Updated: October 6, 2022 (Originally published September 29, 2022)

By Kim Chipman, Dominic Carey and Elizabeth Elkin (Bloomberg) —

American farmers are facing yet another supply-chain headache just as harvest season gets into high gear: A shrinking Mississippi River.

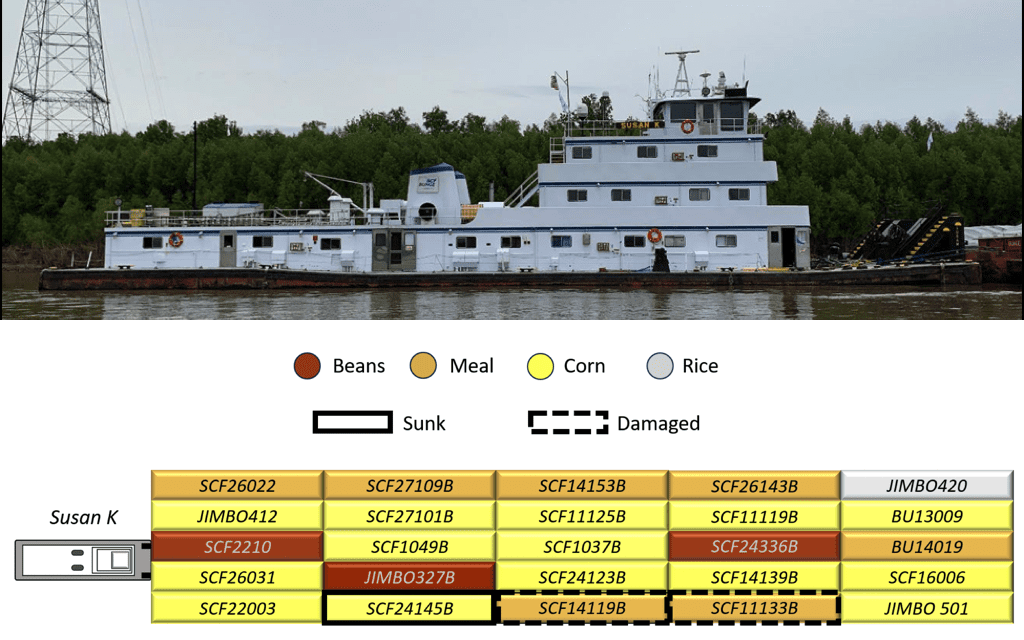

The critical trade route for US crops and fertilizer used to grow them has had such a steep drop in water level that vessel traffic is being limited. Agriculture shipments are starting to stall and the fear is conditions could worsen, said Mike Steenhoek, executive director of the Soy Transportation Coalition.

The ebbing water flows have pushed barge prices to the highest in eight years right as the busiest season kicks off for key US crop exports. The world is in desperate need of the shipments to restock reserves diminished by Russia’s war in Ukraine. Fertilizer sent north from the US Gulf for growers to apply in preparation for next year’s crop is also under threat, raising the risk of price surges at a time of worsening food inflation.

“Rising barge rates will add another layer to farmers’ fertilizer expense in a year already beset by rising costs,” Bloomberg Intelligence analyst Alexis Maxwell said.

River levels in Cairo, Illinois, where the Ohio River flows into the Mississippi, are critically low and forecast to drop even further in October, according to US government data.

The Mississippi River is by far the largest domestic shipping channel for US soybean exports. The narrower route is already reducing the size of a single shipment by as much 38%, and the price for loading a barge of soybeans on the Upper Mississippi this week stands about 33% higher than a year ago, according to Steenhoek, citing US Department of Agriculture figures.

The slowdown comes as the trucking and rail industries also face supply-chain problems, potentially adding to the cost pressure on producers trying to profit after a tough season of weather setbacks and soaring inflation for fuel, fertilizer and other farm necessities.

“This is a time with harvest season when we need our supply chain to be operating on all cylinders,” Steenhoek said.

© 2022 Bloomberg L.P.

Editorial Standards · Corrections · About gCaptain

This article contains reporting from Bloomberg, published under license.

Join The Club

Join The Club