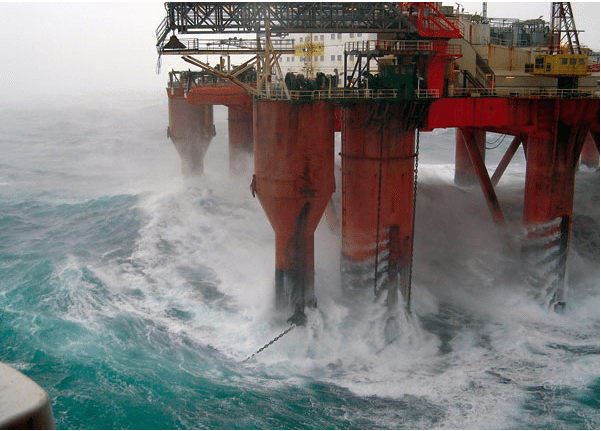

Borgholm Dolphin in a North Sea storm, image courtesy Dolphin Drilling

LONDON–Oil prospecting in the U.K. North Sea has experienced renewed vigor and there is a positive outlook for 2013 activity, according to a report released Friday, despite a separate prediction that actual crude-oil production there will hit a 36-year low this year.

The report, from business consultancy Deloitte, says a range of incentives and a sustained high oil price boosted drilling activity on the U.K. Continental Shelf by one-third in 2012, a year in which there was also a surge in deal activity and the most interest in field development for a decade.

But the Organization of the Petroleum Exporting Countries, in its monthly report issued this week, has cautioned that a natural decline in production, and limited new developments, means North Sea crude output this year will fall to its lowest level since 1977.

Since first production in the 1960s, the North Sea’s revenues have be a major boost for the U.K. economy. The industry still provides around 8 billion pounds ($13 billion) annually in taxation, according to the Department of Energy and Climate Change, but output from the region has been in steady decline since peaking in 1999 and the U.K. has been a net importer of crude oil since 2005.

OPEC this week forecast the U.K.’s average 2013 daily oil output at 910,000 barrels a day, the lowest level since 1977. This decline is significantly lower than that estimated in 2012, OPEC said, as fewer unplanned shutdowns are expected, the Elgin-Franklin field should restart after a spill forced its closure, and some new developments should support output.

The U.K. government last year issued a raft of tax-based incentives for small fields, large deep-water developments, shallow-water natural gas field developments and to extend the life spans of existing fields. In total, more than 90% of new field developments in U.K. waters were eligible for tax allowances following the 2012 budget, according to Deloitte.

“The U.K. government has what appears to be a useful strategy to manage the decline in North Sea’s reserves,” said Derek Henderson, energy partner for Deloitte in the Scottish oil town of Aberdeen.

Graham Sadler, managing director of Deloitte’s Petroleum Service Group, said: “After several years of caution and uncertainty, we have a more positive environment, where a number of factors such as tax incentives, high oil price and appetite to invest have combined to make 2012 the most encouraging year for a long time.”

The benchmark Brent oil price closed 2012 having averaged in excess of $111 a barrel for the year, the highest on record.

This has encouraged a rash of deal making in the region, including the $1 billion acquisition of a number of BP PLC’s (BP) oil and gas fields by Abu Dhabi National Energy Co. (TAQA.AD) and Royal Dutch Shell PLC’s (RDSB) $525 million purchase of Hess Corp.’s (HES) Beryl interest.

But although cumulative hydrocarbon production from the region over the next 30 years could amount to as much as 16.8 billion barrels of oil equivalent, according to a recent University of Aberdeen study, this is some way below the government’s projections of around 20 billion barrels of oil equivalent.

Write to Ben Winkley at [email protected]

(c) 2013 Dow Jones & Company

Join The Club

Join The Club