“There is more and more of a realization that floating LNG could be a solution that is more cost-effective and time- effective than traditional onshore LNG,” Chief Executive Officer Thierry Pilenko said today on a conference call.

Costs for land-based LNG plants are surging in Australia as the country adds projects to challenge Qatar as the biggest exporter of the liquefied fuel. Woodside Petroleum Ltd. and BG Group Plc have blown budgets for Australian ventures after labor expenses rose, while Chevron Corp. is reviewing the cost of its A$43 billion ($45 billion) Gorgon development.

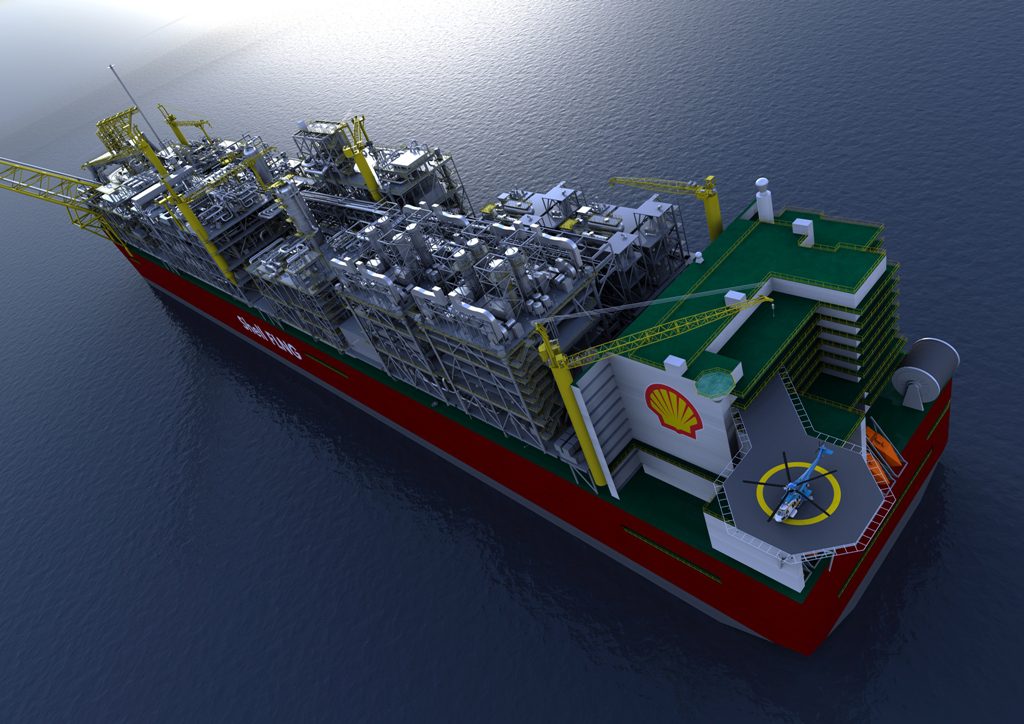

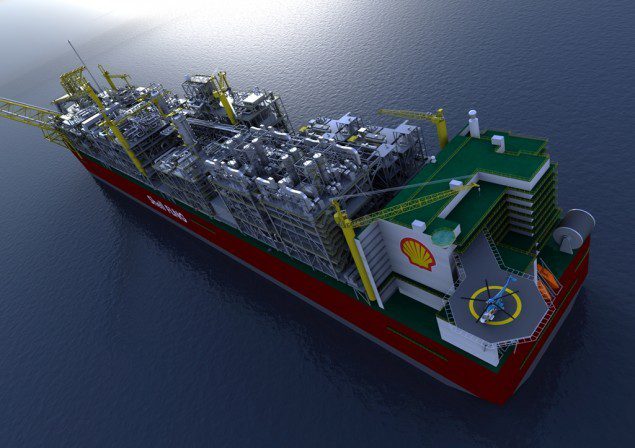

Technip is building Royal Dutch Shell Plc’s Prelude LNG vessel, due to operate from about 2017, with South Korea’s Samsung Heavy Industries Co. Paris-based Technip is also working with Daewoo Shipbuilding & Marine Engineering Co. to develop a Malaysian offshore project for Petroliam Nasional Bhd, and is studying a venture for Brazil.

Demand for LNG, which is gas chilled to a liquid for transport by tanker, was boosted by the shutdown of Asian reactors following Japan’s nuclear meltdown last year, driving up prices. In Australia, ConocoPhillips, ExxonMobil Corp. and GDF Suez SA are considering offshore projects.

GDF Project

Technip will be involved in a GDF Suez competition to look at the feasibility of its Australian venture, according to Pilenko, who said “I wouldn’t be surprised if there are additional projects” announced next year for the Australian market.

Technip, Europe’s largest oilfield-services provider after Italy’s Saipem SpA, reported a 21 percent increase in third- quarter profit today and raised targets for the full year.

Net income climbed to 146.3 million euros ($190 million) from 121 million euros a year earlier after oil producers expanded exploration, raising demand for Technip’s services. Sales gained 23 percent to 2.08 billion euros.

– Tara Patel, Copyright 2012 Bloomberg

Join The Club

Join The Club