China Bunker Fuel Sales Plunge

By Muyu Xu (Reuters) China’s exports of marine fuel in March plunged 15% from a year ago, customs data showed on Wednesday, owing to high prices and anti-COVID restrictions at...

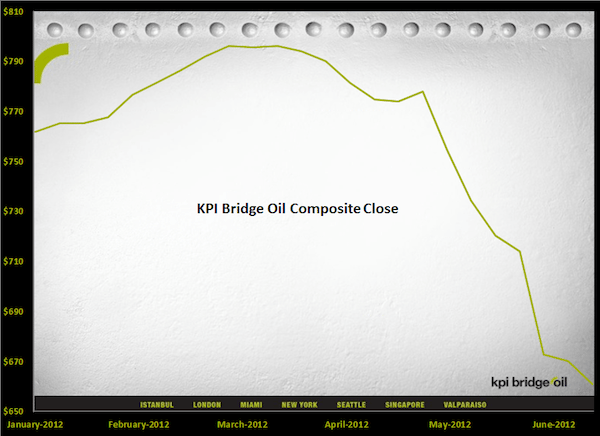

14-21 June 2012

Composite close – $660.95 MT

Oil prices continued their fall this past week as WTI reached new eight month lows and Brent reached lows that have not been seen since December 2010. The main reasons for the continued decline are largely unchanged. Overall, when speculators run the market up beyond what is reasonable in anticipation of a major international incident that does not occur, this is what happens. Significant sovereign debt concerns and lagging economies are not conditions that lead to increasing oil prices; despite what many investors have been betting on. The most significant reason this week for a decline however, was that the US Federal Reserve chose not to institute quantitative easing number three.

With a strong dollar, demand weak and no real prospect for growth, bunker prices have continued to decline in line with crude. Since their peak in mid-March, the KPI Bridge Oil Composite has declined over $135 MT. A gigantic decline in such a short period considering the majority of it has happened in the last two months. Hopefully, this decline will strengthen shipping companies balance sheets going forward and boost the economies of the world.

About the KPI Bridge Oil Composite

The KPI Bridge Oil Composite is a calculated fuel number based on 14 ports strategically positioned worldwide. It is calculated on a weekly basis blending 90% fuel oil prices with 10% distillate prices. The idea behind the number is that it would represent actual fuel costs on a global basis and what vessels would consume on average. This number will not fluctuate as quickly as daily prices and can easily be hedged or used for voyage calculations.

Sign up for gCaptain’s newsletter and never miss an update

Subscribe to gCaptain Daily and stay informed with the latest global maritime and offshore news

Essential news coupled with the finest maritime content sourced from across the globe.

Sign Up