By Jack Kaskey

Sept. 5 (Bloomberg) — When ExxonMobil Corp. kicked off construction last month of its largest U.S. chemical investment, a trio of factories outside Houston, business unit chief Steven Pryor said he’d never seen a project with better economics.

By the time the plants start operating in 2017, the numbers may not look so rosy. Exports are poised to absorb the country’s excess ethane, a natural gas liquid that’s become the main raw material for U.S. chemical makers as increased drilling in shale formations makes it abundant and cheap.

“Ethane exports have the potential to get really big,” Ben Nolan, a Chicago-based shipping analyst at Stifel, Nicolaus & Co., said by phone Sept. 4. “What people are assuming will be a lot of petrochemical manufacturing growth in the back end of the decade may not materialize.”

Interest in ethane exports has soared since Enterprise Product Partners LP announced April 22 its plan to ship 240,000 barrels a day from its Texas terminal starting in 2016. Space is nearly sold out and Enterprise is eyeing an expansion. Saudi Basic Industries Corp. and India’s Reliance Industries Ltd. are among those lining up to buy U.S. ethane, and Reliance has ordered specialty ships.

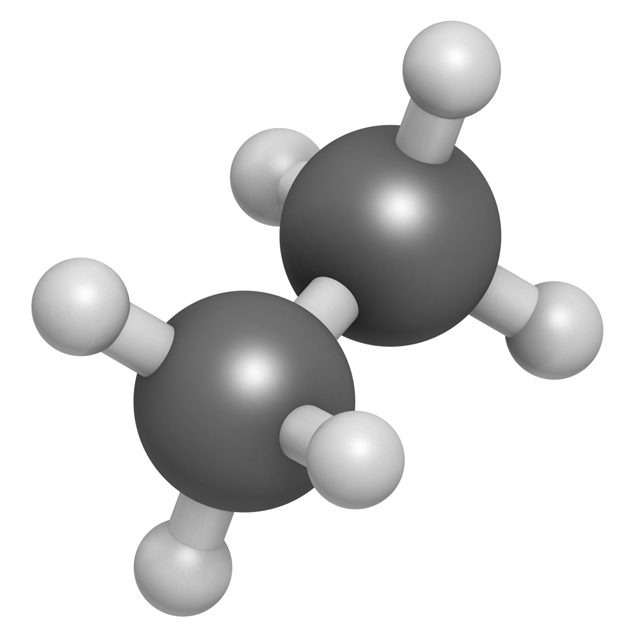

Exxon’s project will convert ethane into ethylene in what is known as a “cracker,” and the ethylene will be turned into polyethylene, a plastic used to make bottles and packaging. The new abundance of ethane has boosted U.S. chemical earnings to near records, while producers in Europe and Asia that process oil-derived naphtha struggle to break even.

Export Threat

Robust exports could threaten what the American Chemistry Council says are plans to invest $124 billion in new and expanded factories. Exxon says chemical expansions could create 600,000 U.S. jobs in a decade and almost $250 billion of economic output.

Enterprise said in July that its terminal is 85 percent subscribed and a 50 percent expansion is possible. Converting 25 percent of northwest Europe’s naphtha-based ethylene capacity to ethane would create 300,000 barrels of daily demand, and 36 new ships have been ordered to handle the load, the Houston company said.

The U.S. currently produces about 1.1 million barrels of ethane a day and leaves about 300,000 barrels excess in the natural gas burned for energy. The price has fallen to about 22 cents a gallon, the lowest in more than a decade, with many producers losing money.

U.S. Consumption

Consumption will climb to about 1.5 million barrels a day when new crackers from Exxon, Dow Chemical Co. and others open later this decade. Nolan forecasts ethane production in 2020 reaching as much as 2.5 million barrels, while Anne Keller, a gas-liquids researcher at Wood Mackenzie Ltd., expects 2.1 million barrels. That leaves 600,000 to 1 million barrels a day for export.

Most of the ethane used by the chemical industry now comes from Texas and neighboring states. As demand rises, supply will have to be piped farther to reach the Gulf Coast, the center of petrochemical production. Prices will at least double to get ethane from the Rocky Mountains and the Marcellus Shale region of Pennsylvania, Nolan said. That would narrow U.S. ethylene profit margins from record levels.

