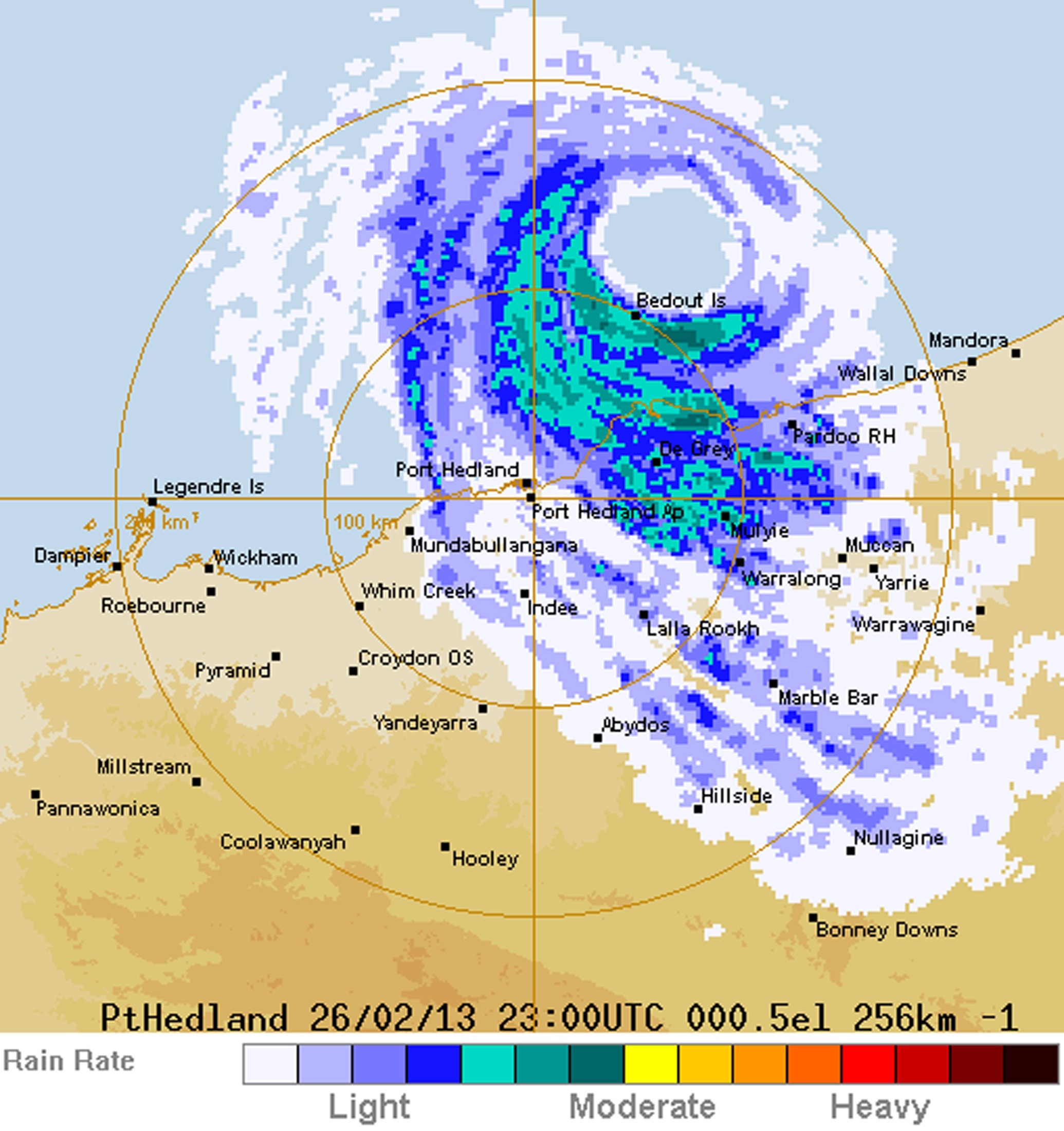

In this radar image by the Australian Bureau of Meteorology, the severe tropical cyclone “Rusty” is seen near the Pilbara region in western Australia at 2300 GMT on February 26, 2013. Image: REUTERS/Australian Bureau of Meteorology/Handout

(Bloomberg) — A storm that closed Australian ports handling 43 percent of world iron-exports delayed as many as 74 vessels amid rain that might interrupt mining, Alphabulk said.

The backlog at Port Hedland and other ports nearby will curb Australia-bound charters of Capesize vessels over the next month, the Paris-based maritime consultancy said by e-mail today. Port Hedland is the world’s largest port for shipping iron ore.

Severe Tropical Cyclone Rusty made landfall at 5 p.m. local time, 110 kilometers (68 miles) from Port Hedland, Australia’s Bureau of Meterology said on its website. The country is the biggest shipper of iron ore, a steelmaking raw material, and Capesizes haul 90 percent of cargoes. Hire costs for the ships as gauged by the Baltic Exchange in London dropped for a 14th session today.

“Even without any significant damage, the backlog will take weeks to work through,” Alphabulk said. Reduced Australian cargoes may spur additional ore shipments from second-ranking exporter Brazil, which would result in longer-distance voyages, it said. China is the leading importer of the commodity.

Port Hedland, Dampier, Port Walcott and other ports in Western Australia handled iron-ore shipments totaling more than 500 million metric tons last year, or a 43 percent world share, according to Alphabulk. They accounted for 24 percent of demand for Capesizes, the biggest ore carriers, it said.

BHP, Fortescue

Prolonged rainfall from Rusty expected over mines owned by BHP Billiton Ltd. and Fortescue Metals Group Ltd. “could lead to more significant long-term loss of production,” Alphabulk said. The companies are Australia’s second- and third-largest ore exporters, respectively.

Ore-shipping ports may stay closed until March 1, Gulf Agency Company (Australia) Pty Ltd. said today by e-mail. Port Hedland and Port Walcott evacuated vessels on Feb. 24, while Dampier’s port closed to traffic the next day, according to e- mails from the port agent.

Ore shipments from the region are estimated to fall by about 5 million tons, or about 5 percent of global volumes, tightening supply into March, Melinda Moore, a London-based bulk-commodity sales executive at Standard Bank Plc, said in a report yesterday.

Port closings will have a “fairly minimal” effect on iron-ore prices if the shutdowns are limited to several days because steel mills in China have ample inventories, said Paul Gray, Guilford, England-based principal iron-ore analyst for Wood Mackenzie.

Well Stocked

“The steel mills are pretty comfortably supplied with iron ore, so it’s not going to be something that sends shock waves and panic around the market,” Gray said by phone today.

Daily average Capesize hire rates dropped 5.9 percent to $4,447, remaining at the lowest level since Sept. 17, according to the Baltic Exchange. A strike at the Cerrejon coal mine in Colombia also hurt demand for the ships in the last few weeks.

The price of ore with 62 percent iron content imported to the Chinese port of Tianjin was unchanged for a second day at $151.90 a dry ton today, according to figures from The Steel Index Ltd., a unit of McGraw-Hill Cos.

– Michelle Wiese Bockmann, Copyright 2013 Bloomberg.

Join The Club

Join The Club