By Andrew Galbraith in Shanghai and Jason Dean in Beijing, Wall Street Journal

A spat over contracts between China’s biggest shipping company and foreign ship owners is calling attention to broader tension over the rise of a Chinese corporate sector that doesn’t always play by established global rules.

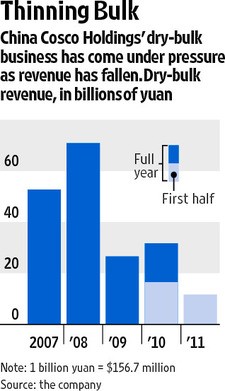

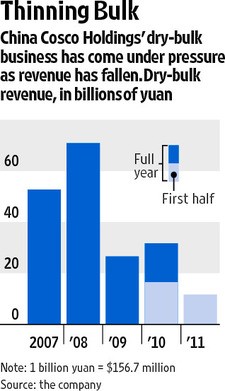

The move by China Cosco Holdings Ltd., the listed flagship of state-owned China Ocean Shipping (Group) Co., to halt or delay payments for vessels it leased at the height of the shipping boom in 2008 reflects in part the cyclical stresses in the global shipping industry. But some analysts, lawyers and executives in China say it also reflects a willingness among some Chinese companies — often, like China Cosco, owned by the government — to snub existing norms of global commerce.

In recent years, foreign banks and other creditors have faced repeated difficulties getting payment on bonds or derivatives contracts from Chinese companies. In 2009, for example, China’s government encouraged state-owned airlines and shipping companies, including Cosco, to challenge losses from derivatives deals with foreign banks used to protect against sudden surges in the price of fuel. That same year, China-based Asia Aluminum Holdings Ltd. offered to buy back its debt for pennies on the dollar, leading to losses for international investors.

Foreign companies that do business in China are routinely warned that contracts aren’t viewed in China with the same sort of legal sanctity that they receive in most developed economies. Jingzhou Tao, a Beijing-based lawyer with Dechert LLP, says that withholding payments is a frequent tactic used in China to force price negotiations. “A contract is not an unchangeable bible for Chinese companies,” Mr. Tao said.

Foreign companies that do business in China are routinely warned that contracts aren’t viewed in China with the same sort of legal sanctity that they receive in most developed economies. Jingzhou Tao, a Beijing-based lawyer with Dechert LLP, says that withholding payments is a frequent tactic used in China to force price negotiations. “A contract is not an unchangeable bible for Chinese companies,” Mr. Tao said.

Prices for leasing the cargo ships that carry commodities like coal and iron ore have plunged since 2008, when China Cosco signed the deals at issue. Industry executives say it is common for shipping companies to want to renegotiate long-term contracts as a result of economic swings. But it is unusual for financially solvent companies to renege on contracts the way that China Cosco has done on some.

Representatives of China Cosco didn’t respond to requests for comment Friday. During a conference call a week earlier after it posted a first-half loss, China Cosco Executive Director Zhang Liang called such disputes “normal” and blamed ship owners for “trying to use the media to make a bigger impact.” The company said it had renegotiated deals on 18 ships. A China Cosco official said Thursday it plans to restructure its unprofitable dry-bulk shipping operations.

China Cosco, which has about 200 dry-bulk ships under charter and owns 234, appears to be trying to correct course. Some ship owners that had complained about the Chinese company’s failure to pay have said in recent days that they started receiving payments again.

Angeliki Frangou, chairman and chief executive of Navios Maritime Holdings Inc., said Cosco stopped payments in July but has since met original agreements with no renegotiations. “We have been paid,” she said. “Cosco is a counterparty that we like to do business with and will continue to do business with. This was an incident that was very quickly resolved.”

But some in the industry remain frustrated. “They’ve paid up to date [and] I don’t want to be nasty,” said Raymond Ching, vice president at Hong Kong-based Jinhui Shipping & Transportation Ltd. “But obviously, withholding payments and giving us either no response or very, very absurd reasons — it’s just something that we won’t tolerate.”

—

Tom Orlik in Beijing contributed to this article.

Join The Club

Join The Club

Foreign companies that do business in China are routinely warned that contracts aren’t viewed in China with the same sort of legal sanctity that they receive in most developed economies. Jingzhou Tao, a Beijing-based lawyer with Dechert LLP, says that withholding payments is a frequent tactic used in China to force price negotiations. “A contract is not an unchangeable bible for Chinese companies,” Mr. Tao said.

Foreign companies that do business in China are routinely warned that contracts aren’t viewed in China with the same sort of legal sanctity that they receive in most developed economies. Jingzhou Tao, a Beijing-based lawyer with Dechert LLP, says that withholding payments is a frequent tactic used in China to force price negotiations. “A contract is not an unchangeable bible for Chinese companies,” Mr. Tao said.