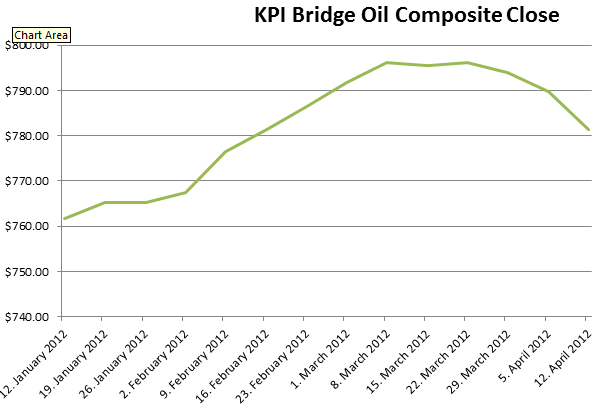

5 April – 12 April 2012

Despite a tremendous amount of continued volatility bunker prices are clearly trending downward at this point. This week the KPI Bridge Oil Composite was down over $8 MT. However, it is clear that supply and demand fundamentals are not the main factor in the global energy price equation. There were many news items this week that should have caused a much greater declines in oil prices.

China’s annual growth numbers were 8.1% which is down from 8.9% and it is much less than expected. The number two oil consuming nation is watched very closely by all energy traders and speculators as declines there could very quickly trigger a collapse in all commodity prices. Additional impetus for much lower prices is that consumer sentiment has been down and jobless claims up in the United States signaling a weakening of the US economy.

What is clear is that the world economies can not support these high energy prices, but until the situation with Iran is resolved we should expect volatility and inflated prices. The good news about that situation is that the United States, Russia, China, Britain, France and Germany are all slated to meet with Iran in Istanbul tomorrow. This is a major step in the right direction towards diplomacy as it has been 15 months since the last meeting of all these nations. While we should not expect Iran’s quest for nuclear weapons to end overnight; it is not unreasonable to expect some resolution for Monday.

KPI Bridge Oil Composite

The KPI Bridge Oil Composite is a calculated fuel number based on 14 ports strategically positioned world wide. It is calculated on a weekly basis blending 90% fuel oil prices with 10% distillate prices. The idea behind the number is that it would represent actual fuel costs on a global basis and what vessels would consume on average. This number will not fluctuate as quickly as daily prices and can easily be hedged or used for voyage calculations.

Join The Club

Join The Club