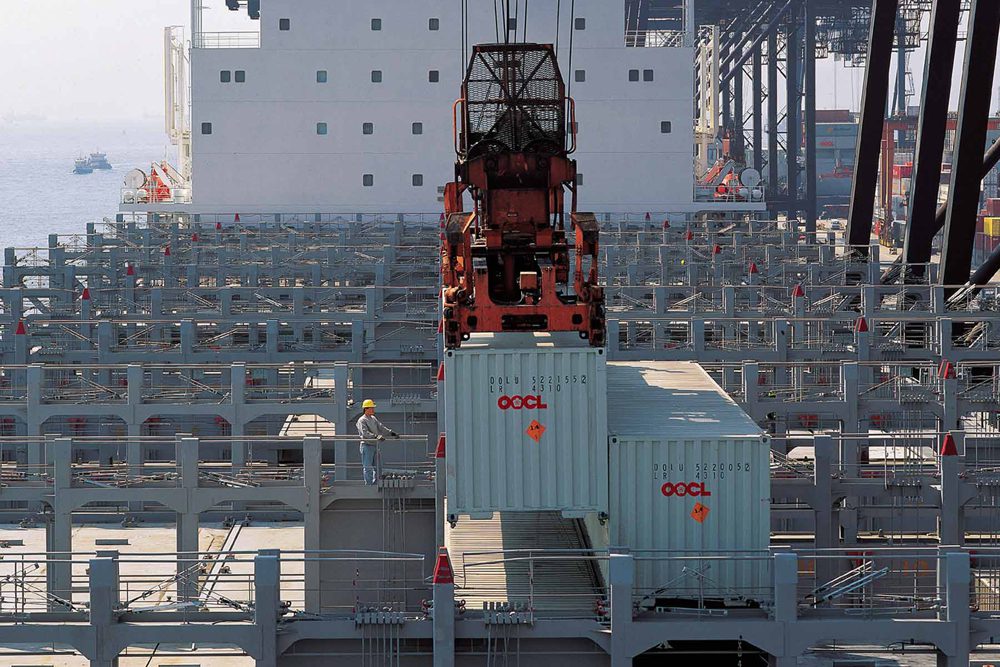

OOCL container loading on a vessel, via OOCL

SHANGHAI–Many in the shipping industry see a sluggish year ahead for Chinese exports, a cornerstone of the world’s No. 2 economy, despite other indications of growing demand for China’s products.

Some executives from shipping companies that carry containers full of Chinese-made products mainly to Europe and North America say they see little evidence of a strong rebound in seaborne exports. Stephen Ng, director of trades for Orient Overseas Container Line Ltd., said the company wasn’t seeing “any particular upsurge” in container volumes on its Asia-to-Europe or trans-Pacific services.

OOCL is the container-shipping unit of Hong Kong-listed Orient Overseas International Ltd. (0316.HK). The parent said Tuesday its container-shipping trans-Pacific services volume fell 6.8% in the fourth quarter compared with a year earlier. Volume on Asia-to-Europe services grew 2.8% compared with the same quarter a year earlier.

Consulting firm Alphaliner expects modest demand growth this year, forecasting a 1% rise on Asia-Europe services and a 1.6% trans-Pacific rise. Last year, Asia-to-Europe volumes declined 5% while trans-Pacific volumes fell 0.4%, according to Alphaliner estimates. The vast majority of containers on both routes carry exports from China.

“We see a rally in shipping-company shares, but the industry has not fundamentally improved,” says Bonnie Chan, an analyst with Macquarie Securities, citing a continued weak trade outlook as well as overcapacity and low rates within the industry.

Chinese exports in December grew a surprising 14% year-on-year compared with modest growth of 2.9% in November. The measure was the latest in a spate of stronger Chinese economic indicators, culminating in Friday’s report that China’s growth in the fourth quarter accelerated for the first time in more than two years.

But many analysts believe the export numbers overstate the gain, and say the latest figures are influenced by exceptional factors such as backlogs caused by port strikes in the U.S. In a Thursday report, brokerage RBS said it saw data discrepancies related to trade with Hong Kong as well as with what are known as customs special-control areas, which are bonded areas that hold goods destined for export.

Both China’s Commerce Ministry and customs officials defend the figures, with a ministry spokesman saying such fluctuations are common in trade data and noting a quarantine fee expired during the period. Zheng Yuesheng, a customs spokesman, said, “Every dollar in our statistical data corresponds to a real declaration bill.”

Others in the industry said they see some growth. Tim Smith, Maersk Line’s North Asia chief executive, said the company was experiencing “a rather unexpected strong pickup in exports” from China, especially to Europe, a rise he said looks set to continue up to the Lunar New Year in mid-February.

Still, he added, “This does not seem to be a reflection of any underlying improvement in the state of the European economies, so it is probably not a sustainable trend.”

In 2012, exports were equivalent to about 25% of China’s GDP, based on official data. But the country’s central position as the world’s center for low-end manufacturing is increasingly coming under threat from other emerging economies, and demand from Europe and the U.S. remains sluggish.

The skepticism also suggests the struggling shipping industry shouldn’t look to China demand for help. Global supply of container-shipping capacity is expected to grow up to 9% in 2013 while demand growth is expected to grow between 4% and 6%, Alphaliner said.

In December, Shanghai International Port (Group) Co. (600018.SH) saw volumes increase 3.9% year-on-year. Cosco Pacific reported that December throughput at the ports it operates in southern China grew 3.7% year-on-year.

Exports figures in dollars don’t always correlate with container volumes, Mr. Smith said, meaning a rise in the value of goods shipped could account for the increase. Port throughput figures also can include containers that are empty or in transit, he added.

Stock-market sentiment is bullish on the recent economic data out of China, boosting shipping companies. From early December to mid-January, China Shipping Container Lines Co. (601866.SH, 2866.HK) has risen 18%, slightly ahead of the benchmark Shanghai Composite Index, which grew 17% in the same period. Stocks of other Asia-based container-shipping companies including OOIL and Singapore’s Neptune Orient Lines Ltd. (NPTOY, N03.SG)–both of which rely heavily on shipping from China–have also improved.

CSCL said Saturday it expected to record an annual profit of 520 million yuan (around $83.5 million) for 2012, compared with a loss of 2.9 billion in 2011. The company said asset sales during the period helped improve financial performance.

–Amy Li in Shanghai and Yajun Zhang in Beijing contributed to this article.

Write to Colum Murphy at [email protected]

(c) 2013 Dow Jones & Company, Inc

Join The Club

Join The Club