Updated: February 5, 2026 (Originally published February 13, 2012)

The Port of Hamburg regains market shares and foresees a positive annual balance on total seaborne cargo throughput…

In 2011, Germany’s largest universal port achieved a seaborne cargo throughput totalling 132.2 million tons that represents an increase of 9.1 percent. Container throughput in 2011 totalled 9 million 20-feet standard containers (TEU), or 1.12 million TEU more than in 2010. Of all ports in the North European Range, in 2011 Hamburg therefore achieved the fastest absolute growth in container throughput.

After a successful year in 2011, the Port of Hamburg with throughput 14.2 percent up at altogether 9 million TEU is again Europe’s second largest container port, ahead of Antwerp. The Port of Hamburg’s total throughput was 9.1 percent higher, reaching a volume of 132 million tons that crossed its quays in the past twelve months. In other words, 11 million tons more were handled compared to 2010.

Claudia Roller, CEO of Port of Hamburg Marketing (HHM), presented the 2011 handling figures at the Port of Hamburg’s annual press conference today:

“We are delighted that in 2011 the Port of Hamburg proved able to achieve above-average growth both in total throughput and in container traffic. With the strongest absolute growth in container throughput, Hamburg regained market shares of approximately 1.3 percentage points as against its competing ports.”

The positive trend in 2011 prompted Claudia Roller to forecast growth once again for next year:

“For 2012 we are also reckoning with an increase in throughput figures, although this will slow down compared to 2011, meaning that by year-end we should have achieved a moderate increase on seaborne cargoes. With its existing capacities, well developed infrastructure and highly efficient port service providers, some of whom have recently won international awards, Hamburg is very well equipped to handle growing cargo volumes with its customary reliability, speed and high quality. The forthcoming deepening of the navigation channel on the Lower and Outer Elbe will further boost Hamburg’s attractiveness in competition with North Range ports as a European hub for ultra-large vessels. Nevertheless, as yet not fully implemented changes in major liner services make it difficult to calculate the trend in container throughput at this stage.”

Following 6.9 percent growth in world trade in 2011, for 2012 the IMF (International Monetary Fund) anticipates a renewed slowdown in such growth to 3.8 percent. The IMF assessment of the prospects for world growth also takes into account that in 2012 the repercussions of the debt crisis will cause countries of the Eurozone to slip into a slight recession in the area of the real economy.

An overview of the Port of Hamburg’s gratifying year in 2011

The Port of Hamburg can look back on thoroughly satisfactory results for the year on both imports and exports. On the imports side Port of Hamburg Marketing (HHM), the Port of Hamburg‘s marketing organisation, reports throughput of 76.2 million tons (+ 8.2 percent). Exports via Hamburg at 56 million tons reflected growth of no less than 10.3 percent on the same period of the previous year.

At 92.6 million tons, the general cargo throughput predominant in Hamburg achieved 14.4 percent growth. In 2011 the Port of Hamburg‘s container throughput totalled 90.1 million tons (+ 15 percent). At 4.6 million TEU, the Port of Hamburg achieved 13.8 percent growth on imports, while exports at 4.4 million TEU were up by 14.5 percent. The trade routes mainly responsible for growth in container throughput were the Baltic region and East Asia, as well as North and South America. These alone accounted for around 82 percent of the growth in box throughput. In container traffic, in 2011 Asia once again retained top position among the Port of Hamburg’s trade routes. Last year altogether 5.2 million TEU were handled from and for Asia, or around 419,000 TEU (+ 8.8 percent) more than in the previous year. Yet the largest rise in container throughput reported for the Port of Hamburg in 2011 was with the USA. With 81.6 percent growth, the USA advanced from twelfth to sixth place among the Port of Hamburg’s foreign trade partners. On container throughput in the Port of Hamburg, growth was also achieved in 2011 by the other trades, namely America (+ 28 percent), Africa (+ 5.3 percent) and Australia/Pacific (+ 0.1 percent).

