Indian Seafarers Freed After Months of Detention at Yemen’s Ras Isa Port

India says it has secured the release of more than 150 seafarers who were stranded at Yemen’s Ras Isa Port, according to the Directorate General of Shipping. All 11 vessels...

Navig8 Faith, image by AlfvanBeem, via Wikimedia commons

London-based Navig8 Tankers is well on their way to achieving a significant position in the evolving tanker market as they continue to head to Asian shipyards with orders for more ships.

After issuing over 1.8 million shares in a private share placement, Navig8 added $245 million to their coffers which has allowed them to fund their existing eight VLCC newbuilds under construction at Hyundai Samho Heavy Industries (HSHI) and Shanghai Waigaoqiao Shipbuilding Co. as well as order an additional six more VLCCs.

These fourteen large crude tankers only represent one part of Navig8’s fleet expansion program.

In a phone call with Navig8 Chairman and co-Founder Nicolas Busch, he notes his company has ordered twenty-six chemical tankers since November and has acknowledged thirty new LR1 and LR2-sized product tankers are on order at numerous Asian yards, plus options for more on top of that.

Busch notes that for the chemical tankers, it has a lot to do with North American shale gas. “The US is investing an incredible amount in shale gas, which will be used to create chemicals – the vast majority of which will go to export.”

When asked about the huge expansion of chemical tankers on order and the threat of overbuilding, he did not seem overly concerned. “The majority of the building has been contracted between now and 2016. In general, the supply is pretty inelastic between now and 2016,” adds Busch.

Supply may be inelastic, yet according to McQuilling Shipping Advisor Chris Neumiller, an astonishing 392 new MR2 tankers have been ordered since 2011.

VLCCs

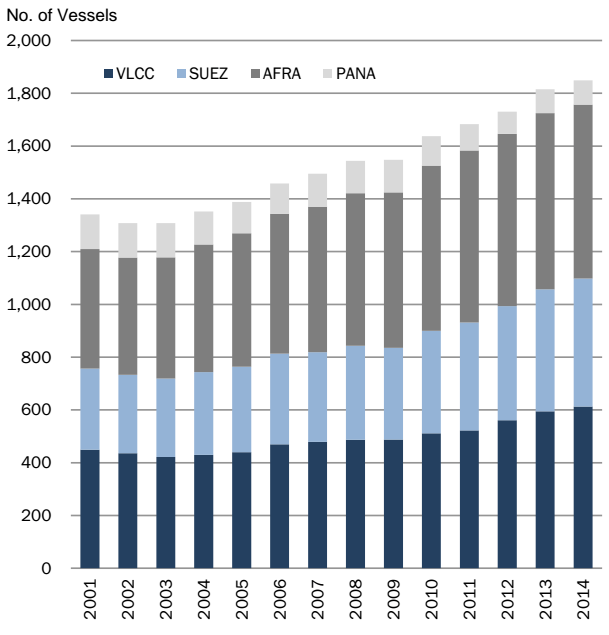

With very few new orders within the large crude tanker market over the past three years, fleet growth has been been stagnant. Teekay’s Director of Research, Christian Waldegrave notes in his February Tanker Market Update that tanker fleet growth in 2014 will grow by 1 percent, largely driven by VLCCs and MR-sized tankers.

For the ships which are currently trading, this is good news as they have been getting hammered over the past few years due to the current state of overcapacity.

In a conversation with a major tanker owner this morning, he notes that even with the recent spurts in activity on the crude tanker front, these ships simply need to increase their speed in order to get right back into the hole of overcapacity. McQuilling notes that increasing the speed of the world’s VLCC fleet by one knot would have the incremental affect of adding 15 to 28 ships to the world’s fleet.

In McQuilling’s Tanker Market Outlook released in January, they note that the IEA projects global oil consumption to grow by 5 percent over 2014 levels to 96.7 mbpd. Nearly 10 percent of that figure will come from the United States which which is expected to increase production from 1 mbpd to 8.5 mbpd.

Considering crude cannot be exported from the United States, the growth of global oil consumption affecting the crude shipping markets will thus be a bit less than 5 percent.

At the beginning of March, McQuilling notes there were 613 VLCCs trading worldwide and that roughly 60 of those ships are over 15 years old. Nineteen new VLCCs are scheduled for delivery this year with a further 32 in 2015.

In a very simplistic equation and if all else remains equal and ship scrapping/newbuilding remains flat over that period, the best case scenario would be that 30 more ships would be needed to meet the energy needs of 2018 while maintaining the current status quo.

This scenario does not seem realistic as rates to build VLCCs are roughly $10 million higher than what they were in 2013, which subsequently requires the ship owner to earn higher day rates, which can only occur if there was higher demand for large tankers.

Neumiller notes that there is a parachute to all of this which may save the tanker owner.

If China were to limit the chartering of tankers to only those vessels 15 years or younger the world’s fleet would be quickly cut, and thus reset the supply-demand balance, for now.

Sign up for gCaptain’s newsletter and never miss an update

Subscribe to gCaptain Daily and stay informed with the latest global maritime and offshore news

Stay informed with the latest maritime and offshore news, delivered daily straight to your inbox

Essential news coupled with the finest maritime content sourced from across the globe.

Sign Up