Trump Trade Wars: A Look At Winners And Losers Since 2016

by Tom Orlik (Bloomberg) Who Loses in Trump’s Endless Trade War? In 2016, Donald Trump campaigned for the US presidency on a promise to beat China. Once in office, he unleashed a...

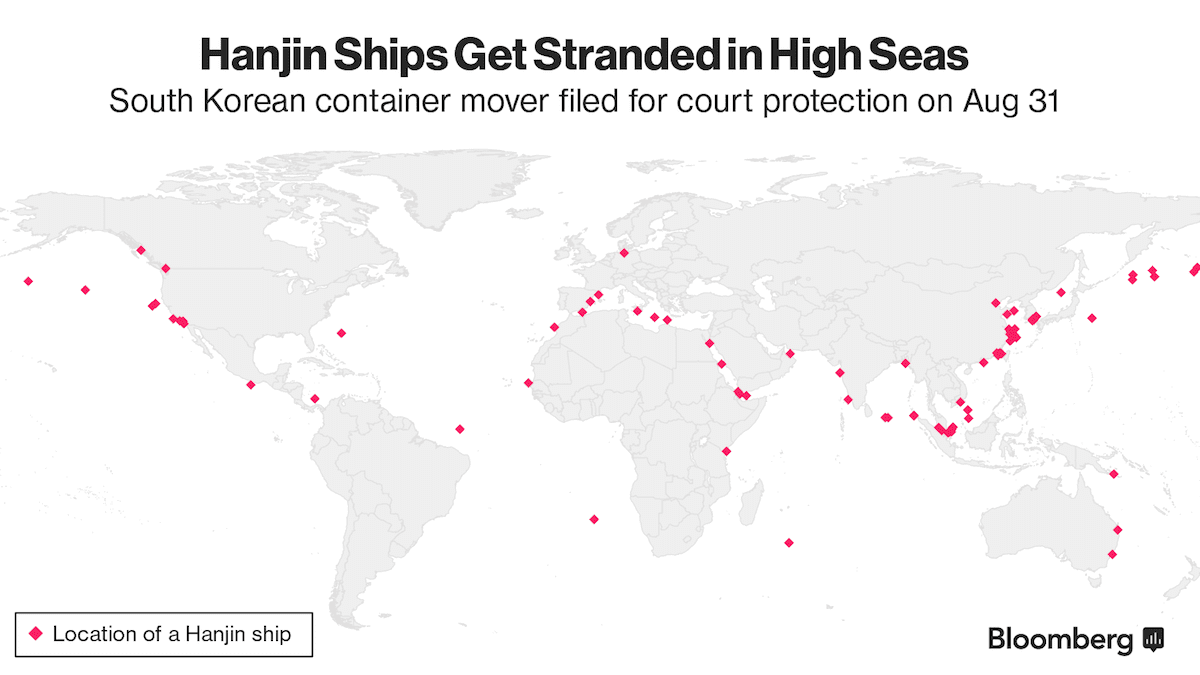

Current location of ships in the Hanjin fleet. Via Bloomberg

by Kyunghee Park (Bloomberg) Hanjin Shipping Co.’s vessels are getting stranded at sea after the South Korean container mover filed for court protection, roiling the supply chain of televisions and consumer goods ahead of the holiday season.

LG Electronics Inc. is trying to find new carriers for its goods, the world’s second-largest manufacturer of televisions said. Shipments through Hanjin account for between 15 percent and 20 percent of LG’s deliveries to America. Hyundai Merchant Marine Co., the nation’s second-biggest container line, stepped in, saying it plans to add 13 more vessels to ease the squeeze.

Hanjin Shipping is South Korea’s largest sea container-shipping firm and the world’s seventh-biggest, with a 2.9 percent market share. So its woes threaten to derail the supply chains of global companies that need to send goods well in advance of the year’s biggest shopping season. TVs, cars and sneakers sail about 10 days to reach Los Angeles from Asia, while they could take as many as 30 days to Rotterdam. Hanjin Shipping owns 59 of the 132 container and bulk ships in its fleet.

“Ports will not have these vessels because they are worried port and other fees won’t be paid,” said Rahul Kapoor, a Singapore-based director at Drewry Maritime Services Pvt. “This is going to play out for the next few weeks.”

For U.S. retailers, the situation brings fresh concerns about the holiday shopping season. The chains are working to minimize delivery disruptions from cargo waiting to depart Asia, traveling on the ocean or arriving at ports, said Jonathan Gold, vice president for supply chain and customs policy at the National Retail Federation trade group.

“Retailers’ main concern is that there is millions of dollars worth of merchandise that needs to be on store shelves that could be impacted by this,” Gold said. “We need all parties to work together to find solutions to move this cargo so it does not have a broader impact on the economy.”

