Danaos Corporation (NYSE: DAC) reported solid fourth-quarter earnings for 2025, underscored by a growing revenue backlog, strong fleet utilization, and a strategic push into LNG that signals a broader shift beyond its traditional containership base.

The Athens-based owner posted adjusted net income of $131.2 million, or $7.14 per diluted share, for the quarter ended December 31, 2025, broadly in line with last year’s results despite softer charter rates. Management instead pointed to long-term charter coverage, balance-sheet strength, and expanding optionality as the key takeaways from the quarter.

CEO Dr. John Coustas said global trade has continued to adapt quickly to geopolitical disruption, with container volumes hitting record highs even as major liners continue to avoid the Suez Canal.

“With the Suez Canal still largely avoided and trade patterns increasingly multipolar, demand for midsize vessels has remained very strong,” Coustas said, noting continued export momentum from China and resilience in global container flows.

Fleet Growth Focused on Midsize Tonnage

Danaos continues to lean into fleet expansion where demand remains tight. Since its last earnings update, the company added four 5,300-TEU containerships to its orderbook, with deliveries scheduled for 2028 and 2029.

The company’s containership orderbook now totals 27 vessels with an aggregate capacity of 174,550 TEU, delivering steadily between 2026 and 2029. All newbuildings are designed to meet IMO Tier III emissions standards and EEDI Phase III requirements.

Danaos is also selectively expanding its dry bulk footprint. The company has ordered two Newcastlemax bulk carriers, each around 211,000 dwt, for delivery in 2028, and expects to take delivery of a secondhand Capesize bulker in early 2026.

On a fully delivered basis, Danaos’ fleet would comprise 102 containerships totaling roughly 652,000 TEU and 13 dry bulk vessels with combined capacity of about 2.37 million dwt.

$4.3 Billion Backlog

The company continued to prioritize long-term employment, adding approximately $428 million to its contracted revenue backlog through charter extensions and new fixtures covering 17 containerships.

Total contracted operating revenue now stands at $4.3 billion, including newbuildings, with an average remaining charter duration of 4.3 years across the containership fleet.

Charter coverage remains exceptionally high, with Danaos reporting 100% coverage for 2026, 87% for 2027, and 64% for 2028, based on scheduled deliveries.

“We continued securing forward employment even into late 2027,” Coustas said, emphasizing earnings visibility as a buffer against future market volatility.

