image (c) Shutterstock/koosen

By John Kemp

By John Kemp

LONDON, Aug 23 (Reuters) – The United States has emerged as a big net exporter of propane and other liquefied petroleum gases (LPGs), thanks to the shale revolution, becoming a prime supplier of heating, cooking and motor fuel for countries across Latin America.

Where once massive gas tankers arrived importing LPG from Algeria, Nigeria, Saudi Arabia and Venezuela, to help meet winter heating demand in the United States, now an increasingly large fleet of LPG tankers is taking U.S.-produced LPG south to Brazil, Chile and Mexico, and even across the Atlantic to Europe.

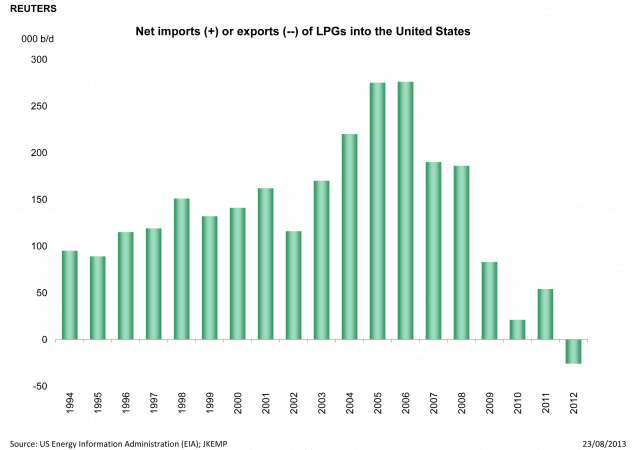

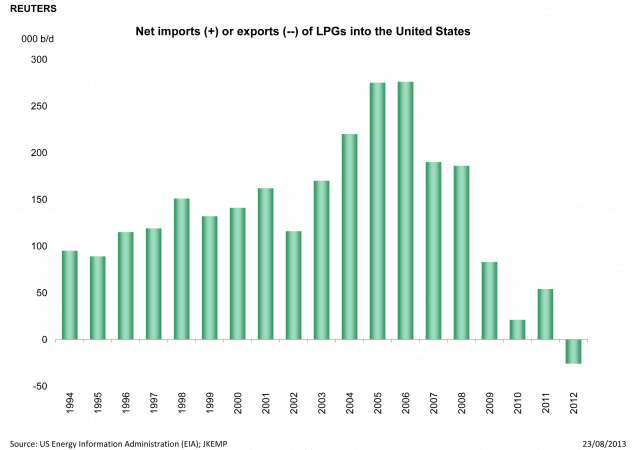

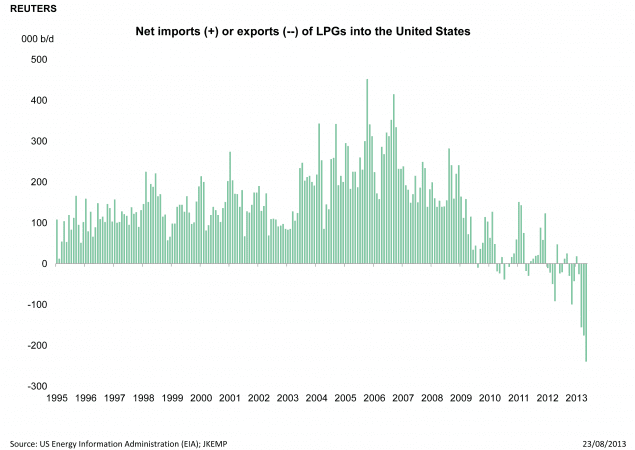

As recently as 2006, the United States imported 276,000 barrels (11.6 million gallons) of LPG per day, net of exports, typically between late summer and the middle of winter, as the country built up stocks to cope with winter demand (Chart 1).

