Last month, CNOOC Limited announced a summary of the company’s business strategy and development plan for the year 2012.

The total targeted net production of the company in 2012 is 330 to 340 million barrels of oil equivalent (BOE). The company’s net production for 2011 is estimated to be 331 to 332 million BOE. For comparison, in 2010, the United States produced 589 million BOE.

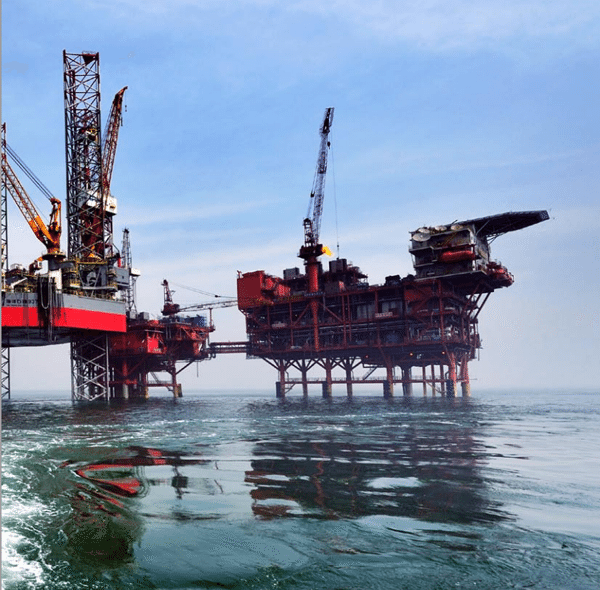

During the year, four new projects in offshore China are expected to come on stream, among which the incremental peak production of Panyu 4-2/5-1 adjustment project is expected to reach around 57 thousand barrels per day in 2014, demonstrating the huge potential of the company’s producing fields. More adjustment projects are expected to come on stream in offshore China in the next few years and become an important driver to the company’s future production growth. In overseas, Long Lake oil sands project in Canada and Missan oilfield in Iraq are expected to make production contribution. Currently, there are 16 projects under construction, laying a solid foundation for the company’s mid to long term development.

In the aspect of exploration, the company will enhance its independent deepwater exploration, while expanding exploration in new areas and frontiers.

In the aspect of exploration, the company will enhance its independent deepwater exploration, while expanding exploration in new areas and frontiers.

An aggregate of 114 exploration wells including 3 independent deepwater wells in South China Sea are expected to be drilled and 18,300 kilometers 2-Dimensional (2D) seismic data and 19,200 square kilometers 3-Dimensional (3D) seismic data to be acquired. The company’s reserve replacement ratio (RRR) is targeted to exceed 100% in 2012.

In 2012, in order to support a sustainable growth as well as to accelerate the exploration and development of deepwater and unconventional energy, the company’s total capital expenditure is expected to reach US$9.3-11.0 billion, among which the capital expenditures for exploration, development and production account for around 17%, 68% and 14% respectively.

“In the coming year, the company will strive to ensure that the capital expenditure plan is effectively implemented in order to support the company’s future production and reserve growth. Meanwhile, the company will continue to maintain its relative cost advantage under the rising industry cost environment,” Mr. Zhong Hua, CFO of the company commented.

Mr. Li Fanrong, CEO of the company said, “In 2011, despite of facing a number of challenges, the company has eventually completed its annual production target. It does not come easy. In the future, the company will still be targeting to achieve 6-10% CAGR on production growth from 2011 to 2015 by means of regional development and comprehensive adjustments in producing oilfields in offshore China as well as pushing for deepwater exploration and development. All these will lay a solid foundation for the company’s mid to long term development strategy and create more value for the shareholders.”

Join The Club

Join The Club