By William Mathis (Bloomberg) —

BP Plc is facing a test of its green energy strategy as the company makes its latest bid to expand wind power production off Britain’s coast and prove itself a serious player in the sector.

In the latest auction of seabed rights in U.K. waters, BP partnered with German utility EnBW Energie Baden-Wuerttemberg AG for the opportunity to build about 2.9 gigawatts of wind power capacity off the Scottish coast. Earlier this year, the two companies won big at a contest to gain access to the seabed off the coast of England and Wales, a process that BP was able to secure by paying more than anyone else.

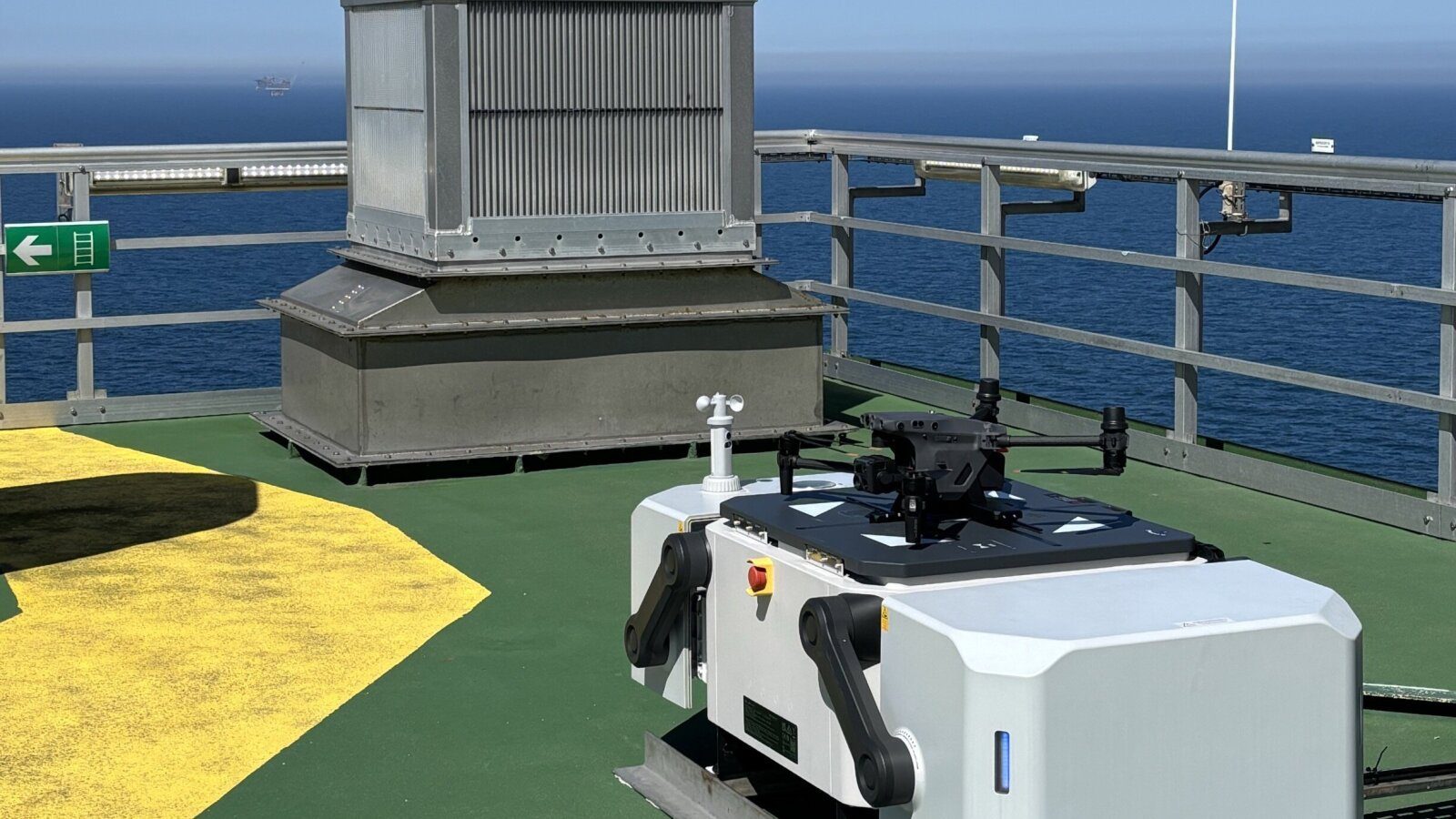

After decades extracting oil and gas from the seabed around Britain, BP aims to piggyback on the skills it acquired in fossil fuels to catch up with rivals that started on the energy transition earlier. The bids would roughly double the company’s wind business in U.K. waters and will be crucial to reaching BP’s goal of 50 gigawatts of renewable capacity by 2030.

For BP to win in Scotland it will have to beat out competitors such as France’s TotalEnergies SE and Royal Dutch Shell Plc as well as renewable specialists and utilities such as Orsted A/S and SSE Plc.

“There’s a huge amount of infrastructure as well as customer access and distribution we can bring together in a way that pure play renewable companies or pure play companies in the space of utilities cannot bring,” Dev Sanyal, BP’s executive vice president of gas and low carbon energy, said in an interview.

