(BIMCO) — By Peter Sand, Chief Shipping Analyst

Global economy: menacing clouds in the sky cast a shadow on global economic developments

2015 never really took off, even though the global economic activity looked stronger earlier in the year. The negative indicators seen at the end of 2014 were not overcome, and we saw a significantly lower level of growth for global GDP in 2015 than in the previous five years. This was primarily due to the struggling emerging markets and developing economies, led by changes in China’s economic focus.

As BIMCO’s hope for a bounce-back in 2016 wanes, shipping should brace itself for yet another challenging year. Despite this, the International Monetary Fund has forecast higher GDP growth rates for 2016 across the board. As China re-evaluates its future growth and direction, the shipping industry can expect an uncertain and lower level of support from one of the most important drivers of shipping demand growth in recent times.

What could turn this around?

Europe and Japan, in particular, look like they might provide positive surprises in 2016. The European Central Bank and Bank of Japan are continuously seeking to boost their economies to bring on the sustainable recovery that everyone needs.

In the US unemployment rates are low and GDP growth is high. This means that higher interest rates may be just around the corner. This could raise prices but could also lead to some “cooling off” for investments and consumption across the globe.

The unpredictability of China’s market forces is really causing some concern. We cannot rely on the usual market forces or conditions within some Chinese industries, which is bringing more volatility in shipping demand. What seems certain is that the rebalancing of its economy from investment to consumer-driven growth will also drag down economic growth. This transition is long overdue and – more positively – its greater sustainability should support a steadier level of growth in shipping demand in the future.

In short, a “new normal” has arrived, lowering the GDP-to-trade multiplier generated by global economic activity.

Dry bulk: The supply-side was pushed lower as demand faded

The dry bulk market experienced a troublesome 2015 as the ongoing decline in Chinese coal imports was not countered by any significant upswing elsewhere. Whereas iron ore imports were on a par with 2014, steel export from China reached a new high, benefitting mid-sized ships. For 2016, much depends on what Chinese steel mills will do. Will they continue production above domestic consumption – or substitute domestically mined ore with imported ore? The jury is still out.

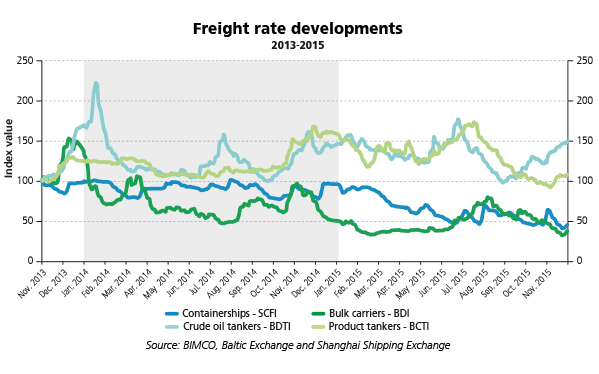

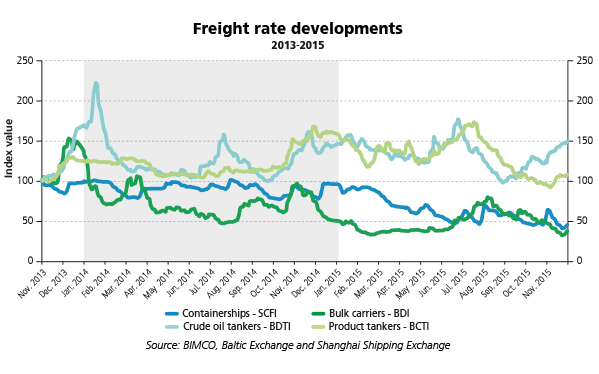

At the end of November, the Baltic Dry Index hit 498, a new all-time low. For most of the year, the majority of ships have traded below OPEX levels, resulting in financial losses for many companies.

The horrific first half of 2015 brought around a new half-year record for scrapping. Improvements in the freight market during Q3 regrettably cooled down demolition market activities. Nevertheless, fleet growth recorded a twelve-year low.

In 2016, BIMCO expects the supply-side to grow by around 2% (2.6% in 2015E) – and that this will be helped by a new record level of scrapping. On the demand-side, growth is forecast to remain level. Challenging market conditions in China will be likely to affect the level of risk.

Tanker: after the perfect storm a steadier year awaits

Both the crude oil tanker and oil product tanker markets enjoyed an extraordinarily strong freight market throughout 2015; ignited by the drop in oil prices that began in mid-2014 and supported by a relatively low supply-side growth in 2015. It was the best year for all oil tankers since the market crashed in late 2008. Strong refinery margins meant that the demand for all oil tankers was high all year – with a momentary pause for much-needed refinery maintenance. Going forward, the significant building of oil stocks in 2015 may slow tanker demand growth somewhat in 2016.

BIMCO expects Iran’s return to the crude oil export market in 2016 to disrupt current trade patterns. As Iran rebuilds its market share, it will seek to take the place of neighbouring and West African competitors in supplying European and Asian markets. Time will tell if this will also bring higher tanker demand, but BIMCO does not expect that to happen.

The multi-year slide in the crude oil tanker fleet growth was reversed in 2015. BIMCO expects the crude oil segment to see a fleet growth of around 4.5% in 2016 (2.3% in 2015E). As the demand-side growth is unlikely to reach the same high level, downward pressure on freight rates will follow.

We expect similar market conditions to develop for oil product tankers, with supply-side growth staying high while the demand-side is likely to soften after the winter market. For the full year, freight rates are predicted to be lower in 2016 compared to 2015. BIMCO estimates that supply growth for the oil product tanker segment in 2016 will be around the same level as in 2015 – which was 5.5%.

Container: growth on key trade lanes is needed to restore market dynamics

Disappointing European demand for containerised goods versus the strong growth of imports into the US slowed the demand for container ships significantly. At the same time, 900,000 TEU worth of ultra large container ship capacity was delivered. Overall, the market imbalance worsened as the supply-side rose to a four-year high (8.0% in 2015E) while the demand-side growth rate hit a three-year low. The lack of head haul volume growth on the Asia to Europe trading lane was particularly worrisome as it accelerated the heavy cascade of ships clogging up other parts of the network.

The revival of time charter rates in the first part of the year was not based on a strong improvement in the fundamental market balance, and both spot and time charter rates dropped as the year passed. Going forward, what is needed to revive European imports of containerised goods is for the Euro to strengthen against the Renminbi and for retailers to begin restocking again.

Towards the end of 2015, idled container ship capacity reaching a high not seen since 2010 at over 1 million TEU, as ships of all sizes were swiftly removed from over-supplied trade lanes. But it did not prove to be enough to counter the drop in demand and subsequent revenue erosion.

What remains crucial for the industry is to improve the fundamental market balance in 2016. As the lower “new normal” GDP-to-trade multiplier limits the potential upside of the demand-side, careful management of deployed capacity by the individual operators is still of utmost importance. Last year did not ease the imbalance as more than 1.6m TEU was delivered in 2015. After a record for new capacity entering the market in last year, 2016 is set for a much lower influx at around 3.5%. This is not sufficient and means the challenging market conditions for container shipping will extend for another year.

Copyright (c) BIMCO, Republished with Permission

Join The Club

Join The Club