Freight Rates Stall After Lunar New Year as Carriers Eye Blank Sailings

Container freight spot rates on the major trades saw limited movement this week as supply chains in China slowly began to restart following the new year holiday.

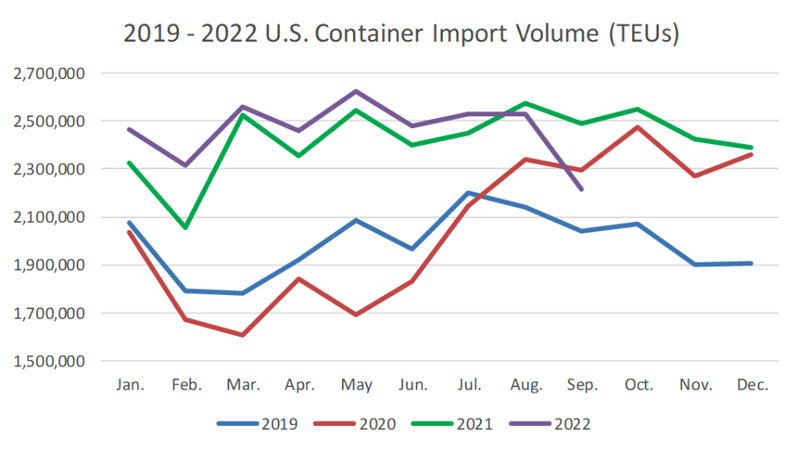

U.S. container import volumes have finally started to fall off the proverbial cliff that some in the industry have been predicting for months.

Data analytics company Descartes came out with a report Tuesday showing that total containerized imports into the U.S. fell by a precipitous 11% in September, to 2,215,731 TEUs, as a slowing economy, retailers reducing purchases, inflation and high fuel costs finally started to catch up to import throughput numbers at U.S. ports. Compared to August, September import volumes were down 12.4%.

For comparison, August’s import volume fell just 1.8% year over year and remained about the 2.5 million TEU mark.

The data shows that U.S. container import volumes in September moved closer to pre-pandemic levels, but though volume was still up 9% compared to pre-pandemic in September 2019.

According to Descartes, much of the drop was related to a decrease in Chinese imports, which were down a whopping 18% compared to August. This had the greatest impact on the major West Coast ports of Los Angeles and Long Beach, which each saw TEU losses of 17% compared to August. But it wasn’t just West Coast ports that are that felt the pinch.

The Port of Savannah saw a significant month over month decline of 21%, but that was in part thanks to Hurricane Ian. The Port of New York and New Jersey, which overtook Los Angeles as the nation’s top port for containerized cargo in August, saw imports fall just 2.3% compared to August, meaning its reign at the top was not simply an August one-off. The Port of Houston, which has seen the biggest gains from the west-to-east cargo shift, saw import volumes decline 5%.

Unfortunately, the declining volumes were not enough to have a measurable impact on port delays, especially for East and Gulf Coast ports, and Descartes is predicting that congestion and challenges in the global supply chain will continue for at least the rest of the year. Overall, port delays in September 2022 were lower than in August, but for East and Gulf Coast ports average wait times (in days) remained in the double-digits.

Descartes’ report also hits on the west-to-east cargo shift, showing that East and Gulf Coast ports saw their overall share of imports continue to increase. East coast ports increased their market share of U.S. imports in September to 48.2%, up 4.1% over August, while the West coast ports decreased to 37.0% in September from 41.9% in August.

Sign up for gCaptain’s newsletter and never miss an update

Subscribe to gCaptain Daily and stay informed with the latest global maritime and offshore news

Essential news coupled with the finest maritime content sourced from across the globe.

Sign Up