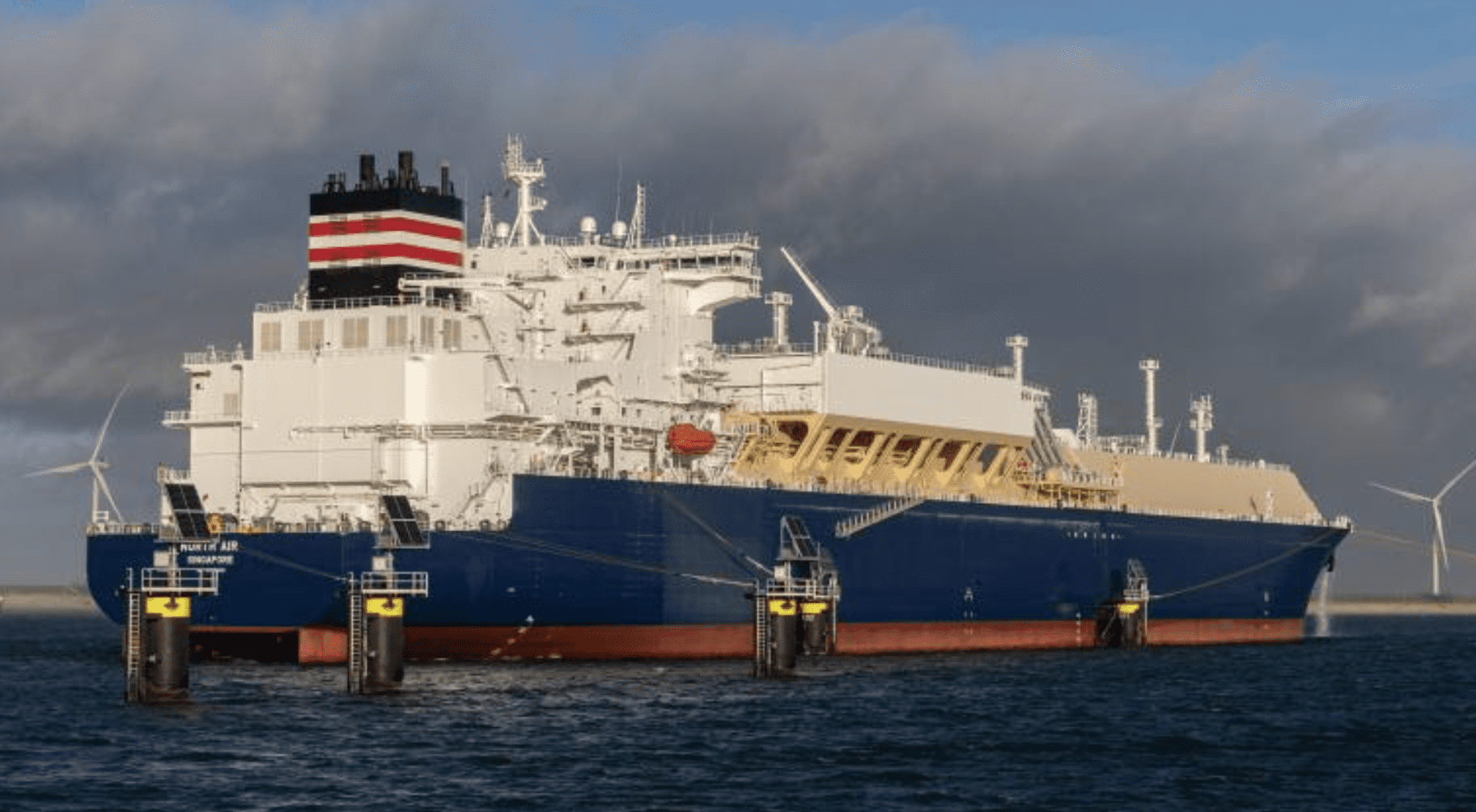

LNG Entry

Danaos’ most notable strategic move came in January, when the company announced a partnership with Glenfarne Group tied to the Alaska LNG project.

The deal includes a $50 million equity investment in Glenfarne Alaska Partners and positions Danaos as the preferred tonnage provider for at least six LNG carriers associated with the project, which targets annual output of 20 million tonnes.

Management framed the investment as a measured expansion rather than a wholesale pivot.

“Backed by a strong financial profile, we have begun exploring selective investments in the energy sector to broaden revenue sources and expand in the LNG business,” Coustas said.

Balance Sheet

Danaos continued to reinforce its balance sheet during the quarter. In October, the company completed a $500 million senior unsecured bond offering with a seven-year tenor and a 6.875% coupon, proceeds from which are being used to refinance higher-cost debt.

The company has already repaid $111.4 million of secured facilities and plans to fully redeem its 8.5% senior notes due 2028 in March 2026.

As of year-end, 77 of Danaos’ 85 vessels were debt-free, with 61 unencumbered, while total liquidity reached $1.4 billion.

Danaos also continued returning capital to shareholders, having repurchased $235.1 million worth of stock under its buyback program and declaring a $0.90 per share dividend for the fourth quarter.

Strong Utilization Across Segments

Operationally, fleet utilization remained high across both segments. Containership utilization reached 99.3% during the quarter, while the dry bulk fleet posted 99.8% utilization, a sharp improvement from a year earlier.

Fourth-quarter operating revenues rose 3.1% year over year to $266.3 million, with dry bulk revenues jumping nearly 24%, driven by higher utilization and improved chartering conditions.

Daily operating costs averaged $6,377 per vessel, which the company said remains among the most competitive in the sector.

“The Company remains focused on positioning itself at the forefront of shipping and energy growth areas,” Coustas said, “while maintaining strong earnings visibility and financial discipline.”

Editorial Standards · Corrections · About gCaptain

Join The Club

Join The Club