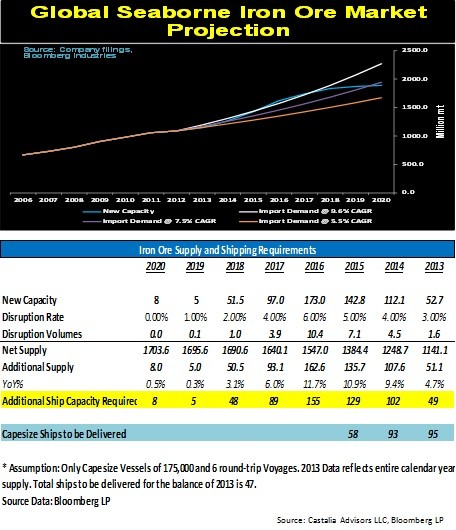

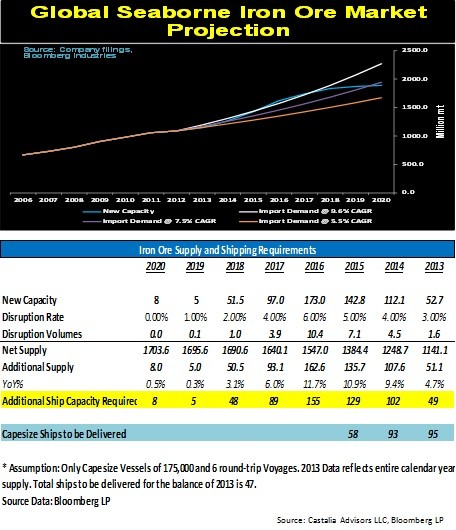

In 2013, new iron ore capacity is estimated at 51.1 million tons. The additional ship capacity required to service this new capacity is 49 Capesize ships. 95 Capesize ships (net) are expected to be delivered in 2013. As of September, 2013, 48 Capesize vessels have already been delivered with another 47 vessels expected to be launched in the fourth quarter. Since October 1st, additional Capesize vessels as well as other dry bulk ships have been ordered. These orders will cover additional vessel requirements of iron ore producers.

In 2013, new iron ore capacity is estimated at 51.1 million tons. The additional ship capacity required to service this new capacity is 49 Capesize ships. 95 Capesize ships (net) are expected to be delivered in 2013. As of September, 2013, 48 Capesize vessels have already been delivered with another 47 vessels expected to be launched in the fourth quarter. Since October 1st, additional Capesize vessels as well as other dry bulk ships have been ordered. These orders will cover additional vessel requirements of iron ore producers.

In 2014, the short-fall in Capesize vessels to be delivered is more than made up by the Capesize vessels that were delivered in excess in 2013 and those vessels that have since been ordered since September 30, 2013. It is only by the end of 2015, assuming all expected iron ore production begins producing, which is debatable, that an additional 33 Capesize vessels are required.

This projection also assumes that by the end of 2015, the world dry bulk fleet is still slow-steaming and none of the shadow tonnage, caused by slow steaming is effectively returned to the market and no additional vessels are ordered between now and then. This is unlikely. For the near term, and even out into 2016, it appears that fleet supply exceeds requirements.

BHP Billiton, Rio Tinto and Fortescue Metals Group are sticking with plans to ramp up production. According to Bloomberg data, these three companies plan to add 240+ million tons per annum (“Mtpa”) of new mine capacity by 2015, which is nearly equivalent to Rio Tinto’s 2012 output. Analysts speak about iron ore capacity coming on-stream and ship requirements to satisfy the production being substantive, but in the marketplace, most of the statistical data lacks verification.

Well, the data is there and we had it checked by a producer in the industry. As stated, for the near term, and even out until 2016, it appears that fleet supply exceeds additional iron ore production.

Producers in Australia keep developing mines on schedule, However, Vale appears to lagging behind schedule in bringing on new capacity. Brazil is the outlier as to what production capacity will exist. Most of the expected new production in Brazil will impact the iron ore market in 2015 and beyond; however, much of this expected new capacity may not come online. Finally, a surprise factor as a new source of iron ore is Mongolia. It has not been factored into the statistics included in the chart, as the iron ore comes to China without maritime shipping requirements. From producers, we know that iron ore projects in Mongolia are actively expanding and that capacity is being developed faster than analysts have been forecasting. We expect, Mongolia may play a major role in supplying China during the next 10 years. These factors combined with new production capacity in Mongolia will change the maritime requirements in 2015 and beyond.

Want more perspective on the dry bulk market? Listen to my presentation at Marine Money HERE.

Join The Club

Join The Club