Ørsted’s Cuts Jobs As Green Offshore Wind Profits Turn Red

Call it the quiet surrender. Ørsted, an oil giant that once had a market cap greater than BP, then pivoted from oil and gas into offshore wind with swagger, is...

by John Konrad (gCaptain) According to the U.S. Department of Energy’s (DOE) new US Offshore Wind Market Report: 2021 – released by its National Renewable Energy Laboratory (NREL) – the U.S. offshore wind industry did not rest during the COVID-19 pandemic of 2020 and early 2021.

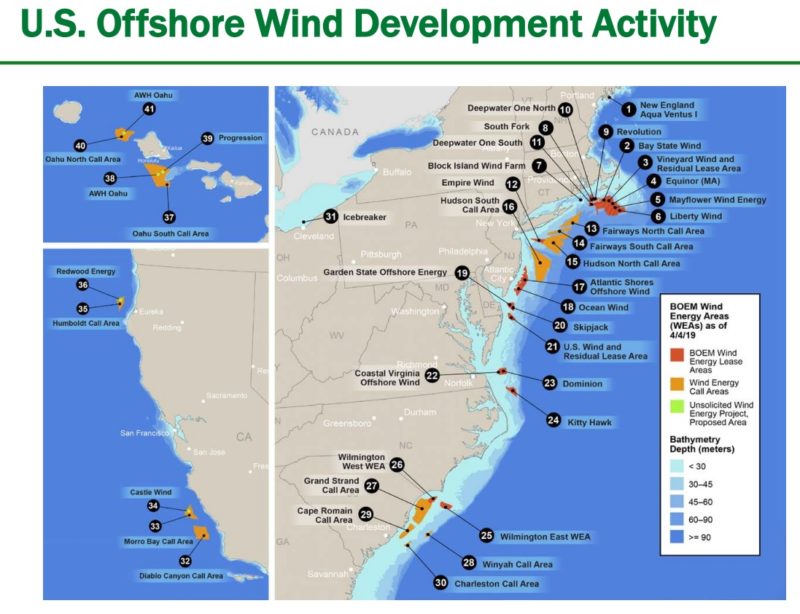

During that time period, the US offshore wind pipeline grew 24%, with 35,324 megawatts (MW) now in various stages of development.

And that’s not all. Increased industry interest, combined with the Biden administration’s goal to deploy 30 gigawatts (GW) of offshore wind power by 2030, may propel the offshore wind energy industry to greater heights in the coming years.

“Offshore wind market is on an upward curve, both nationally and globally,” said Walt Musial, the lead report author. “Maturing technology and falling costs have driven that curve for several years, and today, we’re seeing a continuation of those trends. Here, in the United States, federal and state support is adding momentum.”

With the installation of the Coastal Virginia Offshore Pilot project, the US now has seven offshore turbines in operation totaling 42 MW. This pales in comparison to Europe but The Bureau of Ocean Energy Management (BOEM) created five new Wind Energy Areas in the New York Bight with a total of 9,800 MW of capacity, representing a large portion of the 2020/2021 pipeline growth. Massachusetts’ Vineyard Wind I became the first approved commercial-scale offshore wind energy project in the United States. There are 15 projects in the U.S. offshore pipeline that have reached the permitting phase, and eight states have set offshore wind energy procurement goals totaling 39,298 MW by 2040.

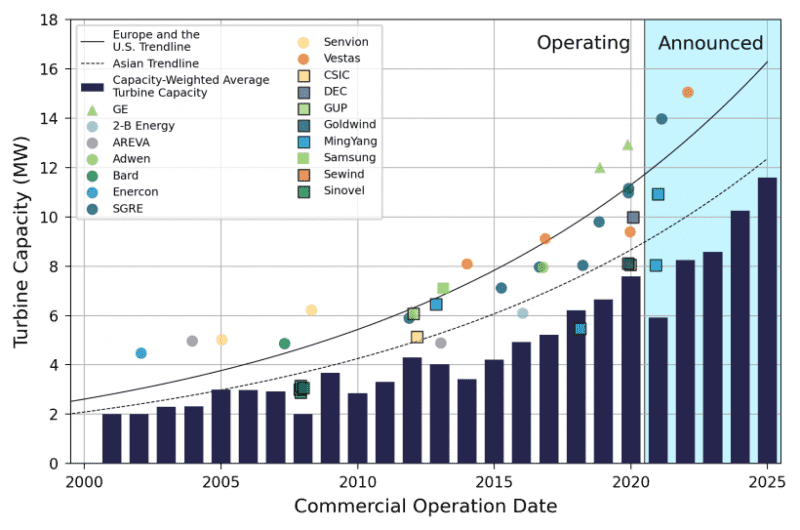

Global offshore wind installations in 2020 totaled 5,519 MW. Turbine sizes continued to grow, with average rotor diameters exceeding 150 meters and turbine capacities more than 7.5 MW. New trends also emerged in 2020, including increased interest in using offshore wind to produce clean hydrogen. The global pipeline for floating offshore wind energy more than tripled in 2020 to 26,529 MW.

