Iranian Ship Linked to Houthi Attacks Heads Home Amid Tensions

(Bloomberg) — An Iranian ship that’s been linked to Houthi attacks in the Red Sea is returning home, removing a prominent asset in the area as the Islamic Republic braces...

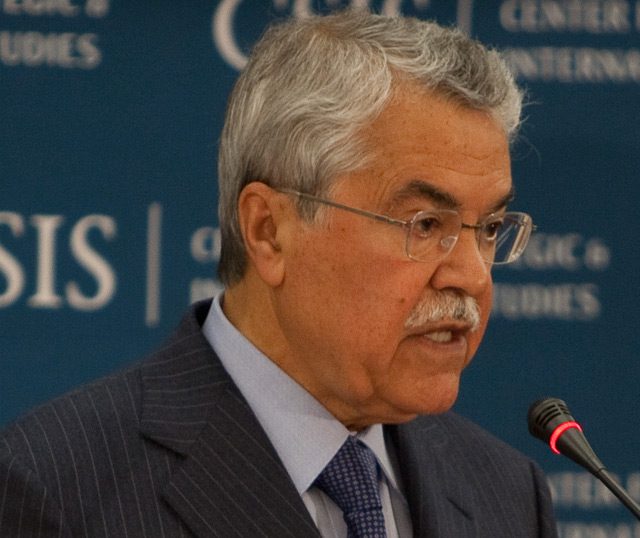

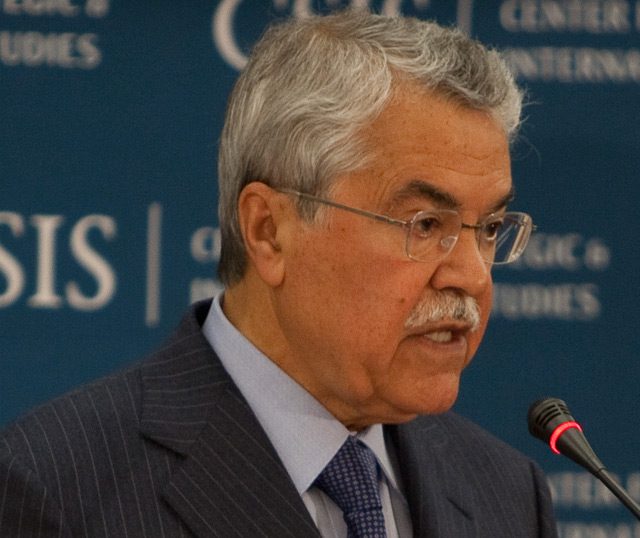

Ali I. Al-Naimi, Minister of Petroleum and Mineral Resources, Kingdom of Saudi Arabia (c) R. Almeida/gCaptain

By Lananh Nguyen and Ben Sharples

Nov. 27 (Bloomberg) — Brent and West Texas Intermediate crudes fell to the lowest in more than four years amid speculation that OPEC will refrain from cutting production limits at its meeting in Vienna.

Brent futures slid as much as 2.9 percent in London, dropping for a fourth day. Venezuela will propose an output cut that’s backed by Ecuador, said Rafael Ramirez, the nation’s OPEC representative. Persian Gulf group members have reached a consensus on production, according to Saudi Arabia’s Oil Minister Ali Al-Naimi. The Organization of Petroleum Exporting Countries will take a “unified position,” he said yesterday.

Crude collapsed into a bear market last month amid the highest U.S. output in three decades and signs of slowing global demand growth. A total of 58 percent of respondents in a Bloomberg Intelligence survey this week forecast no change to the target. The 12-member group, which pumps about 40 percent of the world’s oil, has an official quota of 30 million barrels a day.

“It looks like they will not cut. We’re starting to price that in now,” Olivier Jakob, managing director of researcher Petromatrix GmbH, said by phone from Paris. “The impression is that OPEC needs to withstand lower prices for a little while in order to stabilize the market.”

Brent for January settlement declined as much as $2.27 to $75.48 a barrel on the London-based ICE Futures Europe exchange, the lowest since Sept. 3, 2010. It was $75.82 at 10:55 a.m. local time. The European benchmark crude traded at a $3.72 premium to WTI.

OPEC Output

WTI for January delivery dropped as much as $1.80, or 2.4 percent, to $71.89 a barrel in electronic trading on the New York Mercantile Exchange, the lowest since Sept. 1, 2010. The volume of all futures traded was about 48 percent above the 100- day average for the time of day. Prices have decreased 27 percent this year.

OPEC should reduce production to eliminate a glut of 2 million barrels a day, Ramirez said. Kuwait’s Oil Minister Ali Al-Omair doesn’t know if there is support for a production cut, while Qatar’s Energy Minister Mohammed Bin Saleh said all producers have a responsibility to stabilize the market.

‘Close Position’

“OPEC is the main event,” Michael McCarthy, a chief strategist at CMC Markets in Sydney, said by phone today. “The Saudi actions over the past month quite clearly indicate to the market that OPEC is unlikely to agree to production cuts, or if they do, the market will doubt the intent to deliver.”

Iran, OPEC’s fifth-largest producer, won’t curb its output or ask Saudi Arabia to do so, according to Iranian Oil Minister Bijan Namdar Zanganeh. His country’s position is close to that of the Saudis, he said after meeting Saudi Arabia’s Al-Naimi yesterday. Iran has also held talks with Venezuela.

OPEC pumped 30.97 million barrels a day of oil in October, exceeding its collective target for a fifth month, data compiled by Bloomberg show.

U.S. Stockpiles

Al-Naimi’s comments were a “very clear indication that the Saudis and OPEC will do nothing at the meeting,” Michael Wittner, New York-based head of oil market research at Societe Generale SA, said in a report. “It means that the market itself -– prices, in other words –- will be the mechanism to rebalance the market.”

In the U.S., the world’s biggest oil consumer, crude inventories expanded by 1.95 million barrels to 383 million through Nov. 21, the Energy Information Administration reported yesterday. That was the seventh gain in eight weeks. Supplies were projected to increase by 250,000 barrels, according to the median estimate in a separate Bloomberg survey of 10 analysts.

Stockpiles at Cushing, Oklahoma, the delivery point for WTI contracts, rose by 1.3 million to 24.6 million, said the EIA, the Energy Department’s statistical arm. Production climbed by 73,000 barrels to 9.08 million a day, the highest in weekly records that started in January 1983.

Gasoline inventories gained by 1.83 million to 206.4 million barrels, the report showed. Distillate fuels, which include heating oil and diesel, shrank by 1.65 million to 113.1 million.

–With assistance from Sharon Cho in Singapore, Maher Chmaytelli in Dubai and Laura Hurst and Grant Smith in London.

Copyright 2014 Bloomberg.

Join the gCaptain Club for curated content, insider opinions, and vibrant community discussions.

Join the 105,951 members that receive our newsletter.

Have a news tip? Let us know.

Access exclusive insights, engage in vibrant discussions, and gain perspectives from our CEO.

Sign Up

Maritime and offshore news trusted by our 105,951 members delivered daily straight to your inbox.

Essential news coupled with the finest maritime content sourced from across the globe.

Sign Up