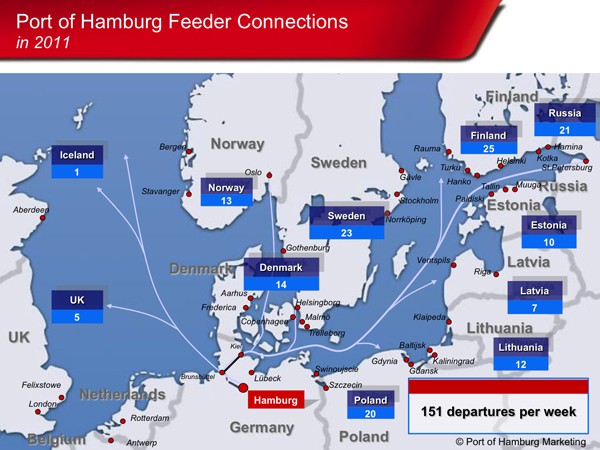

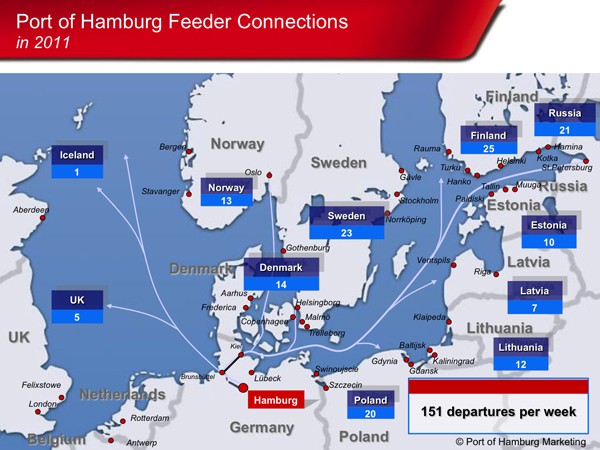

Container throughput in the Baltic trade developed equally satisfactorily. Gaining around 27 percent, in 2011 transhipment traffic by feeder grew at an above-average rate. Russia reported enormous, 35.7 percent growth in container throughput via Hamburg and with 596,000 TEU is meanwhile the Port of Hamburg’s second most important trading partner in container traffic. With altogether 238,000 TEU, in 2011 feeder services with Polish portsreported above-average growth of 33.3 percent. Altogether around 3.3 million TEU were handled in transhipment traffic in Hamburg last year. With more than 150 sailings per week, Hamburg remains the most important feeder port in Northern Europe for the whole of the Baltic region. For both Hamburg and Germany’s North Sea ports, the Kiel Canal cuts the distance to be covered and voyage times for traffic with the Baltic. That represents an important locational advantage in competition with ports situated further West.

Port of Hamburg throughput statistics on conventional cargoes, which also cover RoRo cargoes, have been down at 2.5 million tons (- 3.8 percent) in 2011. The decisive factor for the downturn in this segment of throughput was the drop in imports of conventionally stowed citrus fruits, which were 17.8 percent lower at 497,000 tons. The rise in imports of conventionally loaded metals was gratifying, since at 185,000 tons these were handsomely ahead by almost 26 percent. Also very satisfactory were vehicle imports, handled as RoRo cargoes in Hamburg, which at 96,000 tons grew by 12.3 percent. At 133,000 tons (- 4 percent), imports of paper as a conventional cargo were only slightly below the previous year’s level. On the export side, at 1.4 million tons throughput of conventional general cargo was up by 2.5 percent. The main goods exported were heavy cargoes and plant at 543,000 tons (- 8 percent), vehicles with 517,000 tons (+ 9.5 percent) and iron and steel with 281,000 tons (+ 17.1 percent), all handled at the Port of Hamburg’s specialized terminals.

Accounting for around 30 percent of the port’s total throughput, in 2011 bulk cargo throughput in Hamburg at altogether 39.6 million tons remained slightly (- 1.6 percent) below the previous year’s volume. The main categories of bulk cargoes are grab, suction and liquid cargoes, all of which are handled and stored in the universal port of Hamburg. Throughput of grab cargoes at over 19 million tons accounted for 49 percent of total bulk cargo throughput in 2011 and was therefore the dominant category. Grab cargo throughput consists primarily of ores and coal, along with fertilizers and scrap metal. Despite an 8.8 percent downturn, at 8,5 million tons ore imports top the throughput statistics for this segment in Hamburg. Coal imports at around 6 million tons were up by 12.6 percent. On the export side, throughput of fertilizers at 2.3 million tons grew by 2.7 percent. Throughput of scrap exports at 943,000 tons was around 7 percent lower than in the previous year. Following two very strong years, in 2011 throughput of suction cargoes at 6.2 million tons remained 6 percent below the previous year’s level. Despite a very steep increase of 21 percent in imports of oleaginous fruits that reached 3 million tons last year, it proved impossible to stem the decline in exports of suction cargoes (- 24.4 percent). In 2011 a poor grain harvest and its lack of suitability for the world grain market were behind the almost 36 percent drop in grain exports to 1.5 million tons. Throughput of liquid cargoes at altogether 14 million tons in 2011 remained only slightly (- 1.1 percent) below the previous year’s figure. Caused among other factors by lower refinery production here, crude oil imports at 4.1 million tons were 6.2 percent lower. At 4.8 million tons, those of oil products were up by 2.1 percent. On the export side, at 3.8 million tons (+ 0.3 percent) throughput of liquid cargoes was slightly ahead. Exports of biodiesel at 1.3 million tons produced 4.2 percent growth.