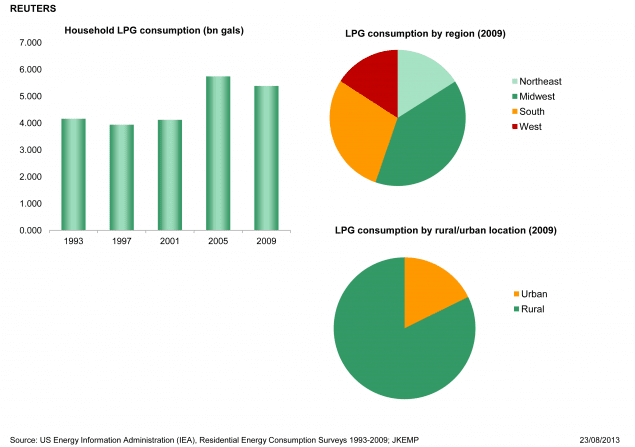

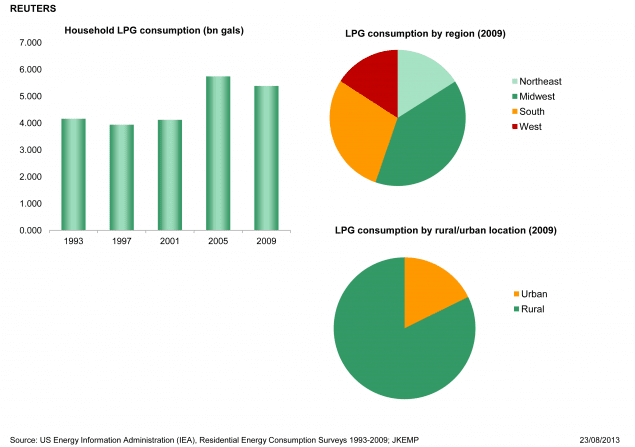

Even today, more than 5.6 million homes still rely on LPG as their main source of heating, most of them in the Midwest (2.1 million) and South (1.9 million), concentrated in rural areas away from the gas grid (4.6 million).

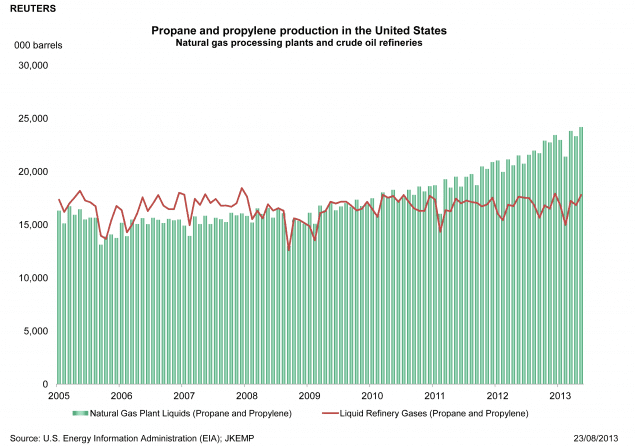

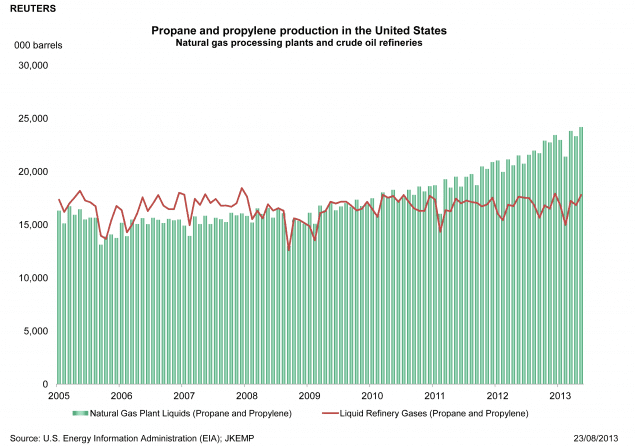

But while demand has been flat, the shale revolution has transformed supply. Natural gas processing plants are now separating more than 24 million barrels of propane and 42 million barrels of other LPGs every month from the wet gas produced from liquids-rich shale formations like Eagle Ford in Texas (Chart 2).

