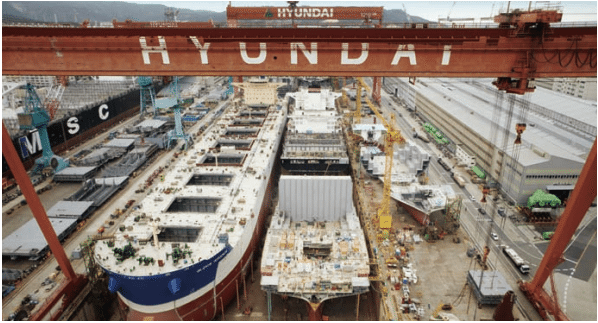

Image courtesy Hyundai Heavy Industries

By Kyunghee Park and Jasmine Wang

May 10 (Bloomberg) — Hyundai Heavy Industries Co. failed for eight years to win ship orders from China. That ended when it pledged to build the world’s biggest container carrier.

China Shipping Container Lines Co. this week said it chose Hyundai Heavy to construct five vessels that can each carry 18,400 20-foot boxes. The world’s biggest yard, which has already won orders for five 14,000-box vessels this year, beat Chinese builders for the $683 million contract.

Rising demand for bigger and more fuel-efficient ships from lines including A.P. Moeller-Maersk A/S will help South Korean yards boost profits amid an overall slump in orders caused by a vessel glut. The nation’s shipbuilders have dominated the construction of mega ships that are longer than Eiffel Tower as they built almost all such vessels in operation.

“Making these ships isn’t easy,” said Park Moo Hyun, an analyst at E*Trade Securities Korea.

“South Korean yards are the only ones that have proved these big ships can be built on time. Chinese shipyards are still way behind and that gap is only going to get wider.”

Since 2010, yards in South Korea delivered all except one of the 143 vessels that can carry more than 10,000 boxes, according to Clarkson Plc, the world’s biggest shipbroker.

Hyundai Heavy dropped 1.7 percent to close at 200,000 won in Seoul trading. The stock has fallen 17 percent this year, compared with a 2.6 percent decline in the benchmark Kospi index.

14,000 Boxes

A South Korean yard previously won a Chinese order for container ships in August 2007, Park said. Samsung Heavy Industries Co., the world’s second-largest shipbuilder, got the contract, also from China Shipping, to build eight vessels with a capacity to haul 14,000 boxes each. The ships were delivered by the first half of last year.

Hyundai Heavy’s previous order from China was in January 2005 for four container ships that can each carry 10,000 boxes, the Ulsan, South Korea-based company said. The vessels were all delivered by 2008.

China Shipping placed the order with Hyundai Heavy after a tender in which Chinese yards also participated, the carrier said in an e-mail. As much as 70 percent of the price would be paid when the ships are delivered. The company favors Chinese builders when conditions and offers match, it said.

“Korean yards do have the capability to build better, giant ships,” said Sarah Wang, a Shanghai-based analyst at Masterlink Securities Corp. “China Shipping may have placed the order because of the technology.”

New Engine

The new ships will use an engine that can automatically control fuel consumption to suit speed and sea conditions. The technology will help improve fuel efficiency, reduce noise and cut emissions.

Delivery will start in the second half of 2014.

“It’s true we never built ships that can carry 18,000 boxes, but that doesn’t mean we don’t have the technology,” said Wang Jinlian, secretary general of the China Association of National Shipbuilding Industry. “We just don’t have the experience, but everything has a beginning.”

Chinese yards had an orderbook of 218 million deadweight tons in 2008, overtaking South Korea as the world’s biggest shipbuilding nation, according to Clarkson. At the end of March, their backlog dropped to 106.5 million tons, compared with South Korea’s 62.3 million tons, according to the shipbroker’s data.

Spot Rates

Chinese shipping lines should be encouraged to place orders with local yards, Wang said. Some shipping lines are in talks with Chinese builders for vessels that can carry 16,000 containers, he said without elaboration.

After China Shipping announced the latest purchase, the China Shipowners’ Association said new orders will exacerbate the overcapacity in the industry and spur a further deterioration in the market. Spot rates for cargo hauled to Europe from Asia have fallen 35 percent this year to $796 per box last week, according to the Shanghai Shipping Exchange.

“If the massive order continues, even five years will not be enough for the market to see the light,” Zhang Shouguo, executive vice president of the association, said in a May 7 statement on the group’s website. “Fuel-efficient vessels are the future, but banks, financial institutions, shipowners and cargo owners should take an extremely cautious attitude toward shipping investment.”

Hurting Margins

Ship prices have plunged because of the overcapacity and industrywide losses, hurting margins at shipbuilders. Prices for a vessel that can carry as many as 13,500 boxes have fallen to $106 million in April, the lowest since Clarkson started compiling the figure in June 2008.

Global orders for all type of ships dropped 38 percent to 51.1 million deadweight tons last year, the lowest since 2001, according to Clarkson. Shipping lines have sold older vessels and non-core assets as they posted losses for a second year in 2012, according to Alphaliner.

Companies are also sailing slower, with the average speed of container ships dropping 16 percent in the past three years to 10.04 knots, according to data compiled by Bloomberg. Reducing the speed of container ships by 10 percent can pare fuel consumption by as much as 30 percent, according to ship assessor Det Norske Veritas.

While overcapacity is a concern, it won’t stop shipowners from ordering more advanced vessels that will help pare fuel costs and reduce emissions, according to Um Kyung A, an analyst at Shinyoung Securities Co. in Seoul.

“Cutting costs is very crucial for shipping lines,” Um said. “During these difficult times, who can make money and who can’t will pretty much depend on who can cut costs more effectively.”

Copyright 2013 Bloomberg.

Unlock Exclusive Insights Today!

Join the gCaptain Club for curated content, insider opinions, and vibrant community discussions.

Join The Club

Join The Club