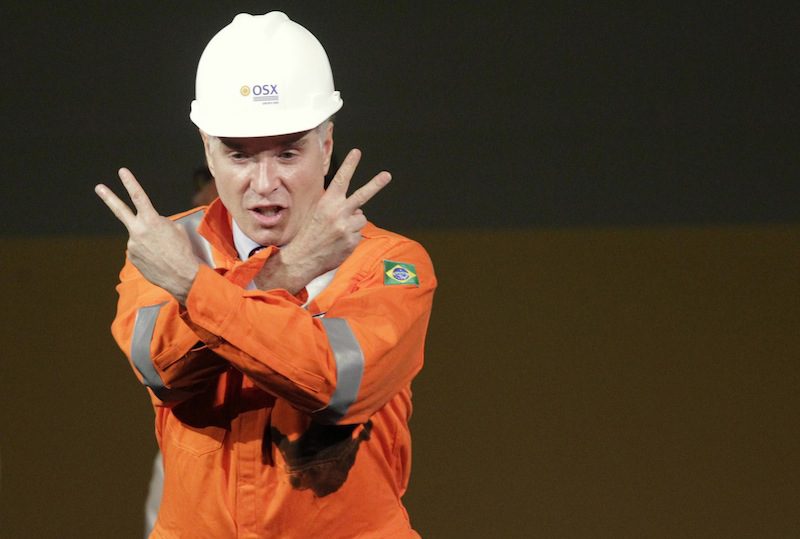

Brazilian billionaire Eike Batista gestures to the audience during a ceremony in celebration of the start of oil production of OGX at the Superport Industrial Complex of Acu in Sao Joao da Barra in Rio de Janeiro in this April 26, 2012 file photo. REUTERS/Ricardo Moraes/Files

By Juan Pablo Spinetto

(Bloomberg) — The last of the 66 meter-long (217 feet) concrete blocks sit ready to be towed out to sea as work on Latin America’s most expensive private port draws to a close. For the project’s mastermind, a flamboyant opening ceremony couldn’t be further from reality.

The 6.3 billion reais ($2.4 billion) Acu port project in Rio de Janeiro state is the brainchild of Brazil’s most famous entrepreneur, Eike Batista. While the port is finally becoming active after delays and cost overruns, Batista is busy defending himself against insider-trading charges after his commodities empire collapsed.

Acu started operations in October, when a ship loaded with 80,000 metric tons of iron ore departed to China from a terminal shared by Prumo Logistica SA, the company that controls Acu, and Anglo American Plc. Another ship was moored last month to a quay of National Oilwell Varco Inc., the largest U.S. maker of oilfield equipment, as Paris-based Technip SA also ramps up a flexible pipes plant.

“This is a new stage,” Prumo Chief Executive Officer Eduardo Parente, 43, said during a visit to the facility. “We are finishing the basic infrastructure works, completing the financial structure arrangements. The commercial negotiations are much easier and we have the first operations taking place.”

Acu, which means grand in the Tupi-Guarani indigenous language, comprises two terminals along the coast near Sao Joao da Barra, about 320 kilometers (200 miles) northeast of Rio’s famous beaches. The venture, which occupies about 90 square kilometers (35 square miles), markets its close proximity to the Campos Basin oilfields, source of about 80 percent of Brazil’s output, to prospective customers.

Surrendered Control

Technip, Europe’s biggest oil-services company, this year opened in Acu its second manufacturing plant in Brazil to produce flexible pipes capable of resisting the layer of salt that blankets Brazil’s giant crude discoveries.

“The Acu plant is performing in line with our expectations with good quality production and is progressing on ramp-up,” the company said in an e-mailed statement. “We remain very excited about the prospects.”

After losing about $30 billion of personal wealth, Batista’s involvement with Acu has been reduced to a minority stakeholder. Overburdened with debt and lack of capital to finish his projects, last year he surrendered control to EIG Global Energy Partners LLC, the $15 billion private-equity fund based in Washington, which now has almost 60 percent of Prumo.

The scale and ambitions of the venture also changed.

‘X’ City

When Batista began construction in 2007, he envisaged a super-port as the centerpiece that would integrate his oil, logistics and commodities ventures. Batista’s vision for Acu included an industrial complex with everything from car plants to steel mills as well as an annexed urban center called the “X” city. He used the letter X in his company names because he said it symbolizes the multiplication of wealth.

The port would be the biggest in the Americas and among the world’s top three, Batista would relentlessly say in his pitches, with the iron-ore terminal initially projected to start operations in 2010. Journalists were shown the project by helicopter to better appreciate its magnitude.

“It will become the tropical Rotterdam,” he said in a message on his Twitter account in March 2013, comparing the venture with Europe’s busiest port.

The entrepreneur, which is having his stake in Prumo reduced to less than 10 percent after failing to participate in a capital increase, last month attended the first hearing of a landmark trial in Brazil for alleged insider-trading and market manipulation. A second session, originally scheduled for Dec. 17, has been postponed to early next year, according to the court hearing the case.

Conservative Approach

Batista didn’t reply an e-mail seeking comments on Acu.

Prumo took a more conservative approach to focus on the delivery of the port and attract customers as shares trade close to its lowest level since 2008. Batista’s grandiose “X” city and the steel, cement and industrial center he once envisioned were scrapped.

The company expects to finish installation of the 47 concrete blocks required for terminal 1 by April and the 42 blocks for terminal 2 by July. Units of Edison Chouest Offshore International and Wartsila Oyj are scheduled to start in the first half of 2015. Prumo also expects a joint venture with BP Plc to set up maritime fuel storage and distribution to start operating in the second half of next year.

The port plans to operate terminal space to handle bulk, containers and cars, too, while it waits to sign contracts with oil companies for crude handling by 2016 after belated negotiations, CEO Parente said, adding that he expects the venture to start generating operating profit next year.

Prumo rose 2.8 percent to 37 centavos at 11:27 a.m. in Sao Paulo, reducing its decline this year to 66 percent.

“This project will gain strength now that it enters the operational stage and companies set their bases,” said Wagner Victer, who originally developed the port concept in 2000 before presenting it to Batista as Rio’s secretary of energy. “It became a reality even with all the obvious difficulties and delays in projects of this scope.”

Copyright 2014 Bloomberg.

Join The Club

Join The Club