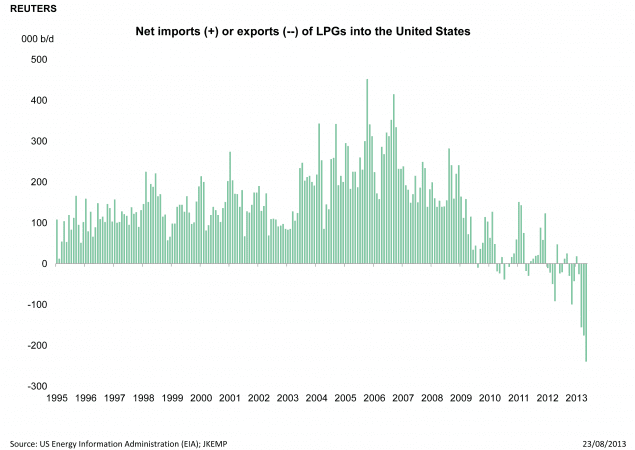

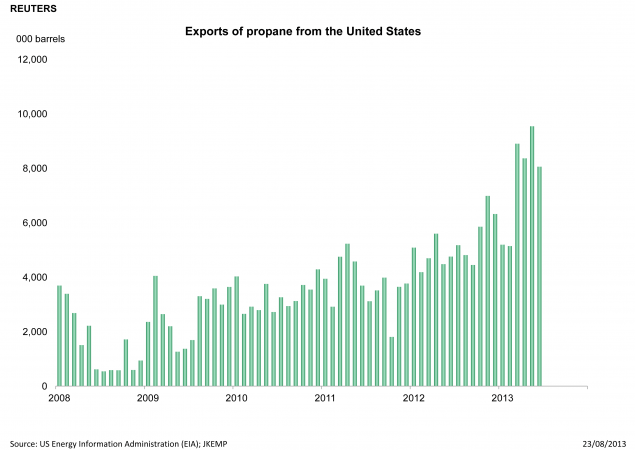

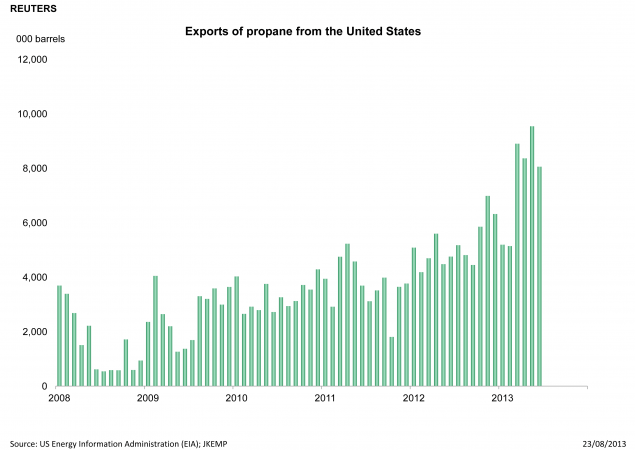

In 2012, the United States became a small net exporter of LPG for the first time in decades. Exports have continued to soar, hitting a record 45 million barrels in the first half of the year, up by nearly 60 percent from 28 million barrels in the same period in 2012, and less than 15 million barrels in January-June 2008 (Chart 3).

The booming export trade has drawn a growing fleet of Very Large Gas Carriers (VLGCs) and other specialist LPG tankers to the hemisphere, many operated by traders like Vitol, to ferry LPG from loading terminals on the U.S. Gulf Coast to consumer markets in Latin America and further afield to Europe.

CO-PRODUCT

Like its lighter cousin ethane and heavier cousin butane, propane is a by-product of natural gas production and crude oil refining.

Together with even heavier molecules like pentane, these products are collectively known as either natural gas plant liquids (NGPLs) when they come from a gas processing plant, or liquefied refinery gases (LRGs) when they come an oil refinery.

Most U.S. propane production comes from gas processing plants. Raw gas contains a mix of methane, natural gas liquids and even heavier hydrocarbons. Before the gas is sold into the interstate pipeline system, the liquids are separated by chilling the raw gas or employing an absorption oil which preferentially absorbs the liquid components from the methane.

