click for larger

Tighter regulations covering sulphur emissions, which imposes limits on the sulphur content of the heavy fuel oil (HFO) burned has become an important consideration for many shipping companies seeking the most efficient cylinder oil feed rate to lubricate their two-stroke crosshead main engines.

Operating on reduced power (slow steaming) in pursuit of lower bunker consumption is now commonplace within the industry due to the higher cost of marine bunkers and overcapacity issues that plague the dry bulk, crude tanker, and container shipping sectors.

The adoption of slow steaming, and the accompanying risk of cold corrosion, has introduced a further variable, making it more complex to calculate which cylinder oil offers the most efficient lubrication solution.

More recently, changes to engine design – such as a longer stroke – have been introduced to reduce fuel consumption, but are also contributing to increased cylinder liner corrosion. At the same time, increased combustion pressures, in combination with cooler cylinder liners, impact the acid dew point on specific regions of the liner, leading to increased condensation of sulphuric acid.

Engine Corrosion Explained

Corrosive wear of cylinder liners and piston rings is caused by acidic attack from the sulphur acids formed during the combustion of sulphur-containing fuels. The rate of corrosion is influenced by the concentration of the acids and the temperature of the liner and ring surfaces relative to the acid dew point. Acid concentration is a function of the fuel sulphur content, the engine pressures and the amount of water in the combustion air.

The higher the liner temperature is above the acid dew point, the less the acid will condense on the liner surface, hence lowering corrosive wear. Corrosive wear can also be controlled by the alkalinity of the cylinder lubricant, which acts to neutralize the acid: the higher the base number, the more protection provided to the liner surface. The available alkalinity at the metal surfaces is a function not only of the cylinder oil’s rated BN but also of the throughput of alkaline material controlled by the oil feed rate.

Engine design changes in the recent past have led to increased liner temperatures; use of corrosion-resistant materials; and better delivery of the cylinder lubricant to the liner surface (multi-level lubrication).

Slow Steaming and HFO

It is well-known that engines operated at the lower loads associated with slow steaming may not achieve optimal cylinder liner temperatures. Under such conditions, , there is a significantly higher risk of suffering increased corrosion on piston rings and liners as a result of the condensation of sulphuric acid formed from the sulphur oxides and water produced by burning HFO.

The risk is further increased when using fuel with a sulphur content over 2.5%.

Increased corrosive wear leads to a shorter lifespan of key parts, causing premature and costly liner and ring pack replacement. The unplanned replacement of a single liner, piston crown refurbishment and ring pack can cost up to $90,000, thus avoidable corrosive wear can lead to a substantial bill of several hundreds of thousands of dollars.

As a consequence, OEMs MAN Diesel & Turbo and Wärtsilä, have issued new service letters limiting the use of mid-range BN oils on certain engine types and strongly recommending cylinder lubricants with a minimum BN of 70, and preferably higher.

To counter the risk of corrosion from sulphuric acid condensates, marine cylinder oils are formulated with a higher alkalinity (BN) than found in other lubricants: typical automotive engine oils may be in the 8-15 BN range, for example, while current marine cylinder lubricants are typically of 40-80 BN.

Selecting a cylinder lubricant of insufficient BN to match the prevailing operating conditions – engine type and load, lubricant feed rate and fuel sulphur content – can result in higher rates of corrosion.

A lower engine load results in less fresh lubricant being injected over a given time; lubricant residence time is thus increased and reduced lubricant refreshment occurs.

As the capacity of a cylinder oil to neutralise any acidic species formed by combustion depends on the alkali (BN) concentration present and the lubricant replenishment rate, an oil under slow steaming conditions (hence more acidic condensates) has to neutralise for longer periods. Therefore, a higher BN lubricant with optimised detergency properties provides greater protection.

Optimum, cost-effective engine protection can be achieved by choosing the most appropriate product from a range of cylinder lubricants. Castrol’s Cyltech 80AW product was promoted in 2012 as a solution to the increased corrosive wear experienced in the field; its higher BN of 80 enables use at the minimum OEM-recommended feed rates across the widest range of available fuel-sulphur contents, even up to 3.5%.

Case study evidence

Significant advantages have been demonstrated by higher base number (BN) oils over cylinder lubricants with lower BNs in reducing ship running costs under severe engine operating conditions such as slow steaming.

Case studies carried out by Castrol demonstrate the harmful effects of selecting a cylinder oil of inadequate BN to match the engine operating conditions, and also how higher BN lubricants can reduce corrosive wear with lower feed rates than those required for lower BN oils.

Valuable data on the performance of high-BN cylinder oils, in terms of corrosion prevention and piston and ring zone cleanliness in a challenging operating environment, was provided by four large containerships in long-haul service with a major container shipping company. Each vessel was powered by a Wärtsilä RT-flex96C low speed two-stroke engine with ten or eleven cylinders.

The ships, operating under very severe conditions (high-sulphur fuel and low engine load with one turbocharger blanked off), have been monitored over several months. All started out with a mid-BN cylinder oil lubricating the 960mm-bore engines, however extreme corrosive wear was noted, indicating that liner replacements would be necessary after just a third of their expected life, two of the ships were then switched to Castrol Cyltech 80 AW.

