Major Cocaine Bust: UK Border Force Seizes Record Shipment at London Gateway

In one of the UK’s largest drug seizures of the past decade, UK Border Force officers have seized cocaine with an estimated street value of £96 million (USD 130 million)...

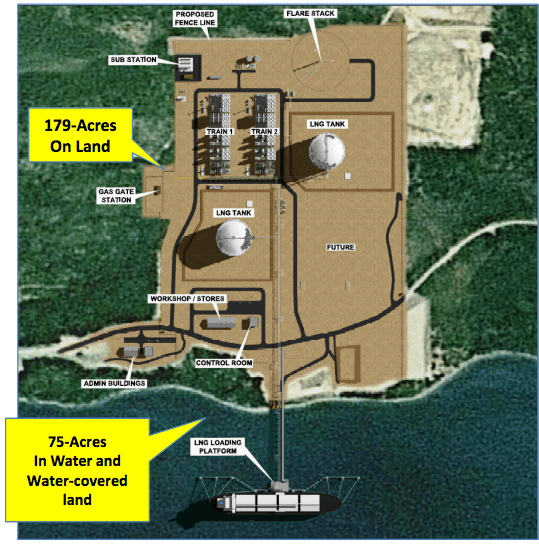

Bear Head LNG site layout, image: LNG Ltd

James Paton

July 28 (Bloomberg) — Liquefied Natural Gas Ltd., whose shares have posted an 11-fold gain in Sydney trading this year, expects a proposed export project in Canada will cost about the same as its planned $2.2 billion U.S. project.

Liquefied Natural, targeting shipments to Europe, may decide in early 2016 whether to go ahead with a development in Nova Scotia, Managing Director Maurice Brand said today by phone. The Perth-based company agreed to acquire the Bear Head LNG project from Anadarko Petroleum Corp. for $11 million.

The Australian company has attracted investors including Boston-based Baupost Group LLC as it proceeds with plans to develop the Magnolia LNG project in Louisiana. Liquefied Natural’s market value has surged to A$1.45 billion ($1.36 billion) from about A$100 million at the start of the year.

“We wanted to de-risk our asset base and diversify,” Brand said. “Magnolia is going well for us in the U.S. and we like Canada because there are some similar characteristics.”

The company is in talks with owners of gas reserves in Canada and the Marcellus shale region in the U.S. and transportation companies, according to the statement.

Liquefied Natural shares rose 7.6 percent to A$3.25 on July 25, before they were halted today pending completion of a planned sale of shares to investors.

While Liquefied Natural is keen to develop an Australian export project in Queensland state, it’s still trying to obtain gas supplies to underpin the Fisherman’s Landing development, Brand said. The potential suppliers are limited, and signing long-term agreements is difficult, he said.

“We’re talking to everybody,” he said. “You can assume” that Arrow Energy Ltd., owned by Royal Dutch Shell Plc and PetroChina Co., is among the companies, he said.

The company is seeking to extend a lease agreement to the end of the year at the project site in Queensland, he said. An extension from Sept. 30 depends on the company showing it’s making progress in its pursuit of supplies, he said.

Copyright 2014 Bloomberg.

Sign up for gCaptain’s newsletter and never miss an update

Subscribe to gCaptain Daily and stay informed with the latest global maritime and offshore news

Stay informed with the latest maritime and offshore news, delivered daily straight to your inbox

Essential news coupled with the finest maritime content sourced from across the globe.

Sign Up