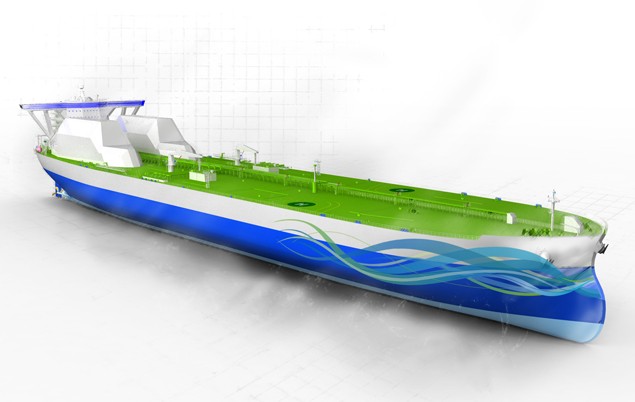

DNV’s LNG-powered crude oil tanker concept, “Triality,” (c) Det Norske Veritas

According to Robert Bugbee, President of Scorpio Tankers, the answer to the eco-ship question can perhaps be found by considering the question, “Do you believe in God?”

If you believe in God and He exists, you go to heaven.

If you don’t believe in God and He does exist, you go to Hell.

Well, if you don’t believe in ec0-ships, and it turns out eco-ships are the right answer, the playing field may no longer be what you thought it was and business could get far more challenging.

There has been much talk about the global oversupply of ships. At face value, further discussion about building more ships suggests shipowners are slightly out of their mind.

In some cases, that might be true, however when it comes to eco-ships, there is data to support the building of new vessels.

Albrecht Grell, Senior Executive Vice President of Maritime Solutions at Germanischer Lloyd mentioned in his presentation at the Connecticut Maritime Association conference that “in container shipping, we see enough benefits of eco ships to justify orders beyond what would be introduced due to supply and demand. The strongest category is within the 4500 TEU range which were originally designed to transit the Panama Canal. The new optimized designs will be able to generate substantial advantages.”

Explaining this further, Grell notes, “Containerships in the 4500 TEU range were designed and built with large engines to transit at over 20 knots and were optimized for the Panama Canal. Their power-to-TEU ratio is far higher than any other containerships, and when you take into account slow steaming operations, the engines are now being operated far less efficiently while carrying less cargo. Slow steaming, oversupply, and the new Panama Canal have made these ships completely obsolete.”

There are many fuel-saving options out there, so what’s the best answer? It depends.

Kishore Rajvanshy, Managing Director at Fleet Management Ltd notes that the cost between a new eco-ship and a conventional ship is roughly 10 percent, with potential fuel savings of 15 percent. Retrofits of existing ships can achieve similar fuel savings as well.

He gave an example of a ship that underwent a refit which included a main engine de-rating (to optimize it for slow steaming), a new, 3-bladed propeller, frequency-controlled seawater pumps, engine room blowers, plus a Mewis duct. The total cost of the refit was $1.7 million and it took 18 days in the drydock.

Fuel savings have averaged 13 to 15% with a payback of 3.5 years.

The eco-ship revolution may be on the horizon, but these new ships will not replace the existing fleet overnight and ship managers are under “severe pressure to deliver high-end services, ensure managed vessels meet regulatory requirements and to cut costs, ” added Simon Barham, Chief Operating Officer at Bibby Ship Management.

“Lower speed equals lower fuel consumption, but not running engines at optimum speed can result in costly maintenance issues,” Barham continued. “In my mind, it comes down to good management.”

To close the gap between eco ships and non-ecos, there are a number of different options which owners are implementing, such as slow steaming, design modifications, and weather routing, but perhaps the biggest factor is the crew. “If you can’t get your senior officers on board with how they need to run the ship, you won’t achieve your goals,” says Barham.

When you add the need to operate ships more efficiently on top of regulatory requirements such as switching to low-sulfur fuel when entering Emissions Control Areas (ECAs), it gets even more complicated.

“It must be said that switching on to low sulphur fuel is not a problem, but switching on to gas oil is, and that will need some modifications to the vessel,” noted Barham.

“The main engines themselves are not designed to burn light fuels. That will mean that changes will have to be made – pumps will have to be examined, even the design of some ships will have to be looked at because it is debatable whether some ships will actually have enough space to carry the additional bunker fuel tanks.

As a lot of the existing fleet was built in the late 1990s or early 2000s, many will only have a couple of bunker tanks. They’re already carrying heavy fuel and light fuel and now they’re going to have to carry gas oil. There’s going to be a lot of conversions going on. There is a cost element involved there as well.”

At the end of the day, a two-tier market with eco and non-eco ships appears inevitable, and for owners who find themselves with less efficient ships than their competitors, innovation will be the key to prosperity.

Join The Club

Join The Club