(Bloomberg) —

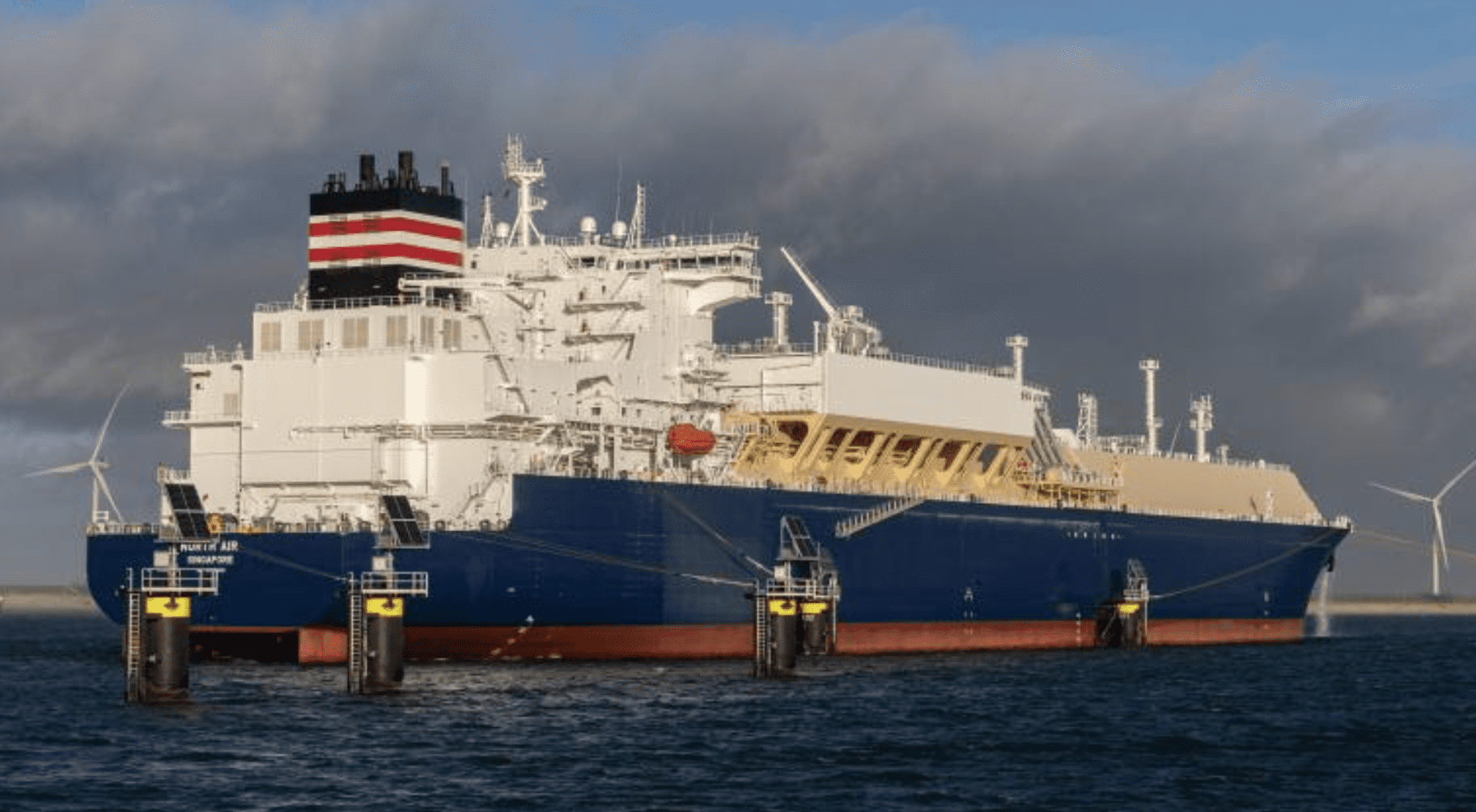

Liquefied natural gas stored on ships jumped to its highest level since May in a sign that weak demand and high inventories in Europe are pushing the fuel toward Asian markets.

The volume of LNG that has stayed on the water for more than 20 days topped 3.1 million metric tons this week — well above the average for the season — according to data compiled by Bloomberg. It comes as European gas storage levels are almost 84% full, lowering the immediate need for additional supplies amid higher flows from Norway and persistently sluggish industrial demand.

Yet rising benchmark futures raise questions about how long the lack of LNG deliveries can last if demand for fuel picks up later this year amid a colder-than-expected winter. Prices have also seen some gains recently amid concerns about escalating Russia-Ukraine tensions and heat waves in parts of Europe disrupting energy networks.

But they’re still about 60% lower since the start of the year, and gas consumption is subdued for now, indicating there’s more fuel available in the market than currently needed.

Even if LNG imports to the region are significantly reduced for the balance of summer, analysts at JPMorgan Chase & Co. still see September’s storage level climbing toward 99%. They’ve trimmed their price forecasts for the third quarter to €20 a megawatt-hour from €27 to reflect “storage congestion pricing.”

Still, Europe isn’t completely out of the woods after last year’s energy crisis. Traders continue to monitor maintenance schedule in Norway after extended outages last month, and some extra works are already set for this week.

If the coming months see prolonged cold periods, that could prompt renewed competition for gas, said LNG analyst Alex Froley at Independent Commodity Intelligence Services.

“The loss of Russian pipeline gas remains a huge structural change not yet replaced by the limited new output starting up in 2023,” he said.

Dutch front-month futures, Europe’s gas benchmark, rose 6.1% to €32.41 a megawatt-hour at 3:44 p.m. in Amsterdam after earlier declines. The UK equivalent contract is rising.

–With assistance from Elena Mazneva.

© 2023 Bloomberg L.P.

Editorial Standards · Corrections · About gCaptain

This article contains reporting from Bloomberg, published under license.

Join The Club

Join The Club