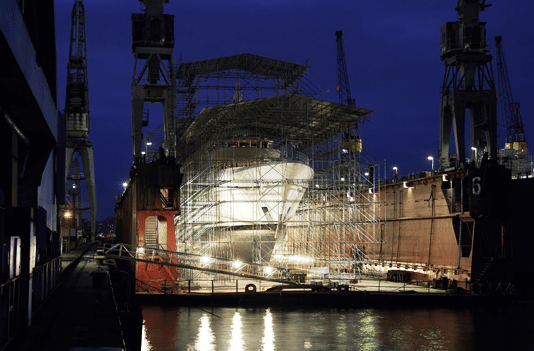

Image: Blohm + Voss Yachts

By Eyk Henning

FRANKFURT–London-based private equity firm Star Capital Partners Ltd. is pursuing a deal that will allow it to turn one of the oldest German marine companies into a firm dedicated solely to building and repairing yachts for the super rich.

The investor is putting Blohm + Voss’s Oil Tools unit, worth more than 100 million euros ($201.8 million), up for sale, and has mandated Australian investment bank Macquarie Capital to help find a buyer, several people familiar with the matter said.

Star Capital was not immediately available for comment.

Selling the unit that makes pipe-handling equipment represents the last step in reinventing the long-standing Hamburg-based company. Founded in 1877, Blohm + Voss grew to become the world’s largest shipyard at the time. During World War I, it built 96 submarines and six battleships, among other craft. It has built ships such as the Bismarck, which was the world’s largest battleship when it sank after an attack by the U.K.’s Royal Navy in 1941.

After World War II, Blohm + Voss increased production of civil ships. In 1990 it delivered a number of expensive boats worth $210 million.

German industrial conglomerate ThyssenKrupp AG (TKA.XE) bought Blohm + Voss’s shipyards in 2005. Thyssen kept the battleship and submarine operations, and sold the civil activities with its around 1,500 employees and EUR500 million in annual revenue to Star Capital about six years later. People familiar with the matter valued the deal at around EUR150 million at the time.

The change of hands revived Blohm + Voss as a maker of super yachts, after the company hadn’t received a new order since 2008 under Thyssen’s ownership.

The global market for super yachts had sales of EUR2.26 billion from 257 ships last year, down from EUR2.5 billion a year earlier, according to industry media specialist Boat International.

To focus on repairing and building mega yachts, such as the Eclipse, which Blohm + Voss sold to Russian oligarch Roman Abramovich for around $800 million in 2010, Star Capital decided to sell two non-related units also acquired from Thyssen.

It recently disposed of the ship component unit Blohm + Voss Industries, which Sweden’s SKF AB bought for EUR80 million. The sale of Blohm + Voss Oil Tools will finalize the revamp. The unit recorded revenues of around EUR100 million in 2012 and roughly EUR20 million in earnings before interest and taxes.

(c) 2013 Dow Jones & Company, Inc.

Join The Club

Join The Club