Firms in Fed’s Beige Book Fret Over Any Lengthy Baltimore Port Closure

(Bloomberg) — The closure of one of the East Coast’s busiest ports after the collapse of Baltimore’s Francis Scott Key Bridge has so far not led to broad price increases,...

The Jones Act tanker, Sunshine State file photo.

The domestic tanker industry in the United States is finding support from the boost in the nation’s crude oil production. After falling to 5 million b/d in 2008, the lowest level since 1946, US crude oil production has climbed sharply to over 7 million b/d and has held steady above this level since the end of 2012.

One of the most significant contributors to the rise in US crude oil production has been the employment of fracking technology in North Dakota’s Bakken shale formation. Illustrating this, crude oil production in North Dakota has increase by approximately 45% from January 2011 to roughly 780,000 b/d in March of this year. Bakken crude is light-sweet with an assessed API of 40 and 0.2% sulfur content. Over the last several years, market participants have invested substantial sums to boost takeaway capacity from this region. This investment has been necessary due to the region’s historical lack of production and the resulting limited takeaway capacity.

This occurrence has supported the use of railcars, combined with the domestic barge and tanker fleet, to transport hydrocarbons. Data from the North Dakota Rail Authority show that railcar take away capacity from North Dakota is expected to reach just over 1 million b/d on the back of newly established projects by year’s end compared to just 115,000 b/d in 2010. Although these gains to take away capacity are impressive, rail offloading terminals at refineries or transfer hubs are still lagging behind delivery volumes. As a result, the use of barges and tankers to move crude between regional consuming hubs has been on the rise.

Additionally, in 2012, the sharp rise in crude oil production kept the spread between the US benchmark WTI and Dated Brent at a wide US -$17.65 per barrel, compared to only US -$0.13 per barrel in 2010. This gave US refiners an advantage through cheaper feedstock, resulting in elevated refinery utilization and petroleum product output.

This rise in downstream activity also facilitated the movement of petroleum products throughout the US.

These requirements to move crude oil and petroleum products have had a knock-on effect on the US flagged tanker and barge fleet due to domestic cabotage regulations. Known as the Jones Act, cargoes that are transported between US ports must be shipped on vessels registered under the US flag, constructed in a US shipyard and staffed by US citizens. This regulation significantly impacts construction and operating costs, resulting in higher charter rates compared to foreign flagged ships. The supply fundamentals of Jones Act tankers have historically been relatively balanced as owners carefully calculate tonnage additions.

The rise in US crude oil production, in combination with limited rail and pipeline capacity at production hubs, is raising the demand for barge and tanker deliveries.