Despite growth in fixed bottom structures offshore, no additions were made to the installed capacity for floating wind projects in 2020.

Despite the epic growth of new offshore wind projects during the pandemic, energy companies are not rushing to build US-flagged ships. There is currently only one under construction. Work on the first U.S.-flagged wind turbine installation vessel, Charybdis, began at the Keppel AMFELS shipyard in Brownsville, Texas, in 2020. The new ship was ordered by Dominion Energy which is developing the Coastal Virginia Offshore Wind project, a 2,600-megawatt project. Part of the project includes a 12MW pilot project, 27 miles off the coast of Virginia Beach, that is expected to become the first in U.S. federal waters.

Construction for the vessel got underway back in December with a keel laying ceremony early this year. The vessel’s hull and infrastructure will utilize more than 14,000 tons of domestic steel, with nearly 10,000 tons sourced from Alabama and West Virginia suppliers. With a hull length of 472 feet, a width of 184 feet and a depth of 38 feet, it will be one of the biggest vessels of its kind in the world. Huisman will fabricate the main crane, which will have a boom length of 426 feet and an expected lifting capacity of 2,200 tons. It will also include accommodations for up to 119 crew and wind farm technicians. The ship is expected to cost $500 million.

The company did announce plans to construct a second U.S.-flagged wind turbine installation vessel but construction has not yet started.

Also read: Head Of Vineyard Wind Project Compares US Cabotage Laws To ‘Soviet Central Planning’

According to the DOE report, the average cost of energy from fixed-bottom offshore wind energy installations is now below $95/megawatt-hour (MWh). This cost level for projects that began commercial operations in 2020 represents a reduction of 16% on average, compared to 2019. In total, MWh cost from offshore wind has declined by 28-51% since 2014.

By 2030, experts predict the MWh cost will drop to $56/MWh.

One reason that costs are falling is an increase in turbine size. The capacity of a wind turbine is often referred to as its rated power, or how much power it can produce when operating at full capacity. The dark blue bars in the figure below show a steady increase in the capacity of offshore wind turbines worldwide. The symbols illustrate the capacities of the largest prototypes, which are expected to become commercially available several years later. The upward trend shows the continued development of larger turbines that require fewer turbines to produce the same amount of power compared to their smaller predecessors. This continued growth in rated power is one of the many factors that has led to lower offshore wind costs.

Over the next few years, the DOE predicts offshore wind projects will expand from northeastern states into other regions of the country but warns that each new location comes with their own challenges.

In the near-term, new wind areas are likely to be identified in the Gulf of Maine where deeper waters require floating offshore wind technologies. In the Gulf of Mexico, wind speeds tend to be lower and hurricane risks need to be addressed, but regulatory activity has been initiated for possible leasing by the end of 2022. On the Pacific Coast and Hawaii, floating offshore wind energy Call Areas are advancing toward commercial leasing.

Related News: BOEM Advances Offshore Wind Leasing Process in California

“Looking to the future, we expect offshore wind energy in the United States to expand beyond the North and Mid-Atlantic into the Pacific, Great Lakes, and the Gulf of Mexico,” Musial said. “That expansion means abundant energy at lower costs, job growth, and progress toward decarbonization. NREL will continue to leverage its expertise, world-class facilities, and industry, research, and commercial partnerships to help the United States lead the charge forward.”

Although markets in these regions may not reach their full stride for a decade, actions taken today could support future deployments. The Biden Administration’s 30-GW-by-2030 goal could also set the industry on a trajectory to deploy 110 GW of offshore wind energy in the United States by 2050. This level of offshore wind energy deployment would be a substantial part of a comprehensive decarbonization strategy to combat climate change.

Offshore Wind Market Report: 2021 Edition: Full Report

Offshore Wind Market Report: 2021 Edition: Executive Summary

Offshore Wind Market Report: 2021 Edition: Summary Slides

Offshore Wind Market Report: 2021 Edition Data

Sign up for gCaptain’s newsletter and never miss an update

Subscribe to gCaptain Daily and stay informed with the latest global maritime and offshore news

Essential news coupled with the finest maritime content sourced from across the globe.

Sign Up