By Alex Longley and Julian Lee (Bloomberg) —

An oil tanker company heavily involved in moving Russian oil lost industry standard insurance for its fleet after falling foul of a Group of Seven price cap relating to the transportation of the nation’s barrels.

Gatik Ship Management lost so-called protection and indemnity cover that was provided by the American Club, a person familiar with the matter said, declining to be identified discussing sensitive information. The cover protects against risks including collisions and spills.

The cover was terminated because the American Club was informed that Gatik intended to transport barrels bought at prices above the threshold, the person said. The American Club confirmed the discontinuation of cover. It declined to comment on why.

Since early December, companies in G-7 countries have only been allowed to provide services for Russian oil if the cargoes cost $60 a barrel or less.

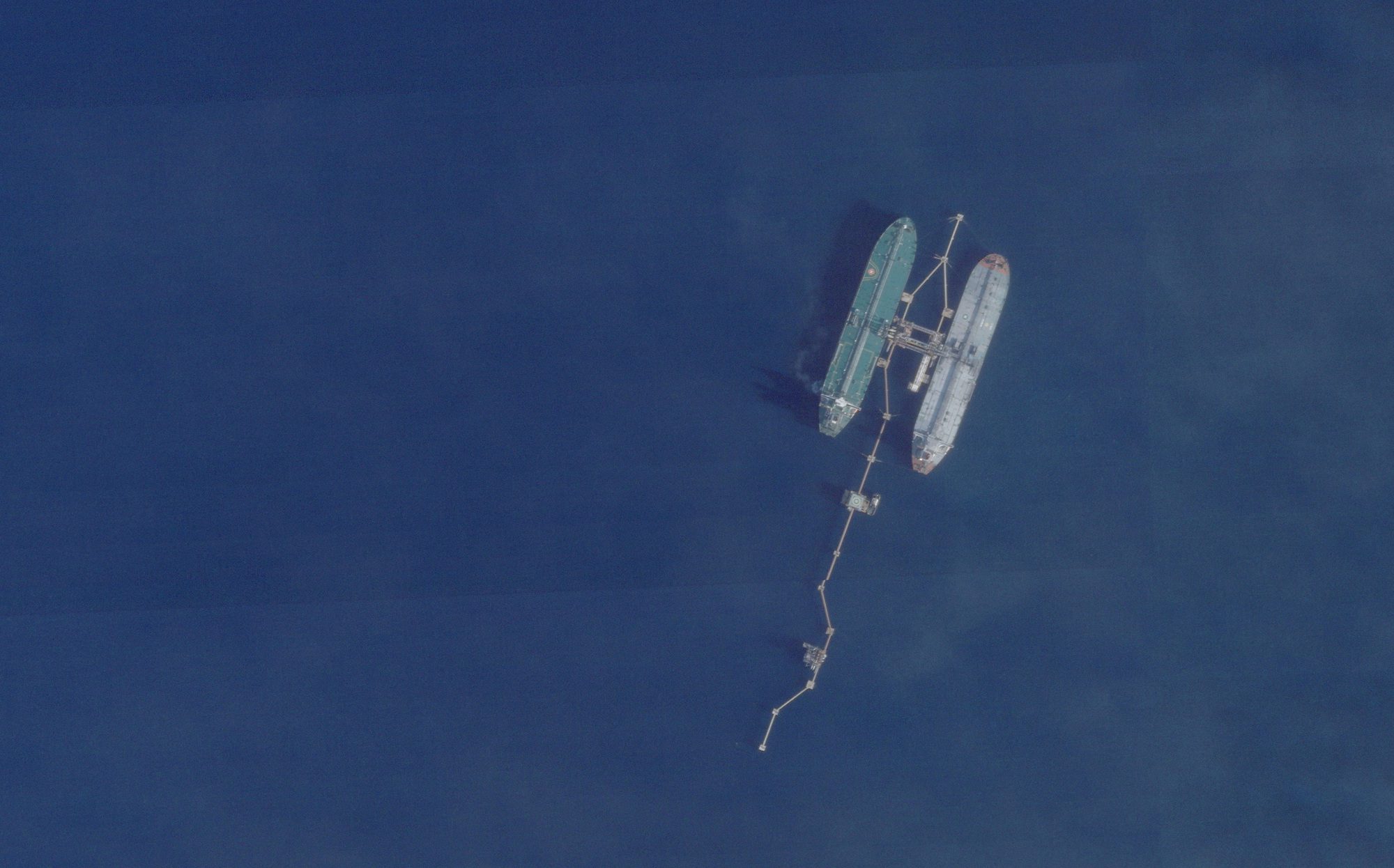

While the threshold initially appeared to prioritize the continuation of Russian oil flows, the cessation of Gatik’s cover shows the measures have some teeth. On Monday, the US government warned that some oil tankers shipping Russian crude in Asia are using deceptive tactics to evade the Washington-led price cap on the country’s exports.

Aging Shadow Fleet Carrying Russian Oil Poses Disaster Risk

The American Club is one of 12 organizations within the International Group of P&I Clubs, which collectively provide industry standard cover that serves as a passport to trade freely.

Gatik, which has an address in Mumbai according to the Equasis international maritime database, is one of a handful of tanker companies that sprang up out of nowhere when the west began ratcheting up sanctions on Moscow last year.

When Bloomberg visited the address earlier this year, a person from a neighboring office said Gatik had moved out and there was mail strewn on the floor outside. There is no website, phone number, or other means of contacting the firm.

The insurance that Gatik lost is important for vessels when they enter ports or sail through key waterways like Turkey’s Bosphorus and Dardanelles shipping straits.

Every one of 48 tankers identified as being managed by Gatik on a database maintained by Equasis, or by data analytics firm Vortexa, has loaded Russian crude or refined products at least once this year. The American Club is listed as the insurer of 34 of them, with another nine covered by unknown entities. Gatik’s fleet can haul about 31 million barrels of oil and fuels, the data compiled by Bloomberg show.

India did not sign up to the price cap, nor does it have other sanctions on Russian oil.

Gatik really began building its fleet up from last summer, according to VesselsValue, a firm that monitors the sale and purchase of merchant ships.

© 2023 Bloomberg L.P.

Join The Club

Join The Club