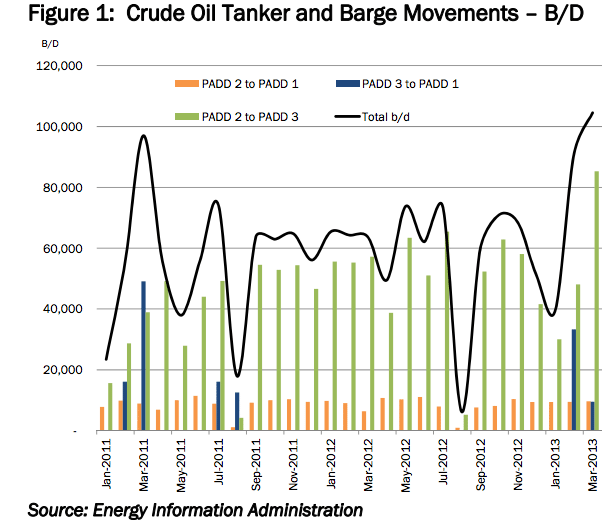

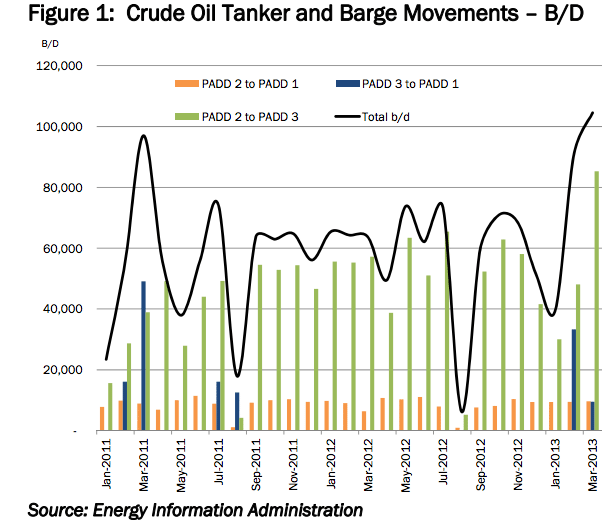

Data from the US Energy Information Administration (EIA) shows that crude oil transported between Petroleum Area Defense Districts (PADD)* has increased by about 35% since Q1 2011. Historically, the most significant volumes have been transported between PADD 2 in the midcontinent to PADD 3 in the US Gulf (Figure 1). These flows were due to the physical delivery point of the WTI contract’s location in Cushing, Oklahoma. The increase in movements between PADD 3 and PADD 1 was likely spurred by an increase in Texas crude oil production towards the start of 2013, and the light sweet appetite of refiners on the Atlantic Coast.

These increased trade volumes have brought some owners back to yards to place new orders. Year-to-date, the General Dynamics NASSCO shipyard in San Diego, California has benefited from this increase in Jones Act demand. At the start of June, the yard received an order for four option four 50,000 dwt tankers for US $130 million each. These orders came on the back of an order for two 49,180 dwt vessels in October last year. These units also had a price tag of US $130 million. While these orders are listed as product tankers, should market conditions dictate, they could be dirtied up if demand for crude oil shipments justifies such a move. SeaRiver Maritime is expecting delivery of two Aframax tankers in 2014 from the Aker shipyard in Philadelphia, Pennsylvania.

In addition to seagoing tankers, barges are also benefiting from these US crude oil and product shipments. The can be observed in strong trade volumes between PADD 2 and PADD 3, illustrated in Figure 1. Year-to-date there has been approximately 85 deliveries of inland tank barges with an average of 20,000-30,000 barrels of capacity.

Furthermore, by the year’s end, some 890,000 barrels of seagoing barge capacity should exit US yards.

The prospect of US crude oil production volumes continuing their upward trajectory is providing a foundation for increased development of infrastructure.

This should continue providing support for hydrocarbon transport, particularly as it seems unlikely that any regulatory changes regarding crude oil exports are on the horizon. One such example is Trafigura, which is already operating 600,000 barrels of storage capacity in Corpus Christi and rumors of an expansion to 2 million barrels in the near term. These barrels could be made up a variety of crude blends ranging from the Eagle Ford shale play to Alberta tar sands which are often moved within the USG or sent to the Atlantic Coast using waterborne transport.

On the West Coast, domestic flagged vessels are increasingly utilized to transport crude oil volumes from rail and marine hubs to refineries. One such unit is a facility along the Columbia River in Oregon, which receives crude oil via rail from North Dakota before it is shipped to refineries in California. Furthermore, Tesoro and Savage Companies are building a similar 120,000 b/d complex in southern Washington State, which could eventually be expanded to 280,000 b/d.

These developments, along with the expectation that US crude oil production will continue to rise in the short term, should provide support for US flagged vessels. The domestic shipping industry is another element of the US economy that is finding support and providing jobs on the back of the current oil evolution. Intra-US crude oil movements will remain supported by the crude oil export embargo. However, the narrowing spread between WTI and Dated Brent (Figure 2) might entice some end users to import lighter grades from traditional suppliers in West or North Africa. The spread has averaged US -$8 per barrel since the start of May.

This would boost all varieties of hydrocarbon transportation requirements within the country and open the spigot from a trickle to a deluge.

McQuilling is a privately-owned marine services company, providing transportation services to clients in the shipping, commodity and financial services industries. Werepresent broad commercial experience and are one of a select few firms that sit on both the International and the Asian Baltic Exchange Tanker Route panels. Article republished with permission.

Join the gCaptain Club for curated content, insider opinions, and vibrant community discussions.

Join the 105,961 members that receive our newsletter.

Have a news tip? Let us know.

Access exclusive insights, engage in vibrant discussions, and gain perspectives from our CEO.

Sign Up

Maritime and offshore news trusted by our 105,961 members delivered daily straight to your inbox.

Essential news coupled with the finest maritime content sourced from across the globe.

Sign Up