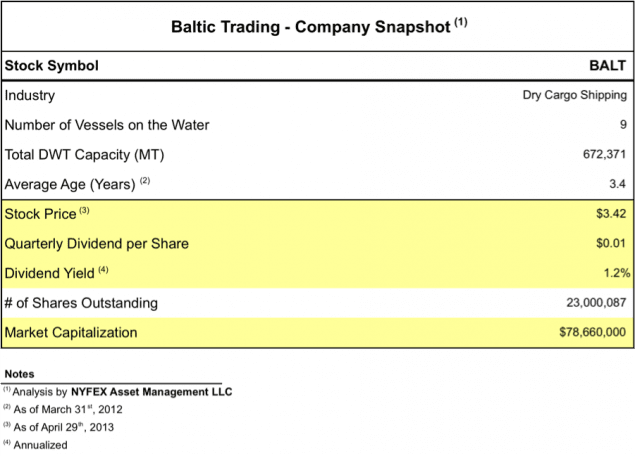

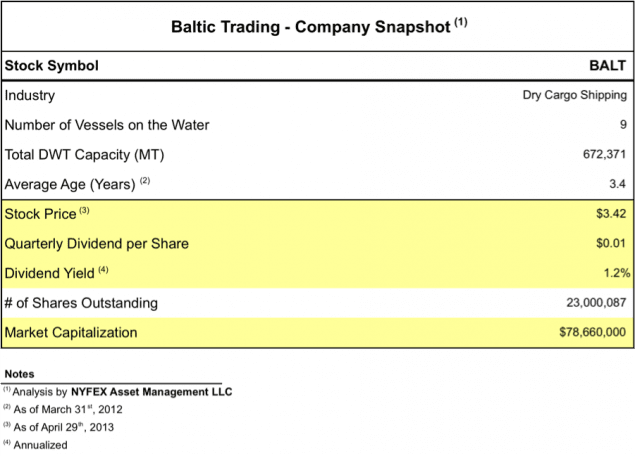

New York-based Baltic Trading Limited (NYSE:BALT) is a publicly traded dry cargo company which operates a fleet of 9 dry cargo vessels, consisting of 3 handysize vessels, 4 supramaxes, and two capesize vessels, with a total DWT capacity of approximately 672,000 MT, and an average age of 3.4 years as of March 31st, 2013.

Even though it is traded as a separate entity, it is a subsidiary of Genco Shipping & Trading Limited (GNK), of Peter Georgiopoulos’ fame. Genco has a 25% ownership stake in BALT, although it exercises full managerial & ownership control.

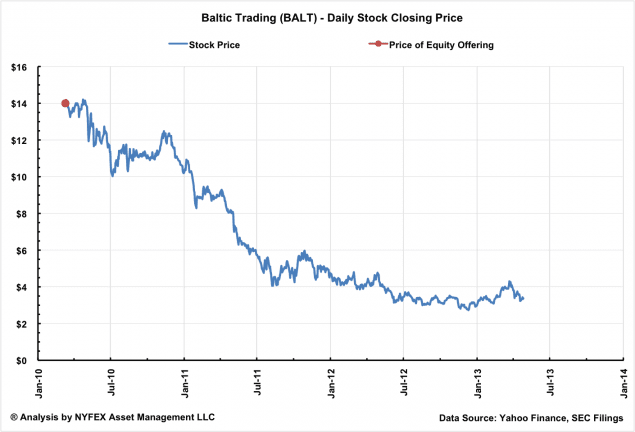

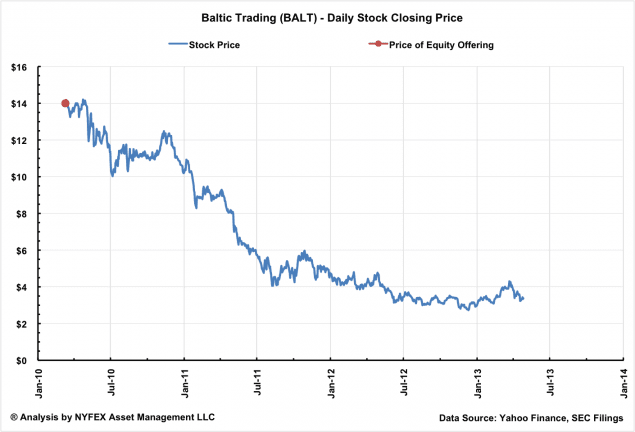

BALT had its IPO in March 2010, when it raised a whopping $210 million in net proceeds, by selling 16,300,000 shares to the public at $14 per share. Since then, the company’s stock has drifted steadily lower, in line with every other dry cargo shipping company. The whole segment has been plagued by a massive oversupply of tonnage, and BALT, which operates all its vessels in the spot market, or in spot index-related time charters, is no exception. Based on Monday’s closing price of $3.42 per share, BALT had a market capitalization of just $79 million.

I like the company because it operates a modern fleet, has little debt outstanding, and trades at a low price vis-Ã -vis its Net Asset Value (NAV).

