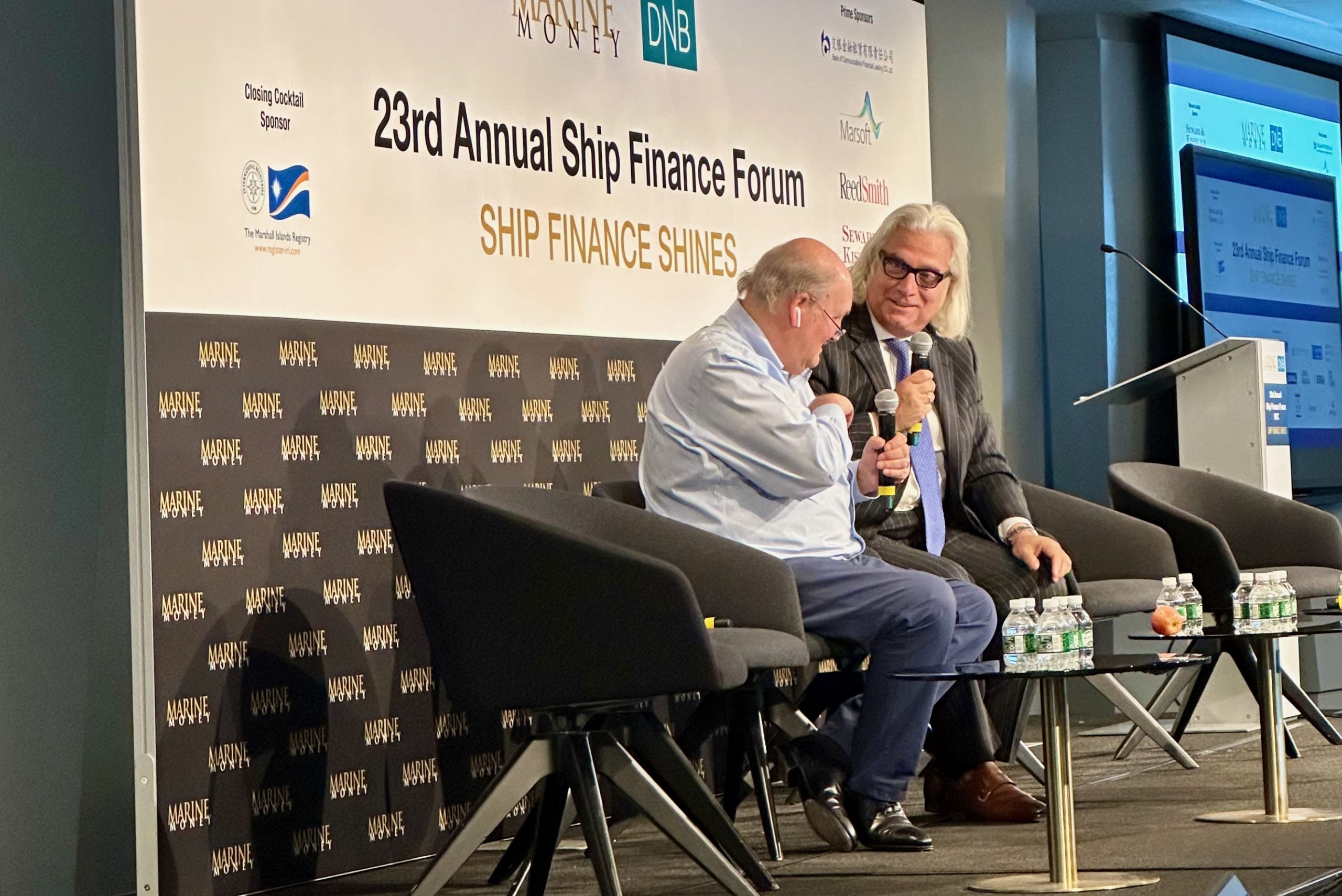

By Barry Parker (gCaptain) Marine Money’s “Ship Finance Forum” in New York attracted a superb roster of speakers, informing a spirited group of attendees on a wide range of topics. The show-stopper, for me, was certainly the pairing of two New York shipping icons, with Robert Bugbee interviewing Peter Georgiopoulos—a New York native who became a quintessential shipping magnate, riding the early 2000s supercycles upward.

Bugbee, who serves as the President of product tanker owner Scorpio Tankers (NYSE:STNG) and in the top role at offshore wind turbine installer Eneti (NYSE:NETI), put his considerable experience as a raconteur/moderator in front of shipping audiences to work in drawing out “Peter G”, who has a less public persona. In a sense, the interview was his “Welcome back”.

The interplay between these two maritime legends (both were recipients of the Connecticut Maritime Association’s coveted Commodore award) was squarely in line with Marine Money’s secret sauce; when money guys (and gals) and shipping folks get in the same room together, deals happen.

At a high level, Bugbee (who has been behind several $billion of capital raises) described Georgiopoulos (whose shipowning voyage was launched alongside private equity) as “an inspiration to many…on the subject of marrying capital to shipping…including to myself.” Peter G. went on to captain a handful of listed companies, notably General Maritime Corp, which was later absorbed into Navig8, and Genco Bulk—still around as a listed company in the drybulk markets.

With Georgiopoulos re-entering the business (on the tanker-owning front with a private company, but also with an investment in a nascent emissions measurement startup), the interview was as much about the past (the changed role of private equity, the ups and downs of market) as it was about the future (telling the younger generation of shipping entrants- “if you have a dream…do your homework, try to find something a little different/find an angle, and then go after it”).

Importantly, the role of personal character, and keeping promises/being loyal, was also stressed. Bugbee highlighted a an en-bloc purchase of a quartet of tankers, earlier in Georgiopoulos’s career, where the market turned sour prior to the actual deal closing; though he could have walked away, Peter G. went through with the deal.

Private equity (mentioned throughout the day in various contexts) was discussed in depth by the two shipping titans, with Peter G. longing for the “old days” (circa early 1990s when he had gone out on his own following several years on Wall Street), when he could deal with named partners, investing alongside them, and directing the shipping business, and lamented the highly bureaucratic nature of today’s large PE outfits. He also bemoaned a shift where the PE guys sought to direct the shipping business (and not listen to the knowledgeable insider), describing a situation where he counseled against an ultimately money-losing PE deal, saying: “I find it shocking…you’ve hired or partnered with someone who is the industry expert- why not listen to them?” PE did obliquely get a shout-out, though. In describing his recent tanker acquisition (being run through an office in Greece), he explicitly highlighted the cooperation of a ship finance unit within Entrust Global, a multi-national manager of PE and hedge fund investments.

In response to a question about future plans, besides the acquisitions in the product/chemical tanker space, Georgiopoulos said: “We can all see that the winds of change are coming in terms of environmental and green….I’ve invested…in a device that measures carbon, sulfur and methane…” emitted from ships’ funnels (which he contrasted with competing alternatives- relying on formulas but not actual measurements). “I think that’s the future…we need to start thinking about these things.”

Join The Club

Join The Club