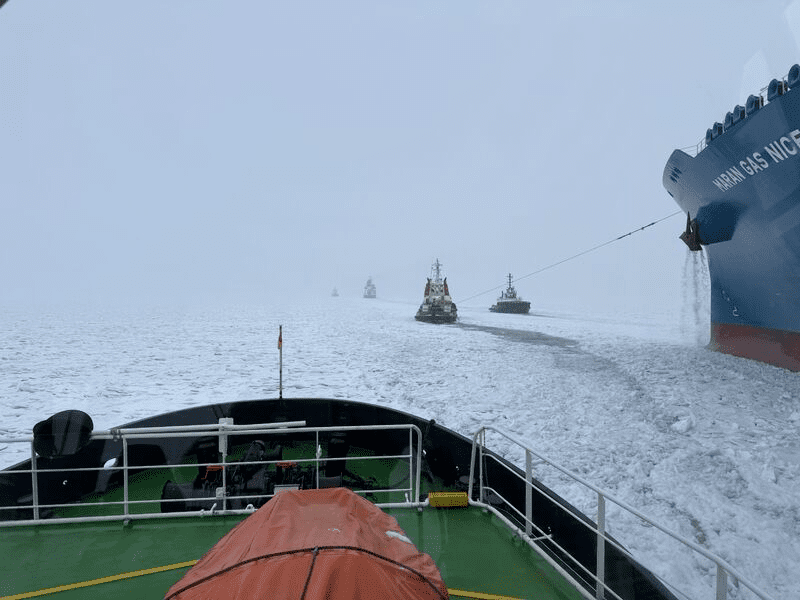

5. Shipping Costs

The best market for LNG is also determined by how much it costs to bring a cargo to Europe or to Asia. For example, if freight rates for LNG are high, there is a higher chance that Atlantic LNG will stay in the region rather than taking longer journeys to Asia, Roe said.

To avoid last winter’s shortage of vessels and unprecedented costs to secure a spot tanker, traders have been booking ships earlier this year.

© 2021 Bloomberg L.P.

Editorial Standards · Corrections · About gCaptain

This article contains reporting from Bloomberg, published under license.

Join The Club

Join The Club