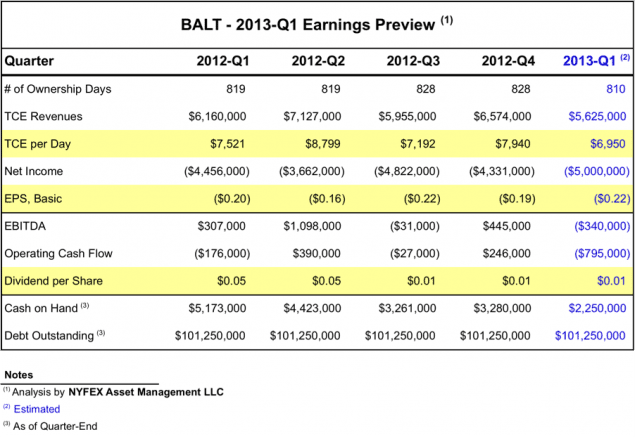

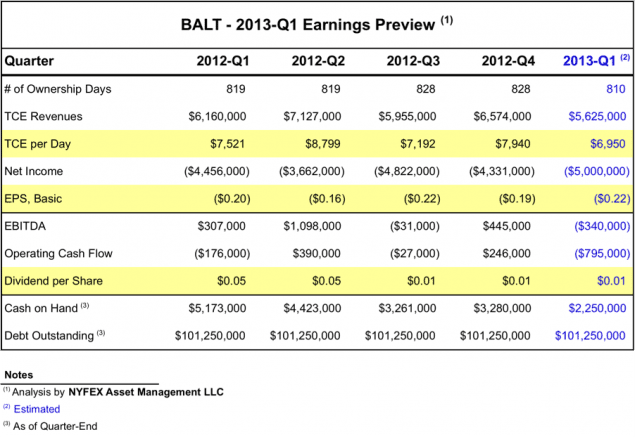

Baltic Trading is scheduled to report earnings for the quarter ending March 31st, 2013, after market closing on Wednesday May 1st. I estimate BALT to report a net loss of ($5,000,000) for the quarter or the equivalent of ($0.22) per share. TCE revenues were negatively affected by continuing softness in spot freight markets, especially in the cape size sector. I estimate that TCE revenues were $5,625,000. The fleet average TCE per day was $6,950, below the company’s operating cash break-even rate of about $7,900. I expect BALT to report negative EBITDA & Operating Cash Flow for the quarter.

BALT has moderate debt leverage. Its debt outstanding is $101,250,000. As of March 31st, 2013, the company had the capacity to borrow an additional $28,750,000 under its credit facility, including $23,500,000 for working capital purposes. The credit facility expires in November 2016. Based on the facility’s amortization schedule and current debt outstanding, BALT does not have any scheduled debt repayments before November 2015.

BALT has in the past declared variable quarterly cash dividends based on cash available for distribution, but also after taking into account the company’s cash flow, liquidity and capital resources. Based on the company’s formula for cash available for distribution, BALT would not have the capacity to declare a cash distribution this quarter. But after taking into account that: (I) BALT has paid a consecutive dividend since its IPO in March 2010, and (II) BALT has previously declared dividends in excess of cash available for distribution, I expect BALT to declare a cash distribution of $0.01 per share for the first quarter.

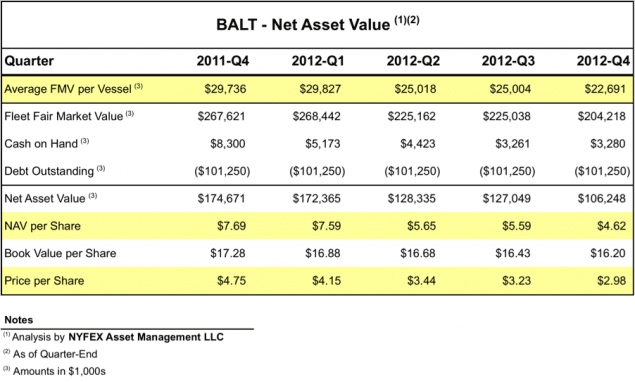

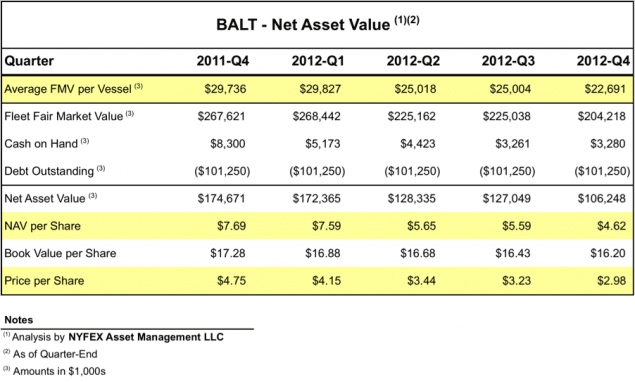

The stock has consistently traded below its net asset value for the past six quarters. Based on figures provided by BALT in its annual report filed with the SEC, the fair market value of its fleet at year-end was $204,000,000. On this basis, the company’s NAV was $4.62 per share. Even in today’s market environment, where shipping stocks have been battered and bruised, it is still very rare to find stocks that trade at a discount to their NAV.

I expect BALT to continue treading water for the foreseeable future, since all its vessels are trading in the spot market. Also with scheduled dry-docks coming due this year, I expect the company’s cash break-even rate to increase. But I do like the stock for its low debt level and bargain basement price.

Join The Club

Join The Club