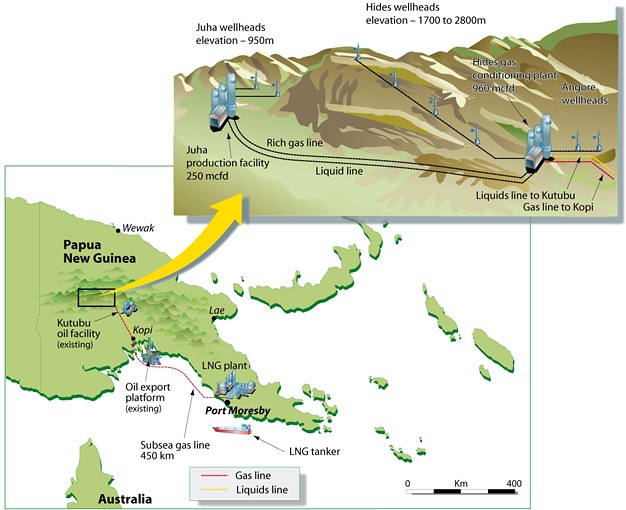

Diagram courtesy PNG LNG

SYDNEY–Exxon Mobil Corp. (XOM) said Monday the cost of building a massive natural gas-export project in Papua New Guinea has blown out to US$19 billion from a previous estimate of US$15.7 billion due to foreign exchange fluctuations, landowner disputes and torrential rain.

Exxon said the project is 70% complete and remains on track to ship its first cargos to buyers in China, Japan and Taiwan in 2014. An increase in the plant’s output capacity announced Monday to 6.9 million metric tons per annum from 6.6 million tons would improve its financial returns, the company expects.

“Despite the cost increase, project economics are helped by the 5% increase in plant capacity and approximately 30% increase in commodity pricing since project funding in 2009,” Exxon said in a statement.

Even so, the large budget overrun highlights the mounting cost pressures faced by international oil majors such as Exxon, Chevron Corp. (CVX) andRoyal Dutch Shell PLC (RDSB.LN) as they attempt to tap rising Asian demand for cleaner-burning fuels by building complex and expensive export terminals in Australia and Papua New Guinea that chill natural gas to liquid for export by tanker.

Chevron said in July that it was reviewing the cost of the 43 billion Australian dollar (US$44.7 billion) Gorgon liquefied natural gas, or LNG, project in Western Australia state following a 20% rise in the Australian dollar since construction began in 2009. Logistical challenges and the strong local currency also prompted two Australian projects involving Total SA andBG Group to announce large budget overruns earlier this year.

Chevron Chief Executive John Watson in August. Mr. Watson said in an interview that the company opted not to hedge foreign-currency risks as Australia’s economy is heavily reliant on the resources sector, so energy prices would rise in step with the Australian dollar, boosting likely revenues from Gorgon.

Exxon‘s cost blowout at the so-called PNG LNG project follows an increase last year from an initial US$15 billion estimate and also highlights the unique challenges faced by companies doing business in Papua New Guinea, an impoverished Pacific nation better known for its jungles and lawlessness.

In a technically complex undertaking, the project involves transporting natural gas from the country’s lush highlands to the coast via a 190-mile, 32-inch pipeline traversing rugged terrain up to 650 feet above sea level. From the shore, it will then be transported by a 250-mile subsea pipeline to a gas-processing terminal to be chilled into LNG for export.

Exxon operates and owns 33.2% of PNG LNG, while Australian companiesOil Search Ltd. (OSH.AU) and Santos Ltd. (STO.AU) own 29% and 13.5% stakes, respectively.

Foreign exchange fluctuations accounted for US$1.4 billion of the cost increase, while delays from work stoppages and land access issues added a further US$1.2 billion, Oil Search said.

Another US$700 million was pinned on adverse logistics and weather conditions including heavy rainfall.

Exxon confirmed that foreign exchange was the largest single contributor, adding to costs associated with work stoppages caused by community disruptions and problems accessing land.

“Extraordinary logistics and weather challenges also increased costs. In particular, rainfall exceeded historic norms for most of the last two years,”Exxon said.

In separate announcements to the Australian Securities Exchange, Oil Search and Santos said they had “ample liquidity” to cover their higher project funding requirements. By 2343 GMT, shares in the companies had fallen 5% and 2.2%, respectively.

– Ross Kelly, (c) 2012 Dow Jones & Company

Unlock Exclusive Insights Today!

Join the gCaptain Club for curated content, insider opinions, and vibrant community discussions.

Join The Club

Join The Club