The remainder comes from oil refineries, where ethane, propane and butane are separated at the top of the atmospheric distillation column and certain other processing units.

In 2005, propane production was split evenly between gas processing plants and refineries, but the split has shifted to nearly 60:40 in favour of processing plants as a result of the shale boom.

MARKETING

Propane has hundreds of applications, but the largest quantities are used for home heating, portable stoves and motor fuel – where propane makes up the largest component of LPG and autogas. Propane becomes liquid with only moderate pressurisation or refrigeration, making it easy to handle, transport and store.

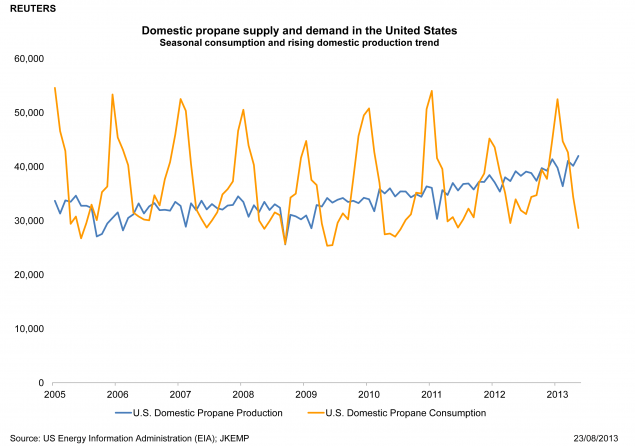

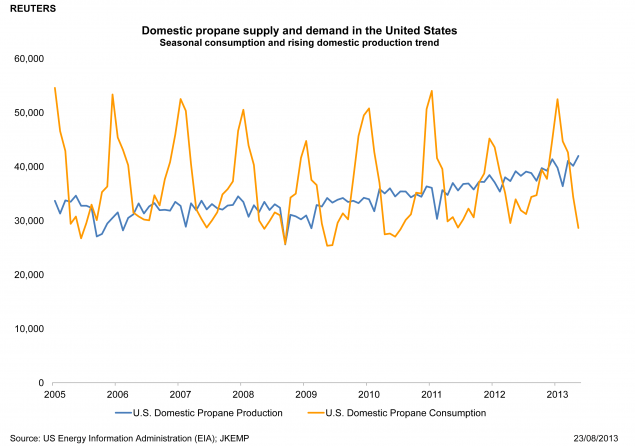

While propane is produced year-round, U.S. demand tends to be seasonal, driven by its use in off-grid home heating. The market is oversupplied from about April to September, then under-supplied from October to March. Large volumes of propane are stored in underground caverns during the spring and summer before the stocks are draw down in autumn and winter (Chart 4).

Monthly consumption can swing from as little as 23 million barrels (May 2009) to as much as 54 million barrels (Jan 2011). On balance, however, domestic production has not been quite high enough to satisfy peak winter demand, so the United States has relied on imports to supplement the annual seasonal stock draw.

Shale has changed all that.

****************************************

SHALE BOOM

Domestic propane consumption has been basically flat for the last decade and may be gently falling. Consumption averaged 1.173 million barrels per day between 2008 and 2012, little changed from 1.198 million between 1998 and 2002.

U.S. homes consumed around 5.4 billion gallons of propane as heating and cooking fuel in 2009, up from 4 billion gallons in 1997, but down from 5.7 billion in 2005 (Chart 5).