That could mean producing power for electric vehicles and making green hydrogen, a spokeswoman said by email. Other companies also have big plans in those areas.

In Scotland, the winners will be selected on a variety of criteria. Bidders must prove they have sufficient financial resources to build the projects, but the Scottish authorities will also consider factors like capability, experience and each project’s overall concept. Results of the process for Scotwind are expected early next year.

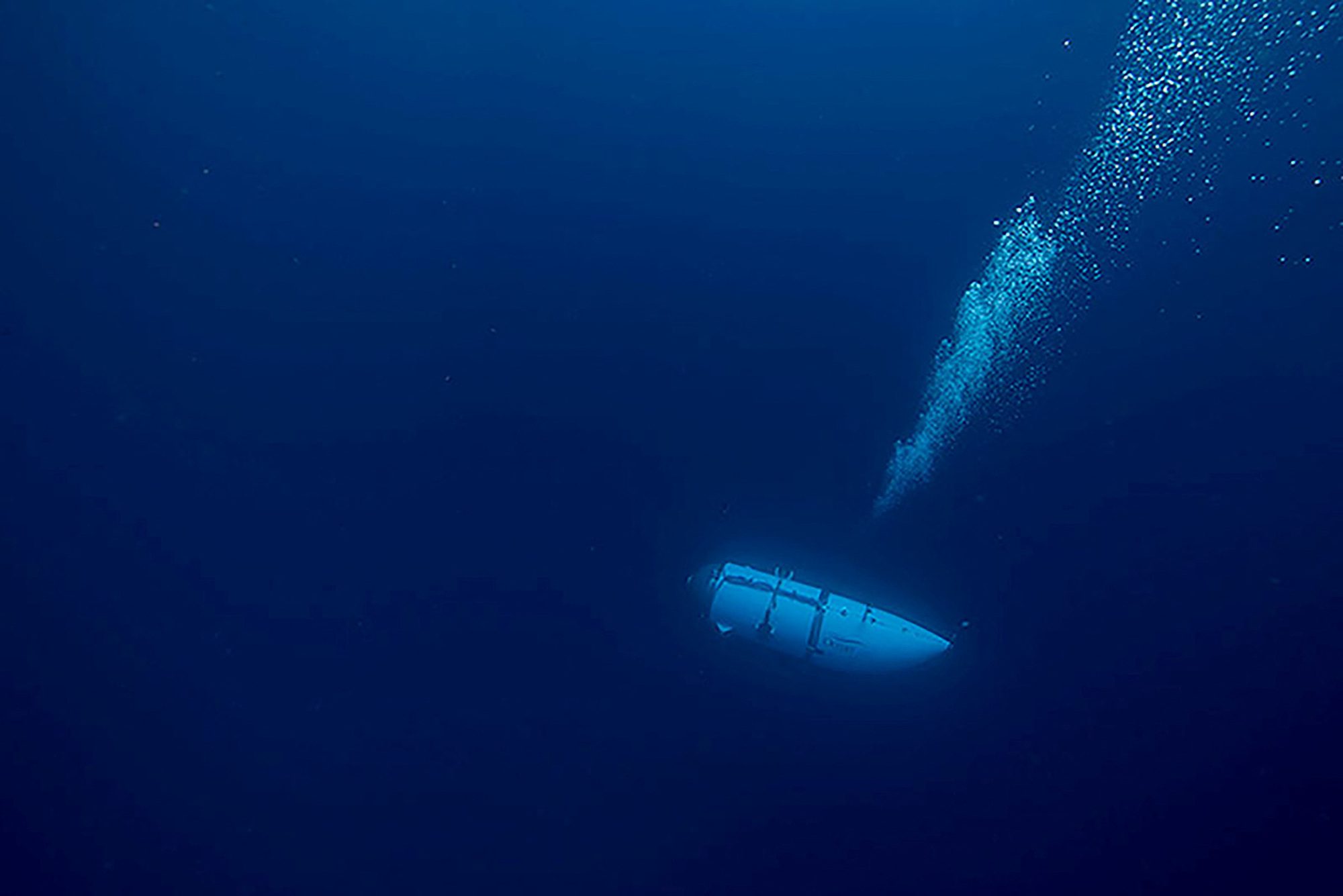

BP is only targeting sites where it would erect turbines attached to the seabed, according to Sanyal. Other participants such as Shell and Iberdrola SA have a more diversified approach vying for sites where turbines would float on buoyant structures in deeper waters, a technology that hasn’t been deployed at a large scale for wind farms before.

One way to get an edge would be to present the project as a way of boosting the local economy in step with the government’s green jobs agenda, according to Charley Rattan, an independent consultant for hydrogen and offshore wind.

“If you’ve got an existing presence, existing taxes, asset base and can see a future for them by transitioning, you have a very good news story to tell,” Rattan said.

As part of its bid, BP plans to invest in a job program that would help train entry-level employees as well as hundreds of oil and gas-sector workers.

© 2021 Bloomberg L.P.

Join The Club

Join The Club