Typically a liner is designed to last for 70,000 running hours. Taking the example of a vessel life of 25 years with 150,000 running hours, this would require one liner replacement throughout the lifetime of the vessel. With an estimated cost per liner replacement of $70,000, the ship owner would be required to spend $0.7m for one replacement of ten cylinders. Shortening the liner life to one third would result in 5 liner replacements in the same time period, increasing the costs to $3.5m. In these case studies, the switching of the two vessels to an 80 BN lubricant should mitigate excessive corrosive wear and hence potential unplanned costs of $5.6m over 25 years ($224,000 annually) solely in liner replacement and not taking into account the costs for ring packs.

“We have argued consistently that mid-range BN oils are not suitable for slow steaming operations in modern engines,” says David Goosey, Castrol Marine chief executive and sales director. “Our own field investigations led us to raise concerns with the OEMs, concerns that were confirmed by Castrol bench tests and further field trials.

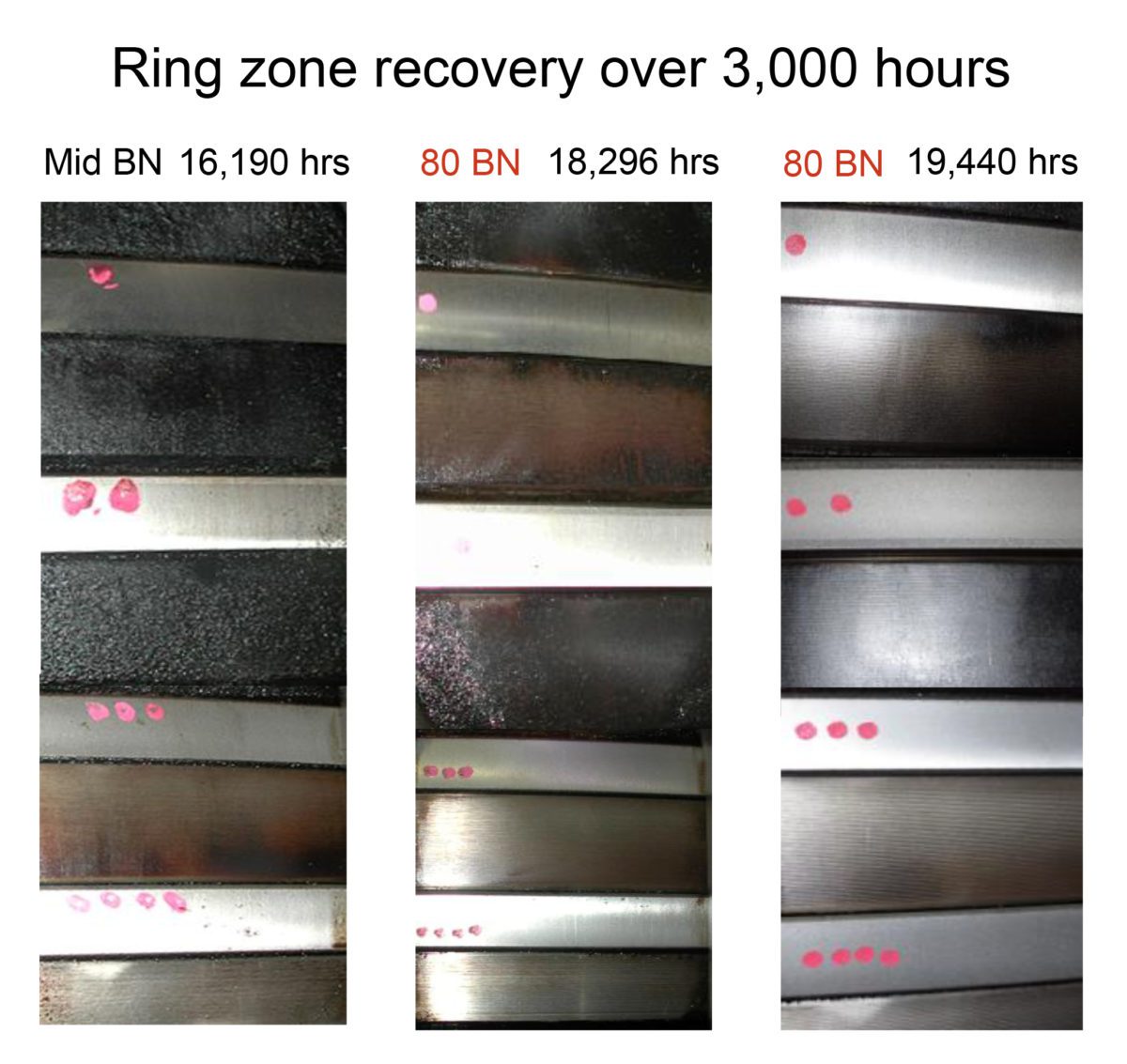

After evaluating two units with similar running hours, respectively served by mid-BN and 80 BN cylinder lubricants, piston crown, crown land and ring land deposits were shown to be significantly cleaner with the higher BN product. Higher resistance to corrosive attack was thus accompanied by enhanced detergency, keeping the ring zone and crown land cleaner.

Furthermore, engine inspections over 3,000 hours, showed a progressive clean-up of existing deposits and generally improved cleanliness of the ring zone.

In addition, iron contents in scavenge drain oils were found to have reduced from nearly 400ppm with the mid BN products to less than 100ppm with Cyltech 80AW.

The case study will now focus on achieving further savings by reducing the cylinder oil feed rate by 10%. Castrol estimates that this will save a further $100k per annum ($2.5m over 25 years) for the two vessels increasing the annual saving to approximately $324k together with the reduction in cylinder liner replacement.

Join The Club

Join The Club