(Bloomberg) —

Almost every day since the expansion of Canada’s Trans Mountain pipeline was completed in May, a tanker laden with oil sands crude shipped through the line has passed under Vancouver’s Lions Gate Bridge en route to refineries around the Pacific.

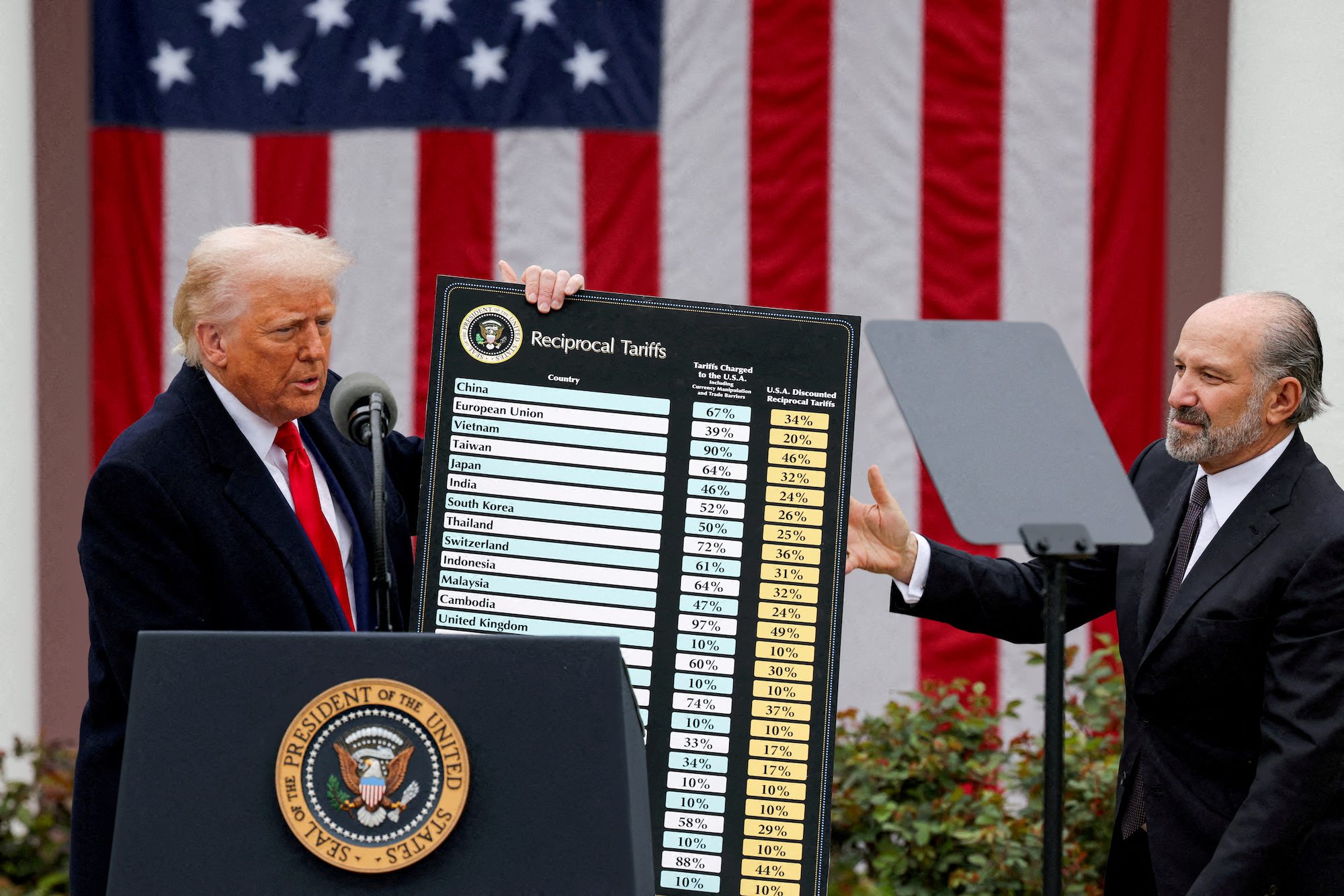

Those tankers, bound for China and Japan among other markets, mark a significant shift for Canada, which has long been stuck exporting its vast flows of oil solely to the US. And with President Donald Trump’s tariff threats highlighting the risk of that dependence, the success of the C$34 billion ($24 billion) Trans Mountain expansion is stoking Canada’s desire to further decouple from its unpredictable neighbor — and play a larger role in global oil markets.

