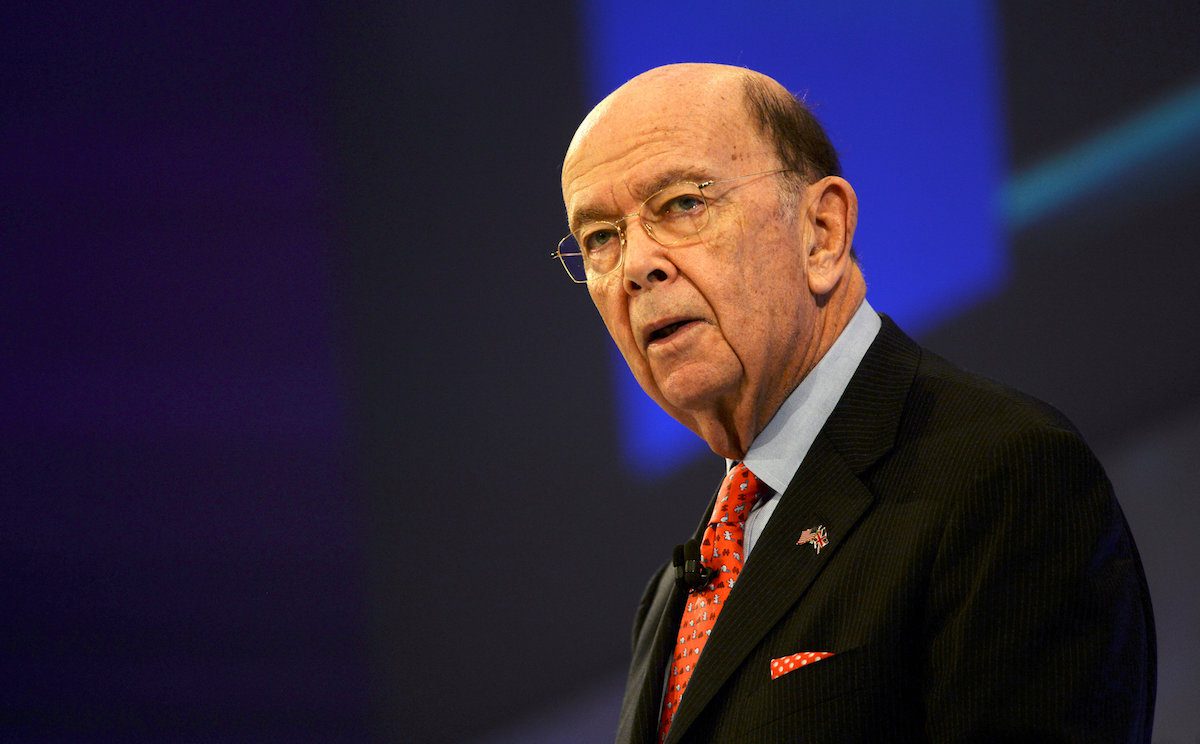

Wilbur Ross, chairman and CEO of WL Ross & Company LLC. (c) REUTERS/Mike Segar

The foray of private equity groups in the shipping industry has been a focal point of discussion in industry forums, ever since the high-profile investments by celebrated investor Wilbur Ross in privately held Diamond S Shipping Group (a company specializing in suezmax crude oil carriers & medium range petroleum product tankers) & Navigator Holdings Ltd. (a company specializing in liquefied gas carriers). Today, Diamond S Shipping remains a privately held company, whereas Navigator Holdings (NVGS) just consummated a very successful IPO on NYSE, selling a total of 12 million shares at $19 per share, at the high end of its expected $17-$19 price range.

Industry pundits, myself included, have attempted to explain the motivating factor behind private equity’s love affair with the shipping industry (answer: high return on investment), and the investment, monetizing, and exit strategies to maximize such return. Typically, private equity groups make sizable investments in privately held companies, aiming to monetize their investment by a subsequent IPO, and eventually divest their holdings, ideally in a three to five year time frame from their original investment.

