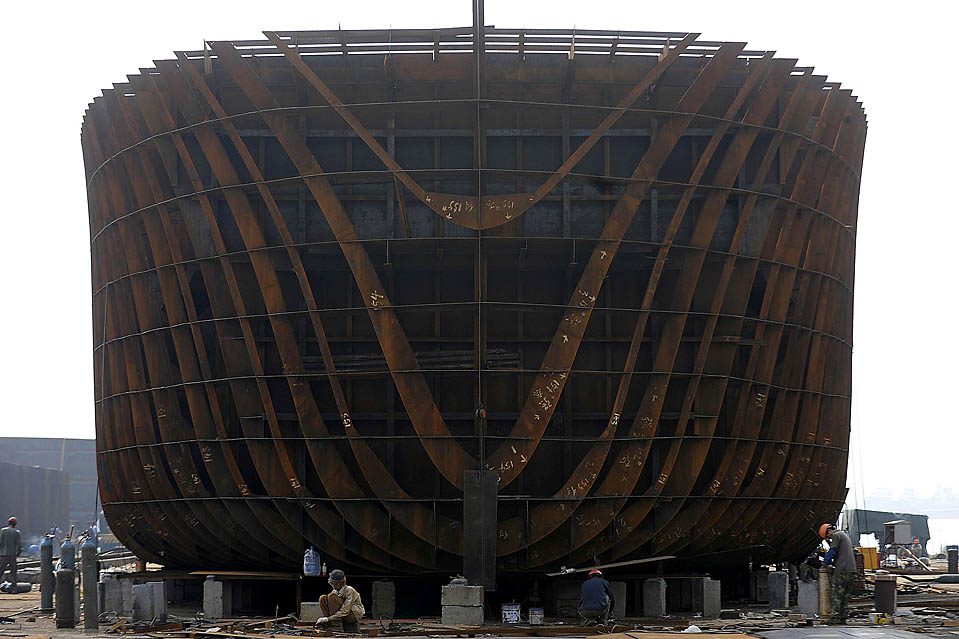

Employees work at a shipbuilding factory in Wuwei county, Anhui province, July 2, 2009. REUTERS/Jianan Yu

In the last week, the Chinese government announced a series of subsidies for the local shipping market. In general the program has as follows:

Chinese shipowners who scrap their Chinese-flagged vessels at Chinese demolition shipyards within Chinese fiscal years 2013, 2014 and 2015 will obtain a subsidy of about 750 RMB (about US$ 125) per gross registered ton (GRT). Vessels have to be eighteen years or newer for containerships, and twenty years old or newer for dry bulk vessels. Also, Chinese shipowners who place orders to Chinese shipyards for vessels that will fly the Chinese flag will be entitled to a subsidy of 750 RMB (about US$ 125) per GRT.

Since these two subsidies are ‘combinable,’ for an owner who replaces an existing vessel with a new contract, the total subsidy will be the sum of the two parts for a total of US$ 250 / GRT.

As a reminder, Gross Registered Tonnage (GRT) is a common measurement of the internal volume of a ship with certain spaces excluded. One ton equals 100 cubic feet. GRT depends on asset class, design, etc, so it’s a unique number for each vessel, but as a rule of thumb, it’s about 5/8 of the vessel’s deadweight (again, a gross simplification for our purposes here.) A 50,000-dwt supramax vessel would be about 35,000 GRT, and would generate about US$ 4.2 million in demolition subsidies and another US$ 4.2 million in shipbuilding subsidies. And average newbuilding contract for such a vessel would be around US$ 26 million today, and the scrap price, in general, of such a vessel in China would be about US$ 2 million.

Effectively, between the subsidies and the scrap value of a supramax vessel, a Chinese owner will need about $16 million to get their hands on a brand-new supramax vessel. This presumes that the shipowner will not obtain any further subsidies (like cheap construction financing, cheap post delivery financing, COAs from a local steel mill, etc.

Again, this subsidy pertains only to Chinese shipowners who will undertake demolition and shipbuilding activities in China and keep their vessels under the Chinese registry. And, it pertains to vessels that are scrapped much earlier than their design life (usually about 25 years) as vessels subsidized cannot be over twenty years of age when scrapped.