Major U.S. ports are forecast to handle 1.61 million 20-foot equivalent units this month, down 0.6 percent from the same month last year, according to the Washington-based trade organization.

Another group, the Retail Industry Leaders Association, urged U.S. Secretary of Commerce Penny Pritzker and Federal Maritime Commission Chairman Mario Cordero to step in.

“While the situation is still developing, the prospect of harm is significant and apparent,” RILA President Sandy Kennedy said in a statement. “We urge that Department of Commerce and the Federal Maritime Commission work together with all stakeholders, including ports, cargo handlers and the South Korean government, to resolve the immediate disruption and mitigate the harms posed by the current situation.”

Wal-Mart Stores Inc., the world’s largest retailer, said it was too early to see what effect the Hanjin situation will have.

“We are waiting to hear the final determination on bankruptcy proceedings and the implications to their current assets before we will be able to assess any impact,” said Marilee McInnis, a spokeswoman for Wal-Mart.

On Thursday, the Seoul Central District Court accepted the receivership application Hanjin made Aug. 31. A revival plan must be submitted by Nov. 25, said the court, which also named the company’s Chief Executive Officer Seok Tae Soo as the manager.

Three of Hanjin’s vessels were stuck off the Los Angeles-Long Beach port complex, while one was stranded near the Port of Prince Rupert in British Columbia, Canada. Workers in the Korean port of Busan refused to work on a ship because the company hasn’t paid dues, forcing the cancellation of a berthing. Another was seized in Singapore late Monday.

About 10 more were impounded at Chinese ports, including Tianjin and Shanghai, for failing to pay service providers, the Korea International Trade Association said.

“The company is internally looking into measures in case our cargo gets stranded while it’s being shipped,” LG said in the e-mail in a response to a Bloomberg query.

Hanjin Shipping’s local-currency notes due June 2017 tumbled to 13.4 percent of face value as of 3:29 p.m. in Seoul, according to Korea Exchange prices, after fetching 90 percent in March. Trading in its shares were suspended after a 24 percent plunge Tuesday to their lowest level since December 2009.

About 70 percent of South Korea’s overseas shipments is through sea, of which Hanjin Shipping accounts for about 6 percent, according to Cheong Seung Il, a trade ministry official. While the government doesn’t expect a large impact on exports, there could still be some issues with machinery and textiles shipped via Hanjin, he said.

“Some of their clients would be worried about getting their cargo if the vessels can’t enter ports,” said Shin Ji Yoon, an analyst at KTB Investment & Securities Co. in Seoul.

Hyundai Merchant plans to add four vessels to the U.S. starting Sept. 9, and nine on Europe routes later this month. Japanese shipping companies Kawasaki Kisen Kaisha Ltd. and Nippon Yusen KK said they are working to limit delays to clients’ cargo.

Kawasaki Kisen, which is in the same shipping alliance as Hanjin Shipping, is studying the impact of the Korean company’s filing, Masaya Futakuchi, a company spokesman, said by phone. Nippon Yusen isn’t part of the same alliance but has a business partnership with Hanjin, spokesman Brandon Kitamura said.

Freight charges from South Korea surged about 50 percent after Hanjin Shipping filed for court receivership Wednesday, Korea Economic Daily reported, citing shipping industry officials it didn’t identify. The fees on Hanjin’s main shipping route between Busan and Los Angeles have jumped 55 percent to $1,700 per 40-foot equivalent box from $1,100, it said.

Hanjin Shipping filed for court protection Wednesday after lenders rejected its restructuring proposal, scuttling revival efforts by the firm that’s been trying to reschedule debt under a voluntary creditor-led program since May. Hanjin’s woes reflect those of an industry that’s been operating at a loss since the end of 2015, and set to lose about $5 billion this year amid an oversupply of vessels, according to Drewry.

The possibility of a liquidation can’t be ruled out, though a court will determine the fate of Hanjin Shipping, said Yim Jong Yong, chairman of South Korea’s Financial Services Commission, in comments e-mailed by the regulator.

Hanjin Shipping is part of Hanjin Group, which also owns Korean Air Lines Co., the world’s third-largest cargo airline. Korean Air loaned funds to Hanjin Shipping and bought shares in the container line in 2014 to become the biggest shareholder with 33 percent. The group, which also counts airport services, logistics and mineral water among its businesses, is headed by Chairman Cho Yang Ho.

“The impact on importers and exporters is having a ripple effect throughout the global supply chain,” the RILA’s Kennedy said.

©2016 Bloomberg News

Sign up for gCaptain’s newsletter and never miss an update

Subscribe to gCaptain Daily and stay informed with the latest global maritime and offshore news

Essential news coupled with the finest maritime content sourced from across the globe.

Sign Up