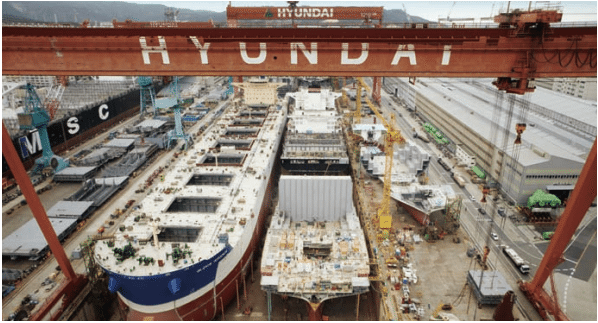

Image courtesy Hyundai Heavy Industries

By Sharon Cho and Kyunghee Park

Aug. 26 (Bloomberg) — South Korean shipbuilders, this year’s worst-performing industry group, are attracting buy recommendations from three of the nation’s biggest brokerages after valuations sank to records.

Hyundai Heavy Industries Co., Samsung Heavy Industries Co. and three other listed shipbuilders lost an average 40 percent this year through yesterday, compared with a 0.1 percent gain in the Kospi 200 Index. The shares trade at 0.7 times net assets, versus a multiple of 1.1 for the Kospi 200 and the Bloomberg World Shipbuilding Index.

While a strengthening won and falling ship prices spurred the industry’s biggest second-quarter loss since at least 2010, bulls from Hana Daetoo Securities Co. to JPMorgan Chase & Co. say the worst is over as new container-vessel orders replace older unprofitable contracts. China, the world’s biggest exporter, reported a bigger-than-estimated jump in overseas shipments last month while a measure of commodity shipping rates has jumped 50 percent from this year’s low.

“The only way they can go now is up,” said Park Moo Hyun, an analyst at Hana Daetoo Securities in Seoul. “Earnings can’t get any worse than the second quarter. The bright side to this is that there is still strong demand for new ships.”

Hyundai Heavy climbed 3 percent at 10:49 a.m. in Seoul, heading for the biggest gain since Nov. 15. Samsung Heavy advanced 2.9 percent, while Daewoo Shipbuilding & Marine Engineering Co. increased 3.1 percent and Hanjin Heavy Industries & Construction Co. added 1.4 percent. Hyundai Mipo Dockyard Co. jumped 5.1 percent for the top gain in the Kospi 200.

Relative Valuation

While shipbuilding’s importance to the Korean economy has diminished since former President Park Chung Hee made it part of his efforts to develop the country into a global industrial center in the 1970s, the nation’s 10 biggest shipyards still employed 183,022 people at the end of 2013, according to the Korea Offshore & Shipbuilding Association. Ship exports accounted for 6.5 percent of the country’s total in 2013, versus 10 percent two years earlier.

The average price-to-book ratio for Hyundai Heavy, Samsung Heavy, Daewoo Shipbuilding, Hyundai Mipo and Hanjin Heavy Industries dropped yesterday to the lowest level since Bloomberg began compiling the data in March 2011. The 33 percent discount versus the Kospi 200 is the widest on record.

Hit Bottom

Hyundai Heavy, the fourth-biggest company by market capitalization in the benchmark Kospi at its peak in April 2011, now ranks 24th after losing about $30.8 billion in value. Among more than 70 industry groups tracked by Bloomberg in the index this year, shipbuilders have posted the biggest decline among those with more than one member company.

“The stock prices of Korean shipbuilders have hit the bottom,” Sokje Lee, an analyst at JPMorgan Securities Asia Pte who has an overweight rating on the industry, said in a phone interview from Seoul on Aug. 22. “Share prices will see sharp gains toward year-end.”

The Kospi 200 is heading for its third straight annual gain, while the won has strengthened 3.2 percent against the dollar this year and is trading near a six-year high. The yield on three-year government notes has declined about 30 basis points to 2.58 percent.

Heo Pil Seok, the chief executive officer at Midas International Asset Management Ltd., says he’s waiting for evidence of sustained earnings growth at shipbuilders before he starts buying.

Old Contracts

Hyundai Heavy, Hyundai Mipo and Hanjin Heavy each reported net losses in the second quarter, while profits at Samsung Heavy and Daewoo Shipbuilding declined from the year-earlier period. Their combined loss of about 549 billion won ($538 million) is the biggest since Bloomberg began compiling the data in the first quarter of 2010.

“I need to see earnings improve for at least two to three consecutive quarters to believe that their valuations are cheap,” Heo, who helps oversee about $9.3 billion, said by phone on Aug. 21.

Korean shipbuilders are recognizing losses from contracts they signed about two years ago, when prices for vessels globally were near the lowest level since 2003 and shipyards took the risk of operating at a loss rather than leave their factories idle. Ship prices have since rebounded 10 percent, according to an index compiled by Clarkson Plc, the largest shipbroker.

Shock Over

Earnings will start to recover by the fourth quarter, said Han Young Soo, a Seoul-based analyst at Samsung Securities Co., Korea’s biggest brokerage by market value. In 2015, Daewoo Shipbuilding’s annual earnings will jump by 55 percent while those of Samsung Heavy will surge 181 percent, according to analyst estimates compiled by Bloomberg.

Hyundai Heavy is building five of what will be the world’s biggest container ships, capable of carrying 19,000 containers, for China Shipping Container Lines Co. Exports from the world’s second-largest economy jumped 14.5 percent in July, more than twice as fast as the median economist estimate tracked by Bloomberg.

Daewoo Shipbuilding won orders in July worth about $2.8 billion to build nine ships that will haul liquefied natural gas from the Yamal LNG project in Russia. Korea Gas Corp. will soon place orders for LNG ships from domestic manufacturers, the nation’s industry ministry said on Aug. 13.

“This is as far as we can be shocked in terms of earnings,” John Yu, a Seoul-based analyst at Woori Investment & Securities Co. whose top pick is Hyundai Heavy, said by phone on Aug. 21. “The latter half is definitely looking brighter than the first half.”

–With assistance from Richard Frost in Hong Kong.

Copyright 2014 Bloomberg.

Editorial Standards · Corrections · About gCaptain

This article contains reporting from Bloomberg, published under license.

Join The Club

Join The Club