Aug. 20 (Bloomberg) — KKR & Co., the private-equity firm led by Henry Kravis and George Roberts, created a unit to lend to the maritime industry, including assets such as drilling rigs and shipping vessels.

The unit, called Maritime Finance Company, will be seeded with $580 million, of which 45 percent will come from KKR’s balance sheet, its mid-market merchant banking unit and its publicly traded KKR Financial Holdings LLC division, according to a statement today from the New York-based firm. Maritime Finance will be led by Kristan Bodden and Gabriel Tolchinsky, former partners at advisory firm Helios Advisors LLC.

KKR joins Blackstone Group LP, JPMorgan Chase & Co.’s asset-management unit and Oaktree Capital Group LLC in stepping into the lending void left by European lenders and private investors, who pulled back after the 2008 recession sent the shipping industry into its worst slump since the 1970s. In Germany, investors lost 2.3 billion euros ($3.1 billion) last year as the number of insolvencies by shipping companies surged, according to estimates by Hamburg-based researcher Fondsmedia.

“This is an area that has historically been served by European banks,” Bodden said in the statement. “The current dislocation in the European banking sector has created a substantial funding gap in maritime asset financing.”

Bankruptcy Protection

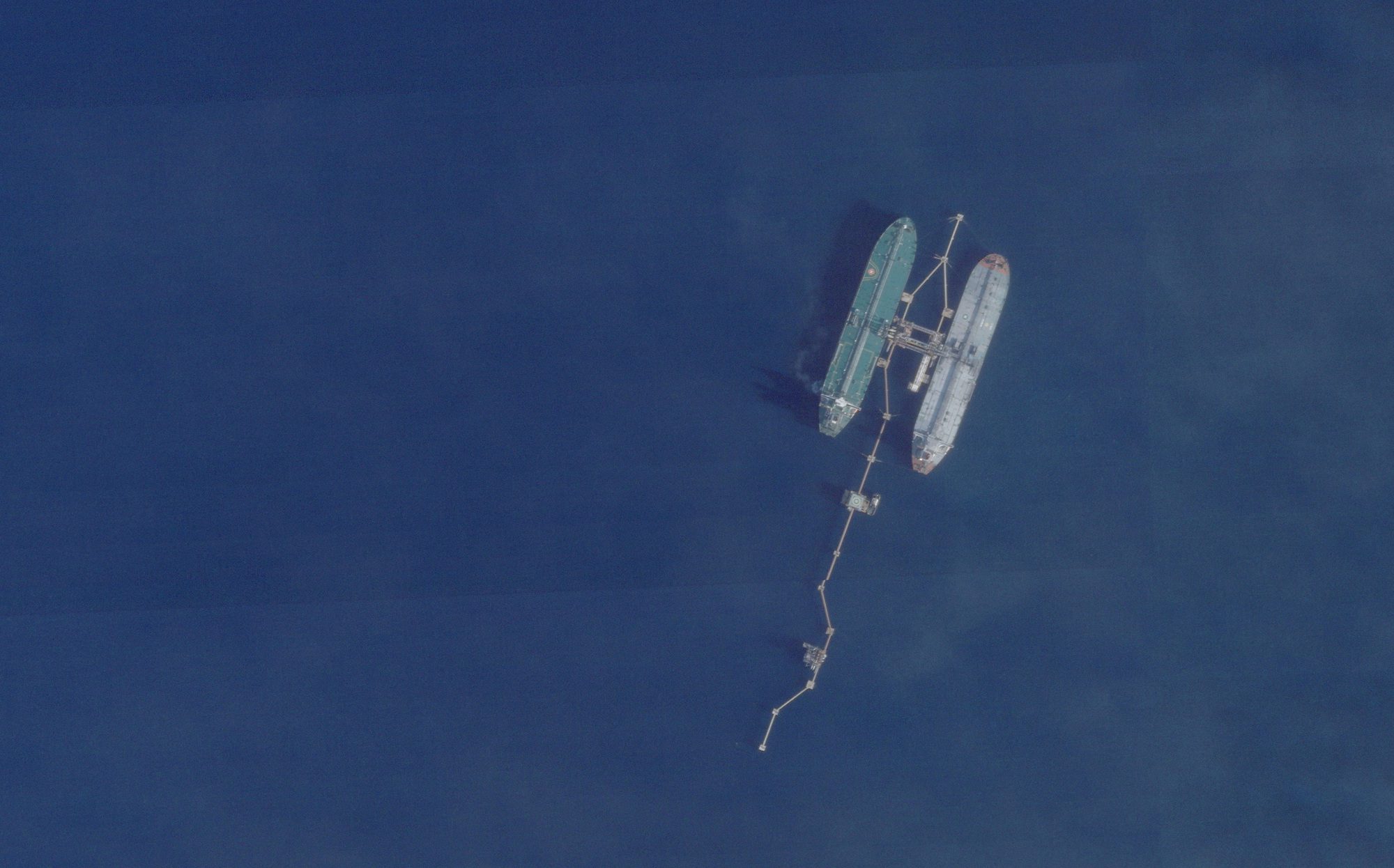

The biggest oil tankers, able to hold 2 million barrels of cargo each, were losing almost $7,700 a day on the benchmark Saudi Arabia-to-Japan voyage at this year’s low in February, according to data from the Baltic Exchange in London. Plunging freight rates forced Overseas Shipholding Group Inc., the largest U.S. oil-tanker operator, to file for bankruptcy protection in November, about a year after rival General Maritime Corp. Other companies in the industry driven into bankruptcy include Korea Line Corp. and Britannia Bulk Plc.

KKR Financial Holdings, known as KFN, deployed $150 million to the new KKR unit, said KFN Chief Executive Officer Craig Farr. KKR’s balance sheet, the largest among peers, was valued at $6.9 billion as of June 30, including $2 billion in cash.

Copyright 2013 Bloomberg.

Join The Club

Join The Club