Trans Mountain “is a good start,” said Adam Waterous, a former investment banker and the founder and chairman of oil producer Strathcona Resources Ltd. “Now we have to build on it. The very fortunate thing is that we’re not starting from scratch.”

Canada’s oil industry has long pushed for more pipelines, both to its own coasts and to the US, only to see them thwarted by opposition from environmental groups, Indigenous communities and courts as well as the country’s own federal and provincial governments.

But those efforts are garnering renewed interest as Canadians reel from Trump’s trade attack, an episode that has sparked anger and distrust at the country’s southern neighbor, even pushing hockey fans to go so far as to boo the US national anthem at recent games.

Two mothballed projects in particular are being discussed as ripe for revival: Energy East, which would carry western Canadian crude east to refineries in Ontario and Quebec; and Northern Gateway, which would haul Alberta oil to a Pacific port in northern British Columbia.

Energy East would have converted an existing natural gas pipeline to carry about 1.1 million barrels of oil a day from Alberta and Saskatchewan to refineries and a shipping terminal in eastern Canada. Crucially, that would avoid moving crude through the US, as is done on Enbridge Inc.’s Line 5, which crosses the border on its route to Ontario and Quebec.

“Everybody is of the view that we have to rethink a little bit some of the vulnerabilities we’ve got, vis-a-vis the United States,” Natural Resources Minister Jonathan Wilkinson said in an interview.

Northern Gateway was halted by a court in 2016 amid objections from environmental groups and First Nations, and it was later rejected by Canadian Prime Minister Justin Trudeau in 2016. The roughly 1,178-kilometer (732-mile) line would have run from Alberta to Kitimat, British Columbia, with a capacity of 525,000 barrels a day, providing oil sands producers with a way to send more crude to buyers in Asia.

Canada’s government should declare an energy emergency to streamline the regulatory process for Energy East and Northern Gateway, start building them in the coming months and complete them while Trump is still in office, Strathcona’s Waterous said.

“Canada, when in a time of national need, can construct nation-building projects,” Waterous said. “There’s no question that this is a time now of national need.”

Enbridge said Monday it has no plans to develop Northern Gateway and is instead focusing on increasing capacity on pipelines it already has in place. South Bow Corp., the oil pipeline company spun out of former Energy East proponent TC Energy Corp., declined to comment on Energy East. TC Energy didn’t immediately respond to a request for comment.

Even with company support, new pipelines would likely take years and billions of dollars to build. The cost of the Trans Mountain expansion, which nearly tripled the line’s capacity to 890,000 barrels a day, ballooned more than sixfold by the time it was completed. That bill was largely footed by Canadian taxpayers because Trudeau’s government bought the line in 2018 to save it from cancellation by original proponent Kinder Morgan.

That’s not to mention the opposition the lines would continue to face from environmentalists.

“This is a very old playbook, where the oil industry is looking to take advantage of a crisis to brush aside environmental and health protections,” Keith Stewart, senior energy strategist with Greenpeace Canada, said in an email.

With all those hurdles, one of the quickest and easiest solutions for Canadian oil producers may lie in further expanding Trans Mountain. The system is currently only shipping about 720,000 barrels a day, about 80% of its projected capacity, because high tolls to pay for its costly completion are making spot shipments uneconomical.

Trans Mountain’s capacity could be expanded by 200,000 to 300,000 barrels a day by boosting pumping power, executives have said.

The dock at the terminus of Trans Mountain is now shipping as many as 480,000 barrels a day, but may approach its slated capacity of about 630,000 barrels a day by mid-year after port authorities add navigational aids that will allow ships into the port at night. Volumes beyond the dock’s capacity largely flow into Washington State through connected pipelines.

Even below its capacity, Trans Mountain is reshaping the global oil market. China is buying increasing amounts of Canadian crude, supplanting purchases from sanctioned countries including Iran and Russia. That’s also pressuring prices of Middle Eastern and Latin American crudes similar to Canada’s heavy oil. Meanwhile, Canadian oil prices had risen and steadied, at least until the tariff threats began.

“The pull from the Asian markets will be there,” Trans Mountain Corp. Chief Executive Officer Mark Maki said in an interview. “We should be exploring opportunities to add value to the system.”

© 2025 Bloomberg L.P.

Editorial Standards · Corrections · About gCaptain

This article contains reporting from Bloomberg, published under license.

Join The Club

Join The Club