This seems to be the strategy followed by WL Ross & Co., the main investment vehicle of Wilbur Ross. In August 2011, WL Ross & Co. led a group of investors committing over $600 million in Diamond S Shipping, to acquire 30 medium-range petroleum product tankers from Cido Tanker Holding Co.

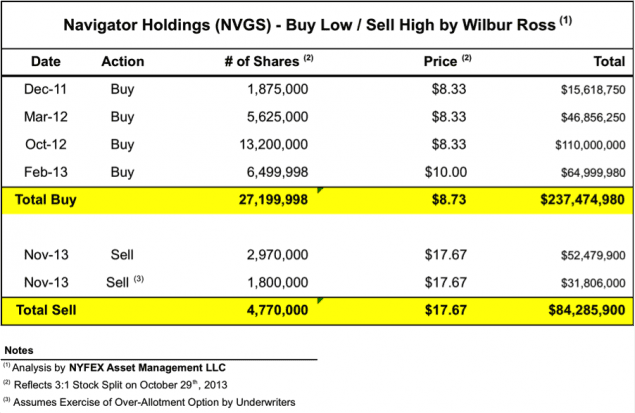

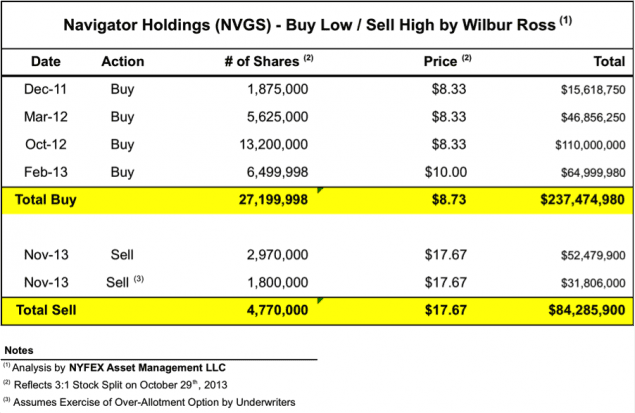

In November 2011, WL Ross & Co. struck a similar deal with Navigator Holdings committing $62.5 million for 7.5 million shares in a private placement, to fund its capital reserves and growth strategy. In October 2012, Wilbur Ross paid $110 million to acquire 13.2 million shares from the bankruptcy estate of Lehman Brothers. In February 2013, Navigator Holdings issued to Wilbur Ross through a private placement an additional 6.5 million shares for $65 million. All told, Wilbur Ross amassed from these three transactions a total of 27.2 million shares, at an average cost of $8.73 per share.

By the time Navigator Holdings filed for its IPO, Wilbur Ross was the single largest shareholder in the company, owning a total of 28,040,508 shares or 60.6% of total shares outstanding.

Navigator Holdings sold a total of 12 million shares to the public on November 20th, 2013. Included in the total number of shares sold were 2.97 million shares offered by a selling shareholder. The selling shareholder was, you guessed it, none other than Wilbur Ross & Co. In fact, if the underwriters exercise their option to acquire an additional 1.8 million shares from the selling shareholder (a scenario that seems very likely given the positive reception by the market so far), WL Ross & Co. stands to divest a total of 4.77 million shares, or a little over 17% of its holdings. Given that the net proceeds after underwriting commissions & discounts were $17.67 per share, Wilbur Ross & Co. stands to generate a cool return on investment of just over 100% in less than two years. Not a bad start for an investment in a staid industry.

As I begin devouring the IPO prospectus for an insight into the liquefied petroleum gas (LPG) industry and the company’s intrinsic valuation, (I plan to revert on these in a future article), I cannot help but notice the absence of any related-party items. Wilbur Ross gave the keynote speech at this year’s Marine Money Conference in NYC, and was vocal about the need for the shipping industry to adopt proper corporate governance practices. Sir, for your business acumen I offer you my compliments, but for your integrity I owe you my gratitude.

Editorial Standards · Corrections · About gCaptain

Join The Club

Join The Club