Calls by ultra-large ships at the Port of Hamburg further increasing

“Following extensive investments in port and infrastructural expansion, as well as state-of-the-art IT systems, today Hamburg is already well equipped for handling growing volumes of seaborne cargoes. We are consequently staying on target for a modern port of the future”, said Jens Meier, CEO of the Hamburg Port Authority (HPA).

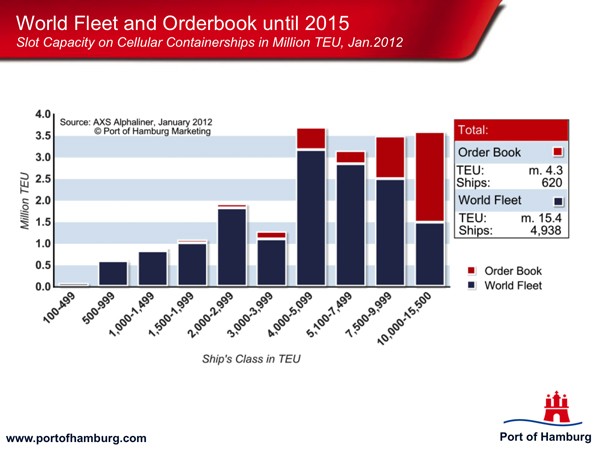

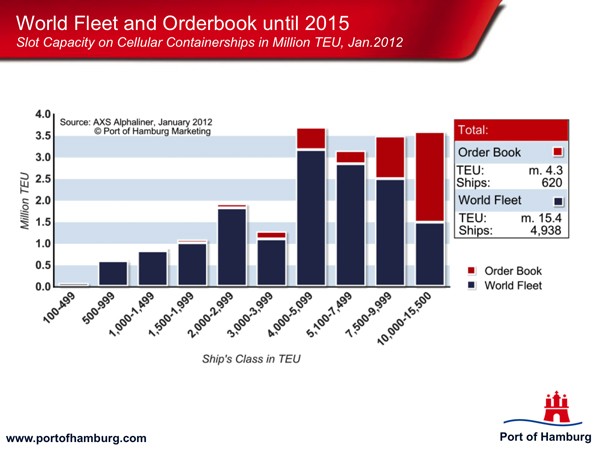

Against the background of the 894 ultra-large vessels handled in Hamburg during 2011, the planned deepening of the Lower and Outer Elbe is from the viewpoint of business in the port and its international customers something that must be implemented at all costs. With its dense network of more than one hundred worldwide liner services and its outstanding transport links, the Port of Hamburg performs an essential function in worldwide foreign trade for the German economy and the business abroad done by its European neighbours. On average, over 100 liner services were operating regularly out of Hamburg in 2011. A high proportion of seaports worldwide were served directly, and the remainder indirectly via transhipment.

The East Asia trades constitute one of the Port of Hamburg’s main markets. In 2011 Hamburg was on average receiving 26 weekly calls by fully cellular services on the East Asia trade route. In addition, there were nine liner services to North America, as well as eleven to South America and 20 to Africa. Almost 50 feeder links serve the North Sea and Baltic regions. In 2011 the Port of Hamburg reported altogether 17 new liner services. Four of these were on the East Asia trade route, three to North America, two to West Africa and one each to South America and the Indian sub-continent. An additional six commenced operating on the Baltic trade route.

Various liner shipping companies have announced new joint services and cooperation deals for 2012. For instance, CMA CGM and MSC will be operating joint liner services and so will CHKY – The Green Alliance and Evergreen Line. The Grand Alliance (Hapag-Lloyd, NYK, OOCL) and New World Alliance (APL, MOL, HMM) shipping alliances have also put their cooperation on a new footing with the G6 Alliance. As the first changes to liner services and the plans for new ones indicate, in the current year the Port of Hamburg will retain its role as both a traffic interface for worldwide cargo flows and a European hub.

Editorial Standards · Corrections · About gCaptain

Join The Club

Join The Club