On the surface of it, there will be no direct impact to international shipping from this program, presuming that it progresses as announced without glitches (you never know if a website doesn’t work these days!) and without too many loopholes busted (i.e. who is a ‘Chinese owner’? Could be someone acting as a front/JV-partner of a US-based private equity fund?) And, on paper, most likely this subsidy program seems to have a neutral impact on the Chinese-flag merchant fleet, as one would expect that shipowners, in order to maximize the subsidies obtained, would order as many vessels as they scrap.

The subsidy obviously will benefit Chinese shipping-related activities as it will motivate more demolition sales and thus create jobs for demolition yards and produce more scrap steel plate; also, given the subsidy, it will make no sense whatsoever for a qualified vessel to ever get scrapped in the sub-continent; the subsidy makes up much more than ballasting costs and any market premium obtained from the scrap yards in the sub-continent. Thus, all being equal, more demolition activity in China in general is to be expected, and the few vessels that could in the past ‘leak’ to the Indian / Pakistani / Bangladeshi demolition yards will now be retained in China, therefore, a small negative impact in terms of volume to sub-continent, and likely a bit better news for international shipowners selling to scrap yards in the sub-continent and getting more competition for their vessels from the scrap yards, again, presuming a perfect ‘model’ with no inefficiencies around it.

The subsidy obviously will also benefit the Chinese shipbuilders through increased volume of business and more newbuilding orders. Shipbuilding jobs are good since it creates payroll and payroll taxes have a trickle-down effect in the economy; and, shipbuilding jobs are also good as they keep workers and shipbuilders sharp with their skills while remaining internationally competitive, or at least it provides for a chance to climb faster the shipbuilding learning curve – a well-known Chinese goal.

Assuming that Chinese shipbuilding capacity is inelastic, these subsidies likely will be bad news for international shipowners, as it will absorb shipbuilding capacity by local players who could afford to bid prices higher given the subsidies, and thus, international shipowners will have to pay higher prices for their contracts. Again, this outcome will take place if the assumption of Chinese inelastic shipbuilding capacity holds, and, we all know with the greenfield yards of 2005-2008, that that’s a tall assumption one to hang their hats from.

In our humble opinion, these subsidies could have a very negative effect on the international shipping industry for a couple of other, major reasons:

First, based on the supramax example above, it provides for about 30% markdown on sticker, newbuilding prices for Chinese shipowners to replace their fleets; if we talk about 10 years old vessels that have made operating profits during their life so far, and their market value is a fraction of their replacement cost, the subsidies offered are extremely substantial. As there does not seem to be any limit to vessels per owner or subsidy amount claimed per owner or vessel size or anything else to that effect (as least as this has been reported in the western press), then major Chinese shipowners like COSCO can effectively replace their fleets very cheaply and become much much more competitive on the international markets and give the Maersks of the world a run for their money. It seems that the only ‘bottleneck’ in this subsidy program is the capacity to scrap and build, as the program is valid until the end of Chinese fiscal year 2015 (same as calendar year.) Therefore, Chinese shipowners are given the government’s blessing to get aggressive and very competitive on the world trade stage.

Secondly, this program will be negative for the overall shipping market for many years to come, and will delay further in the future any market recovery.

Nominally, there are more than five hundred shipbuilders in China, a sizeable number of them established in the last decade and still a sizeable portion of them being ‘greenfield’ yards, meaning that they barely have had any legitimate claim to building continuously competitive vessels, or even seaworthy vessels. Most of these greenfield yards had primarily been active in the construction of small vessels, mostly in the dry bulk market, and a lot of the vessels delivered from these yards over the last five years are not commercially competitive and with little chance that they would ever traded until their design life. A lot of these vessels ended up in the hands of Chinese ‘farmers’ since the yard collected the forfeited down-payment of the original (international) buyer and then sold or ‘warehoused’ these vessels locally.

In our shipbrokerage practice, like many other brokers, we have seen vessels where the hull is literally crooked, where handysize vessels burn as much bunkers as panamax-size vessels, equipment list from makers unknown to the world, vessels whose designs and all their paperwork and documentation are only in the Chinese language. One of the few things that were going for shipping was that many of these ‘modern’ vessels from greenfield yards were expected to get scrapped before their second special survey. And, now they will, indeed; but for each and every of these vessels that gets prematurely scrapped, there will be a replacement, and if people have learned any lessons from the shipping crisis of our time, these newbuildings will be of modern design and ‘eco friendly’ and will be market competitive for their whole design life, 25 years from now, and will add up to the already bulging world orderbook. And, by the way, they will be 30% cheaper than anyone else’s vessels.

Got to love ‘moats’ created by governments!

Join The Club

Join The Club