Russia’s Sanctioned Arctic LNG Plant Sees Record Output With China Flows

Russia’s sanctioned Arctic LNG 2 plant increased gas production to record levels in September as its cargoes appear to find buyers in China.

The U.S. Trade Representative (USTR) has proposed sweeping new restrictions targeting Chinese-built ships and operators, including substantial port fees that could reshape global shipping economics.

The action, stemming from a Section 301 investigation initiated by five major U.S. labor unions in March 2024, found that China’s maritime sector practices are “unreasonable and burdensome to U.S. commerce.”

“China’s targeting for dominance burdens U.S. commerce by undercutting business opportunities and investments in the U.S. maritime sectors, creating economic security risks and undermining supply chain resilience,” the USTR stated in its findings.

The proposed measures include a significant $1.5 million flat fee per port call for any Chinese-built vessel entering U.S. ports. Additional tiered fees will apply based on operators’ exposure to Chinese-built vessels and newbuild orders.

Under the complex fee structure, operators with fleets comprising more than 50% Chinese-built vessels could face fees up to $1 million per U.S. port call, while those with a lower exposure to Chinese-built ships would pay less. For example, operators with 25-50% Chinese-built vessels would up to $750,000 per call, while those falling in the 0-25% range would pay $500,000 per call. Notably, the measures also include potential relief, with operators eligible for refunds up to $1 million per port call if they operate U.S.-built vessels.

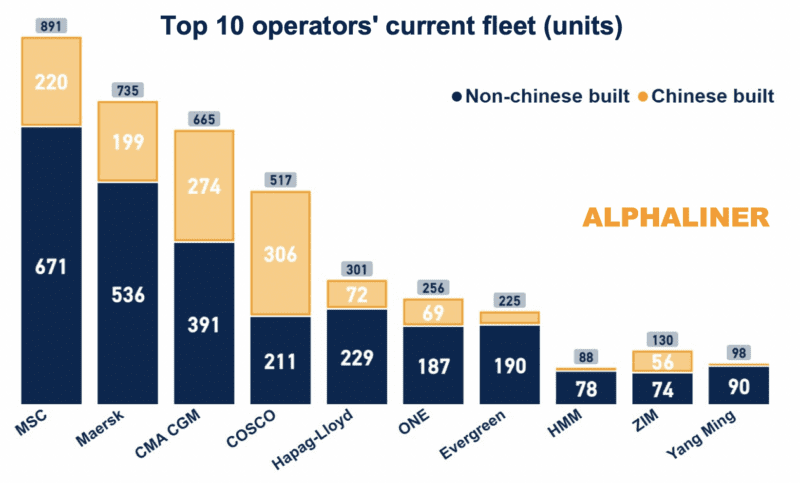

In the container sector, the impact on major carriers could be substantial. According to an analysis Alphaliner, Chinese-built vessels make up 32% of the global container fleet, and all ten of the world’s largest ocean carriers have at least some Chinese-built vessels in their fleets—meaning these carriers would face minimum fees of $500,000 per U.S. port call under the proposed fee structure.

China’s state-owned COSCO Group, including OOCL, appears most vulnerable with 60% of its current fleet built in China and its entire orderbook consisting of Chinese-built vessels, based on Alphaliner’s data. ZIM and CMA CGM follow with 43% and 41% of their operated fleets being Chinese-built, respectively. Aside from COSCO, CMA CGM has the highest number of ships built in China, with 274 currently in operation, followed by MSC (220) and Maersk (199).

Among top carriers, MSC and Hapag-Lloyd show significant exposure to Chinese shipyards through their orderbooks, with 93% and 92% of their new vessels contracted in China, according to Alphaliner. Maersk and CMA CGM also face considerable exposure with 70% and 52% of their orderbooks at Chinese yards, respectively. However, HMM, Yang Ming, and ZIM all have no ships on order in Chinese yards.

The financial implications could be severe. According to Flexport, containerships typically make 2-3 port calls per loop, potentially adding more than $3 million in fees per voyage, representing a significant portion of the typical $10-15 million revenue per journey.

Nathan Strang, Director of Ocean Freight for the US Southwest & SMB at Flexport, says those costs will ultimately be passed to importers or exporters.

“If carriers move the higher TEU China built ships off the trade, then you will have smaller ships and less capacity, which will push rates higher. In any case this is an inflationary move when it comes to ocean pricing and would be felt by anyone shipping on ocean,” Strang told gCaptain.

The USTR’s proposal would also mandate increasing percentages of U.S. exports to be carried on American-flag vessels. Starting at 1% of cargo immediately upon implementation, the requirements would rise to 15% within seven years, with specific allocations for U.S.-built vessels.

The USTR will hold a public hearing on March 24, 2025, at the International Trade Commission to discuss these proposed measures. Public comments are being accepted until March 24.

“After this period, President Trump could potentially enact the proposal via an executive order,” Flexport stated.

Sign up for gCaptain’s newsletter and never miss an update

Subscribe to gCaptain Daily and stay informed with the latest global maritime and offshore news

Essential news coupled with the finest maritime content sourced from across the globe.

Sign Up