By Nightman1965 / Shutterstock

By Serene Cheong (Bloomberg) — Big oil tankers sailing from the U.S. are set to bring along some benefits for refiners in Asia while allowing them to sidestep traders serving the world’s top crude-buying region.

The new option to load oil into very large crude carriers at the U.S. Gulf Coast terminal operated by the Louisiana Offshore Oil Port, or LOOP, will reduce costs and waiting time for Asian buyers of American supplies, according to shipbroking firm Braemar ACM. It also reduces the need to rely on traders to manage complicated tanker logistics that sometimes involve multiple smaller vessels transferring crude into a bigger boat.

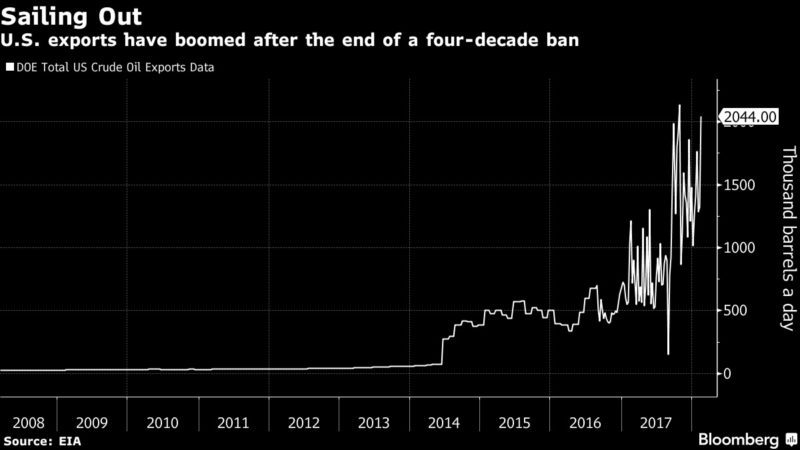

The first fully laden supertanker sailed from America earlier this month, leaving for China from LOOP’s deep-water facility — the only one in the U.S. capable of filling some of the industry’s biggest tankers. In the wake of an end to a four decade-ban on exports and as OPEC curbed output to clear a glut, a stream of shipments from the Gulf Coast headed east as major buyers such as India and South Korea looked farther for supplies.

Looking to Export, America’s Busiest Oil Terminal Tests Loading of First Supertanker

The ability to export via the big ships may prove a blow to traders and their role as middlemen at a time of increasing efficiency and improved market transparency. Until now, Asian refiners have mostly purchased U.S. oil that’s sold to them on a delivered basis by traders, who would source the cargoes, load them onto smaller vessels and arrange for out-at-sea transfers to supertankers that can’t enter the shallow berths of most American terminals.

While it offers cost and time advantages, “the bigger win for Asian buyers, however, may be the ability for buyers to cut out the trader’s margin by using LOOP,” Anoop Singh, an analyst at Braemar ACM, wrote in a tanker-market report. “This is because most buyers of U.S. crude in Asia take delivered barrels from traders, which have traditionally been better at managing” the shipping logistics, he said.

To be sure, traders are unlikely to lose all their business. Braemar ACM expects LOOP shipments to average only 1 to 2 VLCCs a month, still leaving plenty of other opportunities for crude to be exported from smaller terminals.

Cost savings

Loading about two million barrels of oil into a VLCC at LOOP could cut about $300,000 in direct costs — or 20 cents per barrel — compared with the current process of chartering several Aframax vessels to load barrels from inland berths and ship-to-ship transfers to larger tankers, according to Braemar ACM. Additionally, loading at the terminal also reduces the timeline to one day from the four days that’s currently needed.

The LOOP’s About-Face on Oil Imports Cues U.S. Drive Into Global Market

To sweeten the deal, LOOP is also willing to offer storage space in its tanks at discounted rates to enable exporters to collate enough volumes to fill a full VLCC. It has storage capacity of 71 million barrels, nearly as large as the 78 million barrels at U.S. oil hub in Cushing, Oklahoma, Singh said in the report.

Based on the shipbroker’s estimates, U.S. exports have averaged 1.4 million barrels a day this year, rising from 2017 when 1 million barrels a day were shipped from its ports. About nine VLCCs a month departed during the fourth quarter of last year, with more crude bound for the east of Suez market. Those large ships were loaded using supply initially ferried by smaller tankers.

Oil Quality

The supplies exported via LOOP may be focused on crude of so-called medium-sour quality, Singh wrote in the Feb. 23 note. That’s due to direct pipelines linking the most abundant Gulf of Mexico fields such as Mars, Poseidon and Thunderhorse to LOOP’s storage terminal, bringing in more than 500,000 barrels a day of production. These are different in characteristics to light-sweet oil from shale fields, supplies from which have pushed American output to a record.

U.S. Oil Export Boom Putting Infrastructure to the Test

“LOOP’s pipeline capacity has limited ability to bring in light-sweet crudes,” Singh said. “Production of these crudes from Permian, Eagle Ford and Bakken regions is growing fast. But these grades are primarily being exported from ports in Texas because of better pipeline connectivity.”

West Texas Intermediate crude, the U.S. benchmark, traded at $63.54 a barrel at 5:22 a.m. in New York. Prices are up about 5 percent this year.

© 2018 Bloomberg L.P

Join The Club

Join The Club