Major Cocaine Bust: UK Border Force Seizes Record Shipment at London Gateway

In one of the UK’s largest drug seizures of the past decade, UK Border Force officers have seized cocaine with an estimated street value of £96 million (USD 130 million)...

If everyone could predict the future, winning or losing a race would result in the same emotional response, risk would be non-existent and the correct path would always be known. For most shipowners, this would likely be their purgatory.

Fortunately, unpredictability is part of what makes the maritime and offshore sector incredibly rewarding and somewhat terrifying at the same time. It’s kind of like yacht racing where you always try to win your side of the race course.

Sailing up the middle almost always results in mediocre results at best, so it’s best to try and pick a side and defend it as hard as possible while hoping for a wind shift to help leverage you above the competition.

Like the tactics along first beat of a yacht race, deciding what will fuel your ship at the outset is one of the most important initial decisions that can be made and will hopefully result in the lowest up-front and operational costs over the lifetime of the vessel, while still meeting evolving regulatory requirements. This decision has everything do to with predicting what will be available in the future, and at what cost.

One way to look at this problem is to consider two different scenarios, one where public policy plays a significant role in shaping the global energy system, and one where the global energy system is shaped more by market forces and civil society than government policy.

These two scenarios were drawn up by Royal Dutch Shell in 2013 as part of their New Lens Scenarios and depending on which road society takes in the future, could result in a more regulated society where natural gas becomes the global energy backbone, or a more market-based, volatile, and prosperous society where oil and coal continue to dominate the energy landscape.

In Shell’s first scenario, which they call “Mountains,” the widespread use of natural gas is driven by environmental policy and supported by the increase of production of natural gas globally for use in the global power generation market, as well as the maritime transportation market.

This is essentially what we are seeing now with emissions control areas and the associated IMO regulations, but peeling back the layers even more, there is more to be considered.

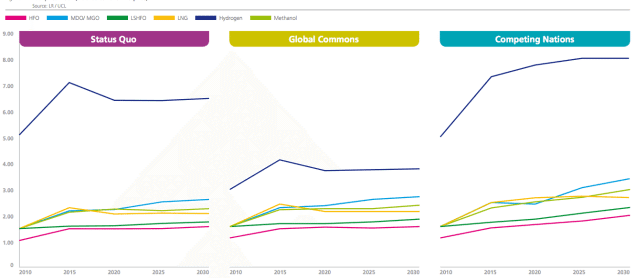

Lloyd’s Register looks at three different scenarios which would present three different realities for the future of marine fuels.

Status Quo – In this scenario, things are “Business as usual” with economic growth at its current rate along with short term solutions and rapid regulatory change. In this scenario, LR’s assumes that the 0.50% sulphur limit comes into global effect in 2025 while most ships will use heavy fuel oil (HFO) in combination with a scrubber to meet emissions control area (ECA) and IMO requirements. LNG will be adopted gradually and more profoundly in the product/chemical segment, followed by the bulk carrier/general cargo segment.

Global Commons – In this scenario, LR assumes a universal sulphur regulation (no ECAs) which results in more economic growth, international cooperation, a harmonized regulatory regime, international trade agreements, environmental protection, globalization and climate change. Emerging policies will seek to curb emissions by imposing a cost on higher-carbon fuels resulting in the replacement of LSHFO with fuels such as hydrogen and LNG.

Competing Nations – Regulatory fragmentation, protectionism, local production and consumption, trade blocks, and slower globalization define this scenario, one which would negatively affect the widespread adoption of LNG or distillate fuels.

Based on these different scenarios, LR put together a chart of how specific fuel prices might be affected in each scenario, as detailed below:

Considering these hypothetical scenarios, the common thread is LNG.

Global production of LNG is growing, as is the market demand for its use in power generation and in the maritime and offshore sector.

“The reality is that no company has yet fully committed to LNG as fuel for a deep sea ship – some of the orders so far are deep sea capable. The commercial premise behind the orders is based on ECA trading, but we don’t think a deep sea order is far away,” commented Nick Brown, Marine Communications Manager at Lloyd’s Register. “Lots of owners are talking to us and receiving our advice on the subject.”

“The key issues are market forces and regulation. For deep sea ships it’s no good advocating alternatives to HFO unless they are supported by regulatory and market realities. Anything else is blind faith,” adds Brown.

Considering the announcement by Mitsui O.S.K. Lines today to invest upwards of $5 billion in new LNG carriers to deliver vast quantities of cargo globally, it seems that fleets of LNG-powered merchant vessels may be seen sooner rather than later, yet LR points out that it will likely be the smaller classes of vessels which become the first-adopters of this technology.

In their report, LR notes, “The smaller ships see earlier take-up because of the way installed power influences capital cost and DWT impacts the size of the LNG tank, and the smaller ships have higher kWh/t.nm than the larger ships. This also explains why the containership segment has the least penetration of LNG. The existing fleet is relatively new and the tonnage renewal focuses on fewer, larger ships.” The same concept applies to the crude tanker market.

Even without huge adoption of LNG power within the crude tanker and containership segments, LR predicts LNG will power 11 percent of the deep sea merchant vessels of 2030. “That is a massive growth from zero deep sea today,” notes Brown.

Sign up for gCaptain’s newsletter and never miss an update

Subscribe to gCaptain Daily and stay informed with the latest global maritime and offshore news

Stay informed with the latest maritime and offshore news, delivered daily straight to your inbox

Essential news coupled with the finest maritime content sourced from across the globe.

Sign Up