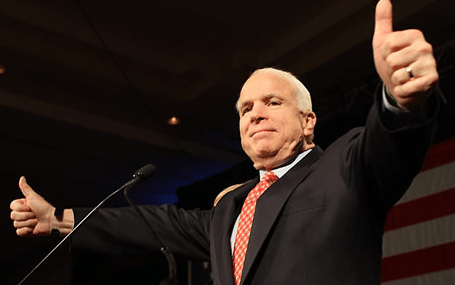

U.S. Senator John McCain (R-AZ) took to the floor of the Senate Thursday to defend his amendment to repeal the Merchant Marine Act of 1920, also known as the Jones Act.

U.S. Senator John McCain (R-AZ) took to the floor of the Senate Thursday to defend his amendment to repeal the Merchant Marine Act of 1920, also known as the Jones Act.

Senator McCain is trying to attach the amendment to a bill that would permit the construction of the Keystone XL oil pipeline, known as the Keystone XL Pipeline Act (S.1), which last week passed an initial hurdle in the Senate. The amendment specifically targets the U.S. build requirement of the Jones Act.

McCain’s amendment has been met with heavy criticism from both maritime and shipbuilding industry stakeholders and lawmakers alike, such as Congressman Joe Courtney (CT-2) and Congressman Steven Palazzo (MS-4) who, along with 30 other bipartisan House Members, have sent a letter to Senate leadership urging opposition to the amendment, stating that its passing would “gut” the U.S shipbuilding industry.

FULL COVERAGE: Senator McCain’s Jones Act Amendment

Senator McCain’s full floor statement is below:

“Mr. President, I come to the floor today to discuss an amendment I have filed to the pending legislation. This is an amendment to modify the Jones Act, an archaic 1920s-era law that hinders free trade, stifles the economy and hurts consumers – largely for the benefit of labor unions. Specifically, my amendment would effectively repeal a law that prevents U.S. shippers from purchasing, or otherwise affordably procuring the services of, vessels built outside the United States for use in American waters.

“From time to time, here in Congress we find that legislation still remains on the books many decades after it has served its original, stated purpose – if it ever had one. I think one of the best examples of this is a law called the Jones Act.

“As many of you know, the Jones Act is simply a continuation of laws passed through U.S. history addressing cabotage (or port-to-port coastal shipping). Those laws have been used to protect U.S. domestic shipping, dating back to the very first session of Congress.

“The Jones Act may have had some rationale back in the 1920s when it was enacted. But today, it serves only to raise shipping costs, making U.S. farmers and businesses less competitive in the global marketplace and increasing costs for American consumers.

“According to a 2002 U.S. International Trade Commission economic study, repealing the Jones Act would lower shipping costs by about 22 percent. The Commission also found that repealing the Jones Act would have an annual positive welfare effect of $656 million on the overall U.S. economy. Since these decade-old studies are the most recent statistics available, imagine the impact that Jones Act repeal would have today: far more than a $656 million annual positive welfare impact – likely closer to $1 billion, truly stimulating our economy in the midst of an anemic economic recovery.

“The requirement that U.S. shippers must purchase vessels in the United States comes at a tremendous cost that is passed onto U.S. consumers. For example:

“Just recently, U.S. container-line Matson placed a $418 million order for two 3,600 twenty-foot equivalent unit (T.E.U.) containerships in a U.S. shipyard. The high price of $209 million per vessel reflects that the ships will be carrying goods within the U.S. and, therefore, governed by the protectionist Jones Act.

“The fact is that Matson’s order at $209 million per ship is more than five times more expensive than those same ships were procured outside the United States. Ships of that size built outside the U.S. would cost closer to $40 million each. For comparison, even Maersk Line’s far larger 18,270 T.E.U. ships cost millions less, at an average of $185 million apiece.

“Further, the U.S. Maritime Administration (MARAD) has found that the cost to operate U.S. flag vessels – at $22,000 per day – is about 2.7 times higher than foreign-flag vessels – just $6,000 per day. A significant factor in these increased costs is obviously the Jones Act.

“There is no doubt that these inflated costs are eventually passed on to shipping customers. In the energy sector, for example, the price for moving crude oil from the Gulf Coast to the Northeastern United States on Jones Act tankers is $5 to $6 dollars per barrel, while moving it to eastern Canada on foreign-flag tankers is $2. That can mean an additional $1 million per tanker in shipping costs for oil producers. This increased cost is why, according the Congressional Research Service, more than twice as much Gulf Coast crude oil was shipped by water to Canada as was shipped to Northeastern U.S. refineries over the last year – all in an effort to avoid payingJones Act vessels shipping rates.

“The implications of this fact touches just about every American who buys gasoline. It is American consumers who pay exorbitantly higher prices because of a law that protects the shipbuilding industry and domestically-manufactured ships that transport crude and other refined products.

“But, it’s not just the energy sector that deals with the distorted effects of the Jones Act. Cattlemen in Hawaii that want to bring their cattle to the U.S. mainland market, for example, have actually resorted to flying the cattle on 747 jumbo jets to work around the restrictions of the Jones Act. Their only alternative is to ship the cattle to Canada because all livestock carriers in the world are foreign-owned.

“I am deeply concerned about the impact of any barrier to free trade. I believe U.S. trade barriers invite other countries to put up or retain their own barriers and that, at the end of the day, the U.S. consumer and the economy at-large pays the price.

“Throughout my career, I have always been a strong supporter of free trade. Opening markets to the free flow of goods and services benefits America, and benefits our trading partners. Trade liberalization creates jobs, expands economic growth, and provides consumers with access to lower cost goods and services. Simply put, free trade means greater growth, greater growth means more jobs, and more jobs mean greater individual prosperity for more Americans.

“And yet, as clear as the benefits of free trade are, actually taking action to remove trade barriers and open markets can be almost impossible here in Congress. Special interests that have long and richly benefited from protectionism flex their muscles and issue doomsday warnings about the consequences of moving forward on free trade. And, judging from the hysterical reaction by some of the special interests to my simply filing this amendment, the debate over the Jones Act will be no different.

“Mr. President, the domestic shipbuilding requirement of the Jones Act is outdated and must to be abolished.

“U.S. consumers are free to buy a foreign-built car. U.S. trucking companies are free to buy a foreign-built truck. U.S. railroads are free to buy a foreign-built locomotive. U.S. airlines are free to buy a foreign-built airplane. Why can’t U.S. maritime commercial interests more affordably ship goods on foreign-made vessels? Why do U.S. consumers, particularly those in Hawaii, Alaska, and Puerto Rico, need to pay for ships that are five times more expensive?

“If there was ever a law that has long ago outlived its usefulness – if it ever had any – it is the Jones Act. On the Jones Act, it is time to change course – today.”

Editorial Standards · Corrections · About gCaptain

Join The Club

Join The Club