“Right now, ethylene margins are insane,” Kelly Van Hull, a manager at RBN Energy LLC, said Sept. 4 by phone. “So instead of swimming in money, you’ll be rolling in money.”

‘Dirt Cheap’

If exports reach 1 million barrels, prices may need to triple to tap ethane from the farthest shale play, the Bakken shale in North Dakota’s Williston Basin, Van Hull said.

U.S. ethane will remain “dirt cheap” until about 2017 when new crackers open and exports begin to sop up excess production, she said.

Hassan Ahmed, a chemical industry analyst at Alembic Global Advisors, estimates no more than 275,000 barrels a day of ethane will be exported to Europe. Even if slightly more than 400,000 barrels were shipped, supplies would tighten “briefly” toward the end of 2017 and then slacken as gas production rises, he said in an Aug. 22 note.

The first exports by ship begin next year from Sunoco Logistics Partners LP terminal in Marcus Hook, Pennsylvania, where the NGL will be sent to European customers such as Ineos Group Holdings Inc. Targa Resources Corp. Chairman Rene Joyce said this month he’s “optimistic” his Houston pipeline company also can export ethane.

European Market

American Ethane Co., a Houston-based startup, plans to build a 400,000-barrel-per-day export terminal in Louisiana, with some going to Jamaica to power the island and a United Co. Rusal alumina plant that would be reopened, Walter Teter, a senior vice president, said by phone.

“Europe is going to be the first and primary market for U.S. ethane, and then it’s going to expand into South America and Asia,” Peter Fasullo, a principal at energy consultant EnVantage Inc., said by phone on Sept. 3. “China is looking seriously at ethane as a feedstock, and so is southeast Asia.”

Andrew Liveris, chairman and chief executive officer of Dow Chemical, said in April that he isn’t concerned exports will affect supply because changing energy prices make importing the gas a “high risk” commitment that limits demand. Rebecca Bentley, a Dow spokeswoman, said Aug. 26 that the Midland, Michigan-based company’s position hasn’t changed.

Dow helped found America’s Energy Advantage, a group of energy-intensive manufacturers that wants the federal government to limit exports of liquefied natural gas to keep gas prices down. The group hasn’t commented on ethane exports, and government oversight of LNG exports doesn’t apply to ethane.

Nova Imports

At Exxon’s new Texas plants, raw material price changes will be buffered by integration with other sites, scale and production of premium products, Margaret Ross, a spokeswoman for the Irving, Texas-based company, said in an e-mail.

Exports began in December with Nova Chemicals Corp. bringing ethane via pipeline to Ontario. In June, the Abu Dhabi- owned company began receiving ethane in Alberta.

Saudi Basic, known as Sabic, plans to ship U.S. ethane to a cracker in England; closely held Ineos will use it in Scotland and Norway; and Borealis AG, a venture controlled by Abu Dhabi, plans to process U.S. ethane in Sweden.

Reliance ordered six of what will be the world’s largest ethane carriers to bring U.S. ethane to crackers in India. South Korea’s Samsung Heavy Industries Co. won the Reliance contract to build the so-called very large ethane carriers, or VLECs, which must keep the product chilled below minus 88 degrees Celsius (-126 Fahrenheit) to remain liquid.

Ethane Ships

About 100 ethane ships, including 50 VLECs, may be needed to support an estimated 600,000 barrels of daily ethane exports from an expanded Enterprise terminal, the Marcus Hook terminal outside Philadelphia and a potential Targa facility, Nolan said.

Robust ethane exports could slash the cost advantage U.S. producers currently enjoy over European competitors to as little as 10 cents per pound of ethylene produced from as much as 40 cents currently, Bradley Olsen, an energy analyst at Tudor Pickering Holt & Co., said by phone.

“Chemical companies are putting on a brave face, but they’re watching very nervously the developments in the rest of the world,” Olsen said. “There is a huge economic arbitrage to be had.”

Copyright 2014 Bloomberg.

Join The Club

Join The Club