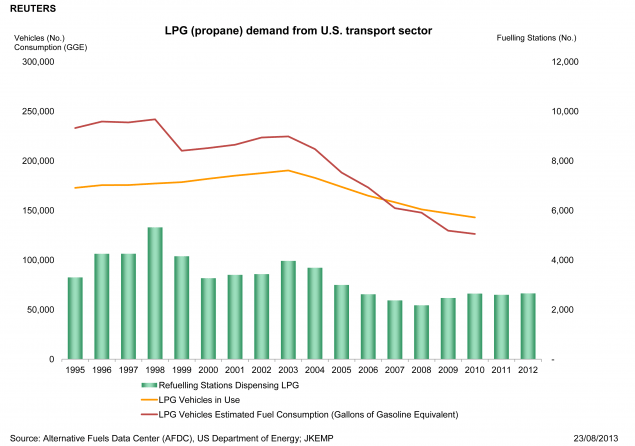

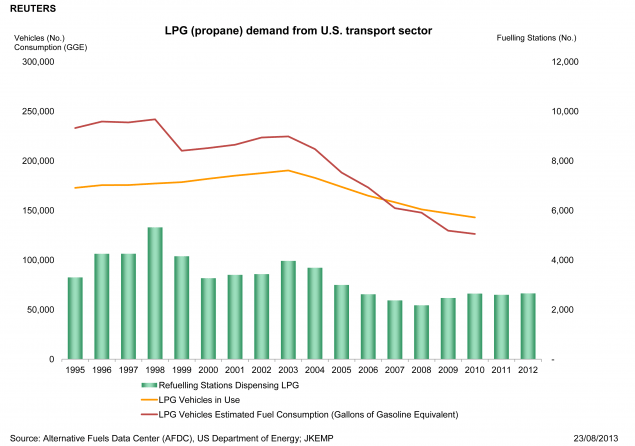

However, propane, sold as LPG for road use, has become less popular as a motor fuel in the United States. The number of LPG-fuelled vehicles on U.S. highways peaked at 190,000 in 2003. Seven years later the number of LPG road vehicles had fallen to 143,000, according to the U.S. Department of Energy’s Alternative Fuels Data Center.

The number of refuelling stations dispensing LPG was down from almost 4,000 to 2,650. The quantity of LPG actually consumed fell from 225 million gallons of gasoline equivalent in 2003 to just 126 million gallons in 2010 (Chart 6).

But as domestic propane demand has stagnated or fallen, output has soared, thanks to shale. With gas producers targeting the most liquids-rich parts of shale formations to maximise revenues and offset depressed prices for pipeline gas, the United States has found itself awash with propane and other LPGs.

Propane prices cratered. From almost $1.50 per gallon in May 2011, prices slid to a low of just 51 cents in June 2012.

SALVATION

The only solution to the glut was to boost exports. Unlike crude oil and heavier condensates, propane can be exported without restriction.

Propane produced in an oil refinery is treated as a refined product, like gasoline or diesel, so escapes the ban on the export of crudes like Bakken. The stuff that comes from natural gas processing plants is treated as a gas, rather than an oil, because it is gaseous at standard temperatures and pressures when they come out of the ground (15 CFR 754.2(a)).

In the first six months of 2013, the largest volumes of propane were exported to the Mexico (7.8 million barrels), Netherlands (6.8 million), Japan (4.4 million), Dominican Republican (4.1 million), Chile (4.0 million) Panama (2.8 million), Venezuela (2.5 million) and Honduras (2.4 million) (Chart 7).

Unlike in the United States, the main use of propane overseas is as a motor fuel. There were more than 17.4 million road vehicles using LPG in 2010, consuming nearly 23 million tonnes of LPG, according to the World LPG Association, which lobbies on behalf of the industry. The number of autogas vehicles has been growing at a compound annual rate of 8.8 percent, from just 11.5 million in 2005.

Trading houses like Vitol as well as oil and gas producers like BP and Shell are heavily involved in the global LPG market. With 27 pressurized vessels and 9 fully refrigerated VLGCs, Vitol claims the largest fleet of LPG carriers in the world, and to be one of the largest LPG traders.

The export boom has helped reverse the normal LPG flows into the United States, and drawn an increasing number of tankers to the region to ply the trade routes between the Gulf Coast and the Caribbean and South America.

Heavy exporting has eliminated U.S. oversupply in the first half of this year and brought the market back to balance.

At the end of May, refiners, processors and distributors had just under 48 million barrels of propane in storage, less than 3 million barrels over the five-year average, and down from 56 million barrels at the same point in 2012. Wholesale prices have doubled over the past year to $1 per gallon. (Editing by William Hardy)

Join The Club

Join The Club