(Bloomberg) —

Exxon Mobil Corp. is the current charterer of a tanker that was sanctioned by the US Treasury Department on Thursday for a previous breach of a Western cap on Russian oil prices, underscoring the scope such actions have to disrupt the tanker industry.

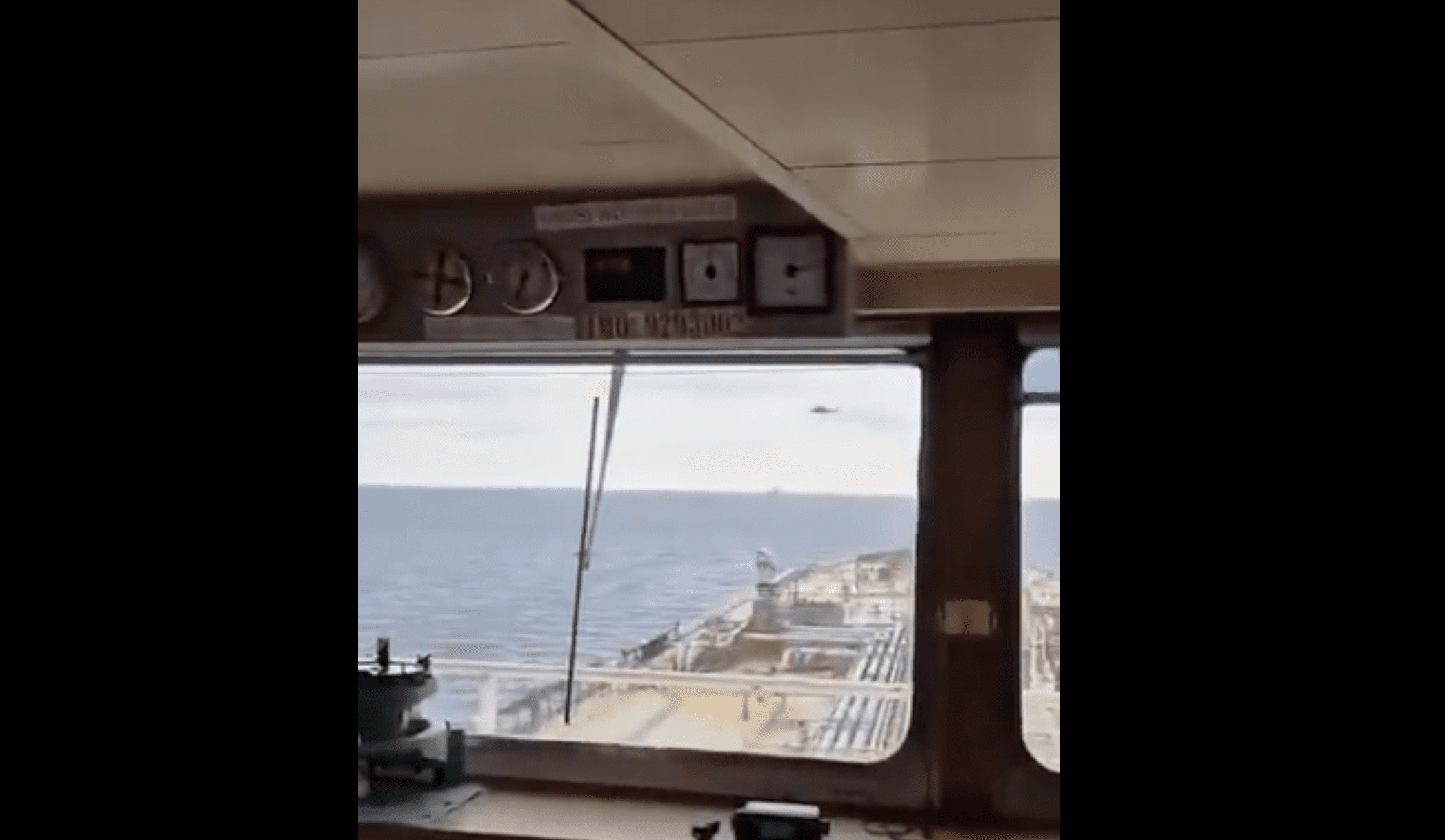

The Yasa Golden Bosphorus is currently carrying a cargo toward the US port of Houston, where it’s due to arrive on Tuesday, according to tanker tracking data compiled by Bloomberg. Its breach of sanctions happened months ago and didn’t involve the US oil major.

On Thursday, the US Treasury said the Yasa Golden Bosphorus had transported oil that cost above $60 a barrel after sanctions into effect last December. Doing so meant it was in breach of a Group of Seven cap that prohibits western firms from being involved in Russian petroleum transport if the price paid was above that level.

US Imposes First Sanctions Over Russia Oil Cap as Impact Fades

“ExxonMobil complies with all applicable laws and does not trade Russian oil or products,” the company said in a statement. “These deliveries are certified products of Canadian origin.”

Pressure has been mounting to add bite to sanctions with widespread evidence that existing measures were either being flouted, or were being worked around with the use of a large shadow fleet of tankers.

Fixture data show a handful of western oil companies have used the ship in recent months, and that it called at ports in Poland, Portugal and France since July.

Tougher sanctions enforcement is likely to lead to heightened checks on vessels by charterers due to the risk of inadvertently booking one that has acted in breach of the cap.

In practice, western service providers rarely know the value a cargo trades at, so the sanctions require them to acquire a so-called attestation pledging the consignment is valued below the threshold.

The Yasa Golden Bosphorus hasn’t changed course since sanctions were placed on it and continues to head for Houston.

The ship is also insured against risks such as oil spills by Britannia P&I, an insurer with offices in the UK and Europe.

A spokesman for Britannia said it is liaising directly with the US Office of Foreign Assets Control and other regulators on the ship but couldn’t comment further. Insurers generally have standard clauses that cancel a ship’s cover if it breaches sanctions.

© 2023 Bloomberg L.P.

Join The Club

Join The Club