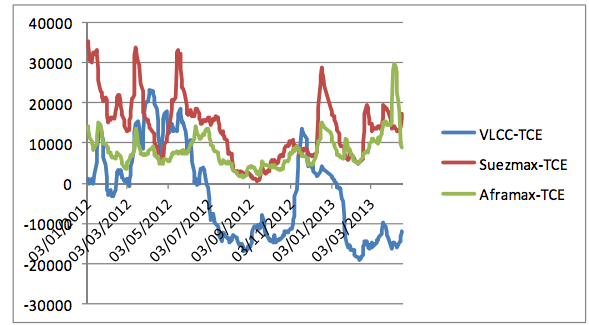

Average Charter Earnings – VLCCs / SUEZMAX / AFRAMAX (01/01/2012 – 22/04/2013), via Optima Shipbrokers

April 22 (Bloomberg) — Exxon Mobil Corp., the world’s biggest energy company by market value, booked two tankers to haul oil to the U.S. Gulf Coast via the Suez Canal in May at what may be this year’s lowest rates, a shipbroker said.

The very large crude carriers, each able to haul 2 million barrels of oil, will load in the Persian Gulf on May 7, Athens- based Optima Shipbrokers Ltd. said in an e-mailed report today. The ships were chartered at rates of 15.75 and 16 industry- standard Worldscale points, it said. Those would be the lowest levels so far in 2013 for the route, according to figures compiled by Bloomberg.

Hire costs for tankers hauling Middle East crude to the Gulf Coast slipped 0.2 percent to 18.3 Worldscale points today, according to the London-based Baltic Exchange. That’s down 26 percent from the start of the year. Charter costs on the journey declined in the third quarter of every year starting in 2007, according to figures compiled by Bloomberg.

“The market is very weak, and I think this summer will be just as bad as the previous two,” Dag Kilen, an analyst at Fearnley Consultants A/S, part of Norway’s second-largest shipbroker, said by e-mail. Rates could get “potentially even worse if oil prices remain under downward pressure, as it will tighten OPEC output.”

Return Voyages

Shipowners will seek to cover fuel costs by securing charters for return voyages after vessels unload their original cargoes, Kilen said. Exxon Mobil spokesman Richard Scrase in Leatherhead, England, declined to comment by phone today.

VLCCs built in 2010 and carrying Middle East oil to the U.S. were losing $2,140 a week on average as of April 19, according to figures from Clarkson Plc, the world’s biggest shipbroker. The ships were earning $31,227 a year earlier.

Hire costs for VLCCs on the benchmark Saudi Arabia-to-Japan journey were little changed today at 32.06 Worldscale points, figures from the Baltic Exchange showed. The ships’ daily losses widened to $714 from $254 on April 19.

The exchange’s assessments don’t account for owners’ efforts to improve returns by securing cargoes for return voyages or reducing speed to burn less fuel. The price of fuel, or bunkers, the industry’s main expense, fell 1.4 percent to $599.88 a metric ton today, figures compiled by Bloomberg from 25 ports showed.

The Baltic Dirty Tanker Index, a broader measure of oil- shipping costs that includes vessels smaller than VLCCs, added 0.6 percent to 638, according to the exchange.

– Rob Sheridan, Copyright 2013 Bloomberg